Here's Why We Think PPHE Hotel Group (LON:PPH) Is Well Worth Watching

It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses. A loss-making company is yet to prove itself with profit, and eventually the inflow of external capital may dry up.

In contrast to all that, many investors prefer to focus on companies like PPHE Hotel Group (LON:PPH), which has not only revenues, but also profits. Now this is not to say that the company presents the best investment opportunity around, but profitability is a key component to success in business.

See our latest analysis for PPHE Hotel Group

PPHE Hotel Group's Improving Profits

PPHE Hotel Group has undergone a massive growth in earnings per share over the last three years. So much so that this three year growth rate wouldn't be a fair assessment of the company's future. As a result, we'll zoom in on growth over the last year, instead. In impressive fashion, PPHE Hotel Group's EPS grew from UK£0.24 to UK£0.53, over the previous 12 months. It's a rarity to see 123% year-on-year growth like that. Shareholders will be hopeful that this is a sign of the company reaching an inflection point.

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. PPHE Hotel Group shareholders can take confidence from the fact that EBIT margins are up from 17% to 20%, and revenue is growing. Both of which are great metrics to check off for potential growth.

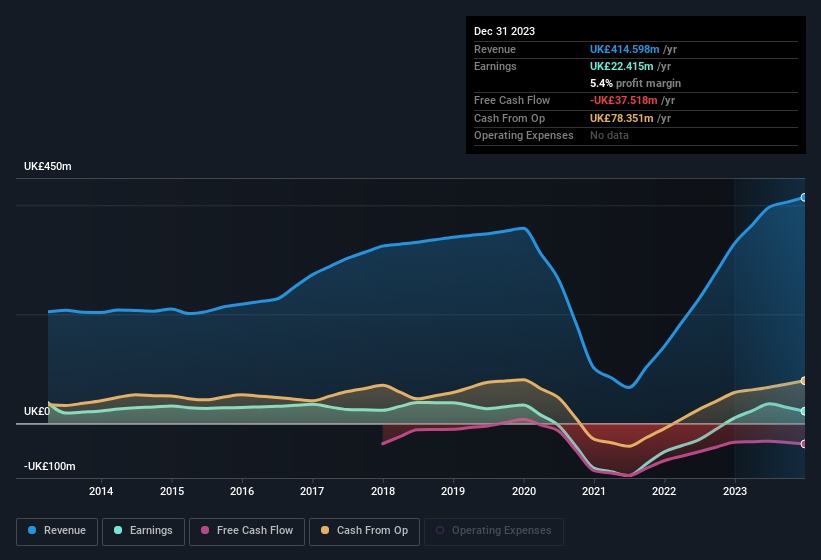

You can take a look at the company's revenue and earnings growth trend, in the chart below. Click on the chart to see the exact numbers.

While we live in the present moment, there's little doubt that the future matters most in the investment decision process. So why not check this interactive chart depicting future EPS estimates, for PPHE Hotel Group?

Are PPHE Hotel Group Insiders Aligned With All Shareholders?

Insider interest in a company always sparks a bit of intrigue and many investors are on the lookout for companies where insiders are putting their money where their mouth is. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

One gleaming positive for PPHE Hotel Group, in the last year, is that a certain insider has buying shares with ample enthusiasm. In other words, the President, Boris Ivesha, acquired UK£53m worth of shares over the previous 12 months at an average price of around UK£11.40. Big insider buys like that are a rarity and should prompt discussion on the merits of the business.

On top of the insider buying, it's good to see that PPHE Hotel Group insiders have a valuable investment in the business. Notably, they have an enviable stake in the company, worth UK£153m. This totals to 26% of shares in the company. Enough to lead management's decision making process down a path that brings the most benefit to shareholders. Very encouraging.

While insiders already own a significant amount of shares, and they have been buying more, the good news for ordinary shareholders does not stop there. That's because PPHE Hotel Group's CEO, Boris Ivesha, is paid at a relatively modest level when compared to other CEOs for companies of this size. Our analysis has discovered that the median total compensation for the CEOs of companies like PPHE Hotel Group with market caps between UK£317m and UK£1.3b is about UK£1.1m.

PPHE Hotel Group offered total compensation worth UK£750k to its CEO in the year to December 2023. That is actually below the median for CEO's of similarly sized companies. While the level of CEO compensation shouldn't be the biggest factor in how the company is viewed, modest remuneration is a positive, because it suggests that the board keeps shareholder interests in mind. It can also be a sign of a culture of integrity, in a broader sense.

Should You Add PPHE Hotel Group To Your Watchlist?

PPHE Hotel Group's earnings per share have been soaring, with growth rates sky high. To sweeten the deal, insiders have significant skin in the game with one even acquiring more. This quick rundown suggests that the business may be of good quality, and also at an inflection point, so maybe PPHE Hotel Group deserves timely attention. You should always think about risks though. Case in point, we've spotted 2 warning signs for PPHE Hotel Group you should be aware of, and 1 of them is significant.

Keen growth investors love to see insider buying. Thankfully, PPHE Hotel Group isn't the only one. You can see a a curated list of British companies which have exhibited consistent growth accompanied by recent insider buying.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Yahoo Finance

Yahoo Finance