Hidden Gems: Three Stocks Estimated Below Market Value in June 2024

As global markets exhibit mixed signals with some indices reaching all-time highs and others showing modest gains amidst economic uncertainties, investors continue to search for value in a complex landscape. In this context, identifying stocks that are potentially undervalued becomes a strategic approach to uncover hidden gems in the market.

Top 10 Undervalued Stocks Based On Cash Flows

Name | Current Price | Fair Value (Est) | Discount (Est) |

Xiamen Amoytop Biotech (SHSE:688278) | CN¥55.42 | CN¥110.68 | 49.9% |

Arcoma (OM:ARCOMA) | SEK18.00 | SEK35.84 | 49.8% |

Net Insight (OM:NETI B) | SEK4.93 | SEK9.85 | 50% |

EdiliziAcrobatica (BIT:EDAC) | €8.70 | €17.36 | 49.9% |

Interojo (KOSDAQ:A119610) | ₩24900.00 | ₩49550.40 | 49.7% |

HeartCore Enterprises (NasdaqCM:HTCR) | US$0.7081 | US$1.41 | 49.7% |

John Wood Group (LSE:WG.) | £1.973 | £3.93 | 49.8% |

Hesai Group (NasdaqGS:HSAI) | US$4.19 | US$8.32 | 49.7% |

M&C Saatchi (AIM:SAA) | £1.99 | £3.97 | 49.8% |

3R Petroleum Óleo e Gás (BOVESPA:RRRP3) | R$25.75 | R$51.44 | 49.9% |

Here we highlight a subset of our preferred stocks from the screener

argenx

Overview: argenx SE is a biotechnology company focused on developing therapies for autoimmune diseases across the United States, Japan, Europe, the Middle East, Africa, and China, with a market capitalization of approximately €25.26 billion.

Operations: The company generates its revenue primarily from its biotechnology operations, amounting to $1.45 billion.

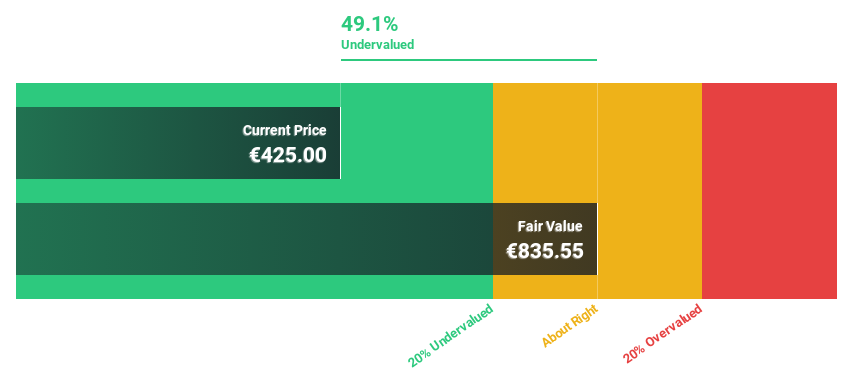

Estimated Discount To Fair Value: 49.1%

argenx SE, despite a recent net loss of US$61.6 million, shows promise based on its cash flow potential and recent FDA approval for VYVGART Hytrulo in treating CIDP. This approval could boost future revenues, aligning with a forecasted high revenue growth rate of 24% per year. Although diluted over the past year, argenx is trading below fair value by more than 20%, suggesting undervaluation based on DCF analysis. Earnings are expected to grow significantly at 59.29% annually, bolstering its investment appeal from a cash flow perspective.

Pantai Indah Kapuk Dua

Overview: PT Pantai Indah Kapuk Dua Tbk, along with its subsidiaries, serves as a property developer in Indonesia with a market capitalization of approximately IDR 79.31 trillion.

Operations: The company primarily generates revenue from real estate development, totaling IDR 2.16 billion.

Estimated Discount To Fair Value: 30.3%

Pantai Indah Kapuk Dua is currently priced at IDR5075, below the estimated fair value of IDR7280.12, indicating a significant undervaluation based on discounted cash flow analysis. Despite a decline in profit margins from 23.5% to 12.5%, the company has experienced substantial earnings growth of 98.2% over the past year and forecasts suggest continued robust growth in both revenue (25.4% per year) and earnings (41.23% per year), outpacing market averages significantly.

Global-E Online

Overview: Global-E Online Ltd. operates a platform that facilitates direct-to-consumer cross-border e-commerce in Israel, the United Kingdom, the United States, and other international markets, with a market capitalization of approximately $5.36 billion.

Operations: The company generates its revenue primarily from the Internet Information Providers segment, totaling approximately $598.19 million.

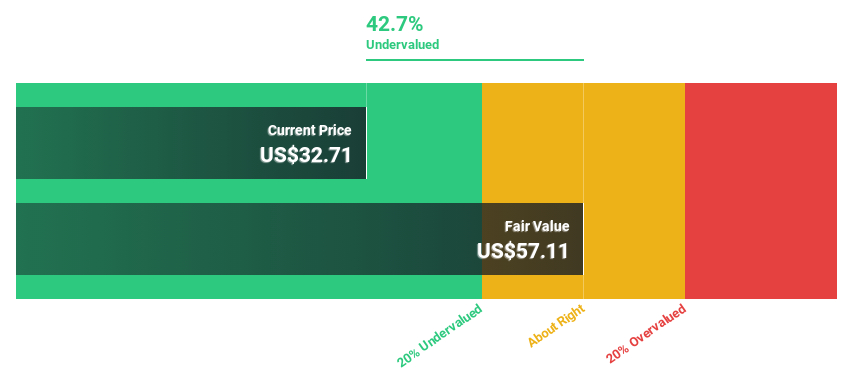

Estimated Discount To Fair Value: 42.7%

Global-E Online Ltd. is trading at US$32.71, well below the estimated fair value of US$57.11, reflecting a potential undervaluation based on discounted cash flow (DCF) analysis. Despite a current low return on equity forecast at 5.8% in three years, the company's revenue growth is robust at 24.9% per year, significantly outpacing the US market average of 8.6%. Recent adjustments to their fiscal year 2024 earnings guidance suggest an optimistic outlook, with expected revenue ranging from US$733 million to US$773 million.

Where To Now?

Take a closer look at our Undervalued Stocks Based On Cash Flows list of 962 companies by clicking here.

Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Contemplating Other Strategies?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include ENXTBR:ARGXIDX:PANI NasdaqGS:GLBE.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance