Here's Why it is Worth Investing in Applied Industrial (AIT)

Applied Industrial Technologies, Inc. AIT currently boasts robust prospects on strength in its end markets, solid product portfolio, acquired assets and a sound capital-deployment strategy.

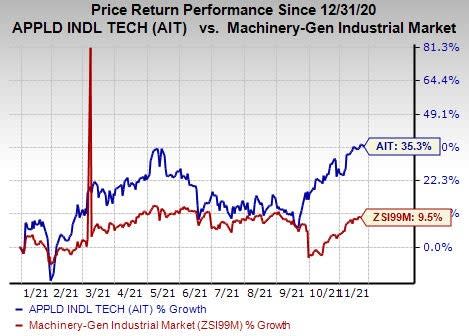

The Zacks Rank #2 (Buy) company has a market capitalization of $4.1 billion. Year to date, it has gained 35.3% compared with the industry’s growth of 9.5%.

Image Source: Zacks Investment Research

Let’s delve into the factors that make the company investment-worthy at the moment.

Strong End Markets: Applied Industrial has been benefiting from a strengthening demand environment in industrial end markets along with its pricing actions and growth initiatives. The company’s focus on improving the product line, value-added services and initiatives to drive operational excellence are likely to boost its performance. Also, its investments for expanding automation, IIoT and digital offerings are likely to be beneficial. For fiscal 2022 (ending June 2022), it predicts organic sales growth of 7-9% on a year-over-year basis.

Acquisition Benefits: AIT intends to strengthen and expand its businesses through acquisitions. The R.R. Floody acquisition (August 2021) has been enhancing its offerings in the automation technology space and boosting its reach across the U.S. Midwest market. Also, it completed the buyouts of Advanced Control Solutions (October 2020) and Gibson (January 2021). In first-quarter fiscal 2022 (ended September 2021) the buyouts had a positive impact of 2.1% on the company’s sales.

Rewards to Shareholders: It remains committed to rewarding shareholders through dividend payouts and share buybacks. In the fiscal first quarter, AIT paid out dividends worth $12.7 million and repurchased shares worth $6.5 million. Also, in January 2021, it announced a 3.1% hike in its quarterly dividend rate.

Estimate Revisions: In the past 30 days, analysts have increasingly become bullish on Applied Industrial, as evident from positive earnings estimate revisions. The Zacks Consensus Estimate for its fiscal 2022 earnings has trended up from $5.31 to $5.41 on one upward estimate revisions against none downward. Over the same timeframe, the consensus estimate for fiscal 2023 (ending June 2023) earnings has trended up from $5.81 to $5.94 on one upward estimate revision against none downward.

Other Key Picks

Some other top-ranked companies from the Zacks Industrial Products sector are discussed below.

SPX FLOW, Inc. FLOW presently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here. Its earnings surprise in the last four quarters was 40.42%, on average.

In the past 30 days, SPX FLOW’s earnings estimates have increased 8% for 2021 and 17.9% for 2022. Its shares have gained 2.5% in the past three months.

Welbilt, Inc. WBT presently carries a Zacks Rank #2. Its earnings surprise in the last four quarters was 172.50%, on average.

Welbilt’s earnings estimates have increased 3.2% for 2021 and 5.9% for 2022 in the past 30 days. Its shares have gained 1.1% in the past three months.

AZZ Inc. AZZ presently carries a Zacks Rank #2. Its earnings surprise in the last four quarters was 25.47%, on average.

AZZ’s earnings estimates for fiscal 2022 (ending February 2022) and fiscal 2023 (ending February 2023) have been stable in the past 30 days. Its shares have gained 6.7% in the past three months.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Applied Industrial Technologies, Inc. (AIT) : Free Stock Analysis Report

AZZ Inc. (AZZ) : Free Stock Analysis Report

SPX FLOW, Inc. (FLOW) : Free Stock Analysis Report

Welbilt, Inc. (WBT) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Yahoo Finance

Yahoo Finance