How GFC history reveals the Australian dollar will keep rising

At the risk of sounding like Jerry Seinfeld, I have to ask the question that a lot of people must be pondering and it goes like this: “What’s the deal with the Aussie dollar at US $0.71?”

And with the way things are going, when we’re allowed to fly and holiday overseas sometime in the middle of next year, we could be doing it with a currency that might have a US $0.80 plus price tag! Now who would’ve thought that possible?

Earlier this week, I interviewed Michael Knox, chief economist at stockbroking firm Morgans in Brisbane. Knoxy has been a TV guest of mine for a decade. For normal people, he might be a little too highbrow but as an economist, I love hearing his predictions.

It means I have to decode him sometimes and he can go on a tad too long, as he explains the complexities of economics, policy decisions and so on.

One night on my old Sky Business programme, he went on so long with one answer I had to say to him: “Knoxy, I can listen to you all day and for a moment there I thought I was going to have to!”

But I digress.

Michael explained that a critical factor for the US dollar is the size of the US budget deficit. The last time the deficit exploded was during the global financial crisis and for the period 2008-13, the deficit averaged 6.8 per cent. Before that, it averaged 1.8 per cent for the seven years prior.

Let’s see what happened to the AUD/USD foreign exchange rate then, using pictures.

As the US budget deficit rose to fight the GFC that started in 2008, the US dollar fell and our currency rose. We were helped by a rapid expansion of China, and mining stocks did well.

However, as the US started to economically come back, the deficit fell and the greenback rose against the Aussie dollar.

Now Knoxy tells us that the US budget deficit is going on steroids to beat the coronavirus and will be much bigger than it was during the GFC or Great Recession, as the Yanks call it.

The deficit surged to a record-breaking US $864 billion in June. Knox thinks it could end up near 15 per cent of GDP! And that’s why he sees our dollar higher.

I asked him if he thought we’d be anchored in the US 80 cents region in coming years. To this he said ‘yes’ but implied it could go even higher!

When I took my TV show to New York in 2012, New York apartments were cheap looking because their prices had fallen in the GFC. Our dollar was then priced at US $1.08! I bought a great Burberry suit that was so cheap because of the currency but maybe I should have bought an apartment!

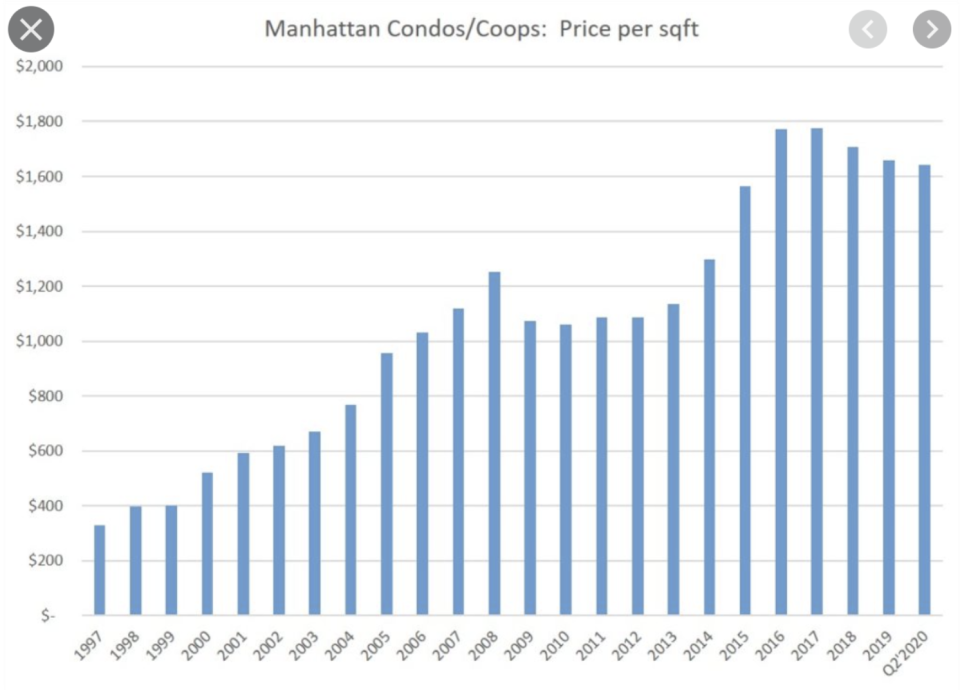

In 2012, prices had fallen to around US $1,100 per square foot. That number is now $1,600. That would’ve been a 45 per cent gain!

You live and learn.

Make your money work with Yahoo Finance’s daily newsletter. Sign up here and stay on top of the latest money, economy, property and work news.

Follow Yahoo Finance Australia on Facebook, Twitter, Instagram and LinkedIn.

Yahoo Finance

Yahoo Finance