Here's Why We Think Edison International's (NYSE:EIX) CEO Compensation Looks Fair for the time being

Key Insights

Edison International's Annual General Meeting to take place on 25th of April

Total pay for CEO Pedro Pizarro includes US$1.40m salary

Total compensation is similar to the industry average

Edison International's EPS grew by 16% over the past three years while total shareholder return over the past three years was 31%

Under the guidance of CEO Pedro Pizarro, Edison International (NYSE:EIX) has performed reasonably well recently. As shareholders go into the upcoming AGM on 25th of April, CEO compensation will probably not be their focus, but rather the steps management will take to continue the growth momentum. We present our case of why we think CEO compensation looks fair.

View our latest analysis for Edison International

How Does Total Compensation For Pedro Pizarro Compare With Other Companies In The Industry?

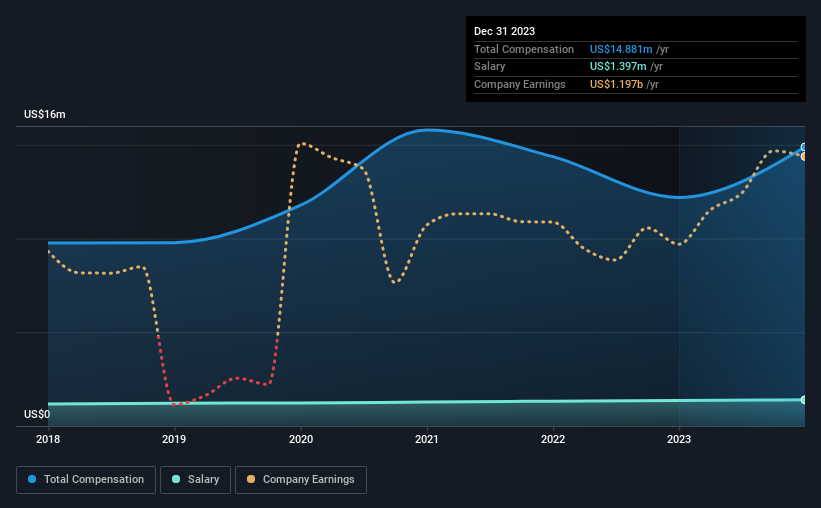

At the time of writing, our data shows that Edison International has a market capitalization of US$26b, and reported total annual CEO compensation of US$15m for the year to December 2023. That's a notable increase of 22% on last year. We think total compensation is more important but our data shows that the CEO salary is lower, at US$1.4m.

On comparing similar companies in the American Electric Utilities industry with market capitalizations above US$8.0b, we found that the median total CEO compensation was US$14m. This suggests that Edison International remunerates its CEO largely in line with the industry average. What's more, Pedro Pizarro holds US$13m worth of shares in the company in their own name, indicating that they have a lot of skin in the game.

Component | 2023 | 2022 | Proportion (2023) |

Salary | US$1.4m | US$1.4m | 9% |

Other | US$13m | US$11m | 91% |

Total Compensation | US$15m | US$12m | 100% |

Speaking on an industry level, nearly 11% of total compensation represents salary, while the remainder of 89% is other remuneration. It's interesting to note that Edison International allocates a smaller portion of compensation to salary in comparison to the broader industry. If total compensation is slanted towards non-salary benefits, it indicates that CEO pay is linked to company performance.

A Look at Edison International's Growth Numbers

Edison International's earnings per share (EPS) grew 16% per year over the last three years. It saw its revenue drop 5.1% over the last year.

This demonstrates that the company has been improving recently and is good news for the shareholders. It's always a tough situation when revenues are not growing, but ultimately profits are more important. Looking ahead, you might want to check this free visual report on analyst forecasts for the company's future earnings..

Has Edison International Been A Good Investment?

Edison International has generated a total shareholder return of 31% over three years, so most shareholders would be reasonably content. But they would probably prefer not to see CEO compensation far in excess of the median.

In Summary...

The company's decent performance might have made most shareholders happy, possibly making CEO remuneration the least of the concerns to be discussed in the upcoming AGM. Despite the pleasing results, we still think that any proposed increases to CEO compensation will be examined based on a case by case basis and linked to performance outcomes.

CEO pay is simply one of the many factors that need to be considered while examining business performance. We identified 3 warning signs for Edison International (2 are concerning!) that you should be aware of before investing here.

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Yahoo Finance

Yahoo Finance