Hill-Rom (HRC) Earnings & Revenues Beat in Q2, Margins Up

Hill-Rom Holdings, Inc. HRC reported second-quarter fiscal 2018 adjusted earnings per share (EPS) of $1.05, reflecting a 19.3% increase from the year-ago quarter. Adjusted earnings surpassed the Zacks Consensus Estimate by 2.9% and were well above the company’s projected range of $1-$1.02.

The strong bottom-line performance was backed by solid core revenue growth, continued margin expansion and strategic investments to drive growth This marked the 11th consecutive quarter of double-digit earnings growth for the company.

Revenue Details

Revenues in the second quarter increased 4.7% year over year to $710.5 million (up 1.8% at CER). The top line also exceeded the Zacks Consensus Estimate of $710 million on momentum in core business, Mortara acquisition and value added from new products.

Geographically, U.S. revenues grew 1% to $466 million while revenues outside the United States increased 12.5% (up 3.5% at CER) to $245 million. Core revenue growth was 2% at CER.

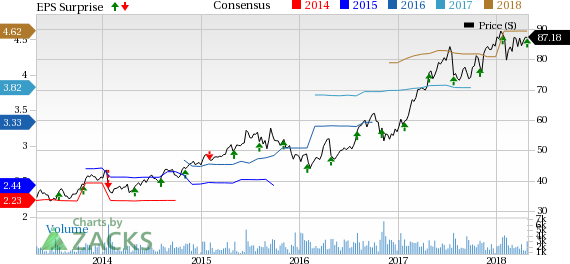

Hill-Rom Holdings, Inc. Price, Consensus and EPS Surprise

Hill-Rom Holdings, Inc. Price, Consensus and EPS Surprise | Hill-Rom Holdings, Inc. Quote

Segmental Performance

In the second quarter, Patient Support Systems revenues dropped 2.2% year over year (down 4.5% at CER) to $355 million. The segment’s domestic revenues declined 5.5%. However, after adjusting for divestitures, U.S. core revenues decreased 5% from the prior year.

Revenues at the Front Line Care segment, which includes Welch Allyn, Respiratory Care and Mortara, increased 12.7% to $238 million (up 10.7% at CER). Apart from gains from Mortara, the performance was driven by contributions from new products, strong growth of thermometry and blood pressure monitoring devices and physical assessment tools plus double-digit growth at respiratory care business.

The Surgical Solutions segment revenues increased 12% (up 5.6% at CER) to $118 million on 18.4% international growth, driven by strong momentum in the Middle East and Europe. U.S. revenues increased 5.4%. The growth was backed by solid uptake of Integrated Table Motion and contribution from products like the iLED7 and the new TS 3000 Mobile Operating Table.

Margins

Reported gross margin in the fiscal second quarter was 49.3%, up 150 bps year over year. Despite a 1.6% increase in cost of revenue, the company witnessed gross margin expansion on account of a 4.7% rise in revenues. Adjusted gross margin grew 130 bps to 49.3% buoyed by the company’s initiatives like portfolio diversification, benefits from cost and sourcing efficiencies and product launches. Adjusted operating margin improved 120 bps to 16.2%.

Outlook

In view of a promising second-quarter performance, Hill-Rom has updated its fiscal 2018 earnings guidance and has also provided the third-quarter estimates.

For the full year, the company continues to expect revenue growth of 3-4% on a reported basis (up 2% to 3% at CER). Excluding foreign currency, Mortara, divestitures and other non-strategic assets, the company continues to expect core revenue growth of 3%. The Zacks Consensus Estimate for fiscal 2018 revenues is pegged at $2.85 billion.

Hill-Rom now expects adjusted earnings per share for fiscal 2018 in the range of $4.60-$4.65 compared with the previous range of $4.57-$4.65. The Zacks Consensus Estimate for fiscal 2018 earnings is pegged at $4.62, within the company’s guided range.

For the third quarter, Hill-Rom expects revenue growth of around 3% on a reported basis (or approximately 1% at CER). Core revenues are expected to increase 3-4% year over year. The company expects adjusted earnings per share of $1.12-$1.14. The Zacks Consensus Estimate for third-quarter earnings stands at $1.18 on revenues of $709.9 million. Our consensus estimate for earnings is above the company’s guided range.

Our Take

Hill-Rom exited the fiscal second quarter on a strong note. The company saw a solid year-over-year increase in revenues on strong international growth. The upside in international growth was driven by double-digit growth in Canada and the Middle East, along with strength in Europe and Latin America. The company is also focusing on product innovation through research and development. In this regard, the company recently announced the upgrading of its Welch Allyn Spot Vision Screener. The latest version is capable of quickly and efficiently screening adult patients with pupil sizes as small as 3 mm to diagnose any vision-related issue.

However, a decline in revenues at the Patient Support Systems segment is quite disappointing. Also, foreign exchange remains a concern.

Zacks Rank & Key Picks

Hill-Romhas a Zacks Rank #4 (Sell).

A few better-ranked stocks in the broader medical space, which reported solid earnings this season, are ResMed Inc. RMD, Chemed Corporation CHE and Intuitive Surgical, Inc. ISRG. While Intuitive Surgical sports a Zacks Rank #1 (Strong Buy), ResMed and Chemed carry a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Intuitive Surgical reported first-quarter 2018 adjusted EPS of $2.44, which beat the Zacks Consensus Estimate by 22.6%. Revenues totaled $848 million, also surpassing the Zacks Consensus Estimate by 10.6%.

ResMed reported third-quarter fiscal 2018 adjusted EPS of 92 cents, beating the Zacks Consensus Estimate by 10.8%. Revenues came in at $591.6 million, exceeding the consensus estimate of $564.9 million.

Chemed posted first-quarter 2018 adjusted EPS of $2.72, beating the Zacks Consensus Estimate of $2.37. Revenues came in at $439.2 million, steering past the Zacks Consensus Estimate of $420 million.

The Hottest Tech Mega-Trend of All

Last year, it generated $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce "the world's first trillionaires," but that should still leave plenty of money for regular investors who make the right trades early.

See Zacks' 3 Best Stocks to Play This Trend >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Intuitive Surgical, Inc. (ISRG) : Free Stock Analysis Report

ResMed Inc. (RMD) : Free Stock Analysis Report

Hill-Rom Holdings, Inc. (HRC) : Free Stock Analysis Report

Chemed Corporation (CHE) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance