Here's Why You Should Retain Snap-on (SNA) in Your Portfolio

Snap-on Incorporated SNA appears well-poised for growth, thanks to its solid business strategies. The company is focused on growth strategies, including enhancing the franchise network, improving relationships with repair shop owners and managers, and expanding into critical industries in emerging markets.

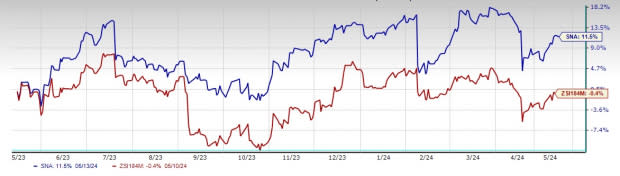

Buoyed by such catalysts, shares of this current Zacks Rank #3 (Hold) company have gained 11.5% against the industry’s 0.4% decline in the past three months.

What’s More to Know?

Snap-on's emphasis on its Rapid Continuous Improvement (RCI) process is aimed at enhancing organizational effectiveness, reducing costs, and boosting sales and margins. Savings from the RCI initiative come from continuous productivity and process-improvement plans. The company’s robust business model helps enhance value-creation processes, which, in turn, improve safety, quality of service, customer satisfaction and innovation.

The company is dedicated to various strategic principles and processes aimed at creating value in areas like RCI. Management intends to boost customer services along with enhancing manufacturing and supply-chain capabilities through the RCI initiatives and further investments. This apart, Snap-on’s ability to innovate bodes well. The company has been investing in new products and increasing brand awareness across the world as well.

Image Source: Zacks Investment Research

Snap-on’s business trends remain robust, as evident from the strong performance across its few operating segments. In the first quarter, sales in Repair Systems & Information Group advanced 3.9% year over year, with organic sales growth of 3.3%. Sales also gained from a $2.5-million positive impact of currency. Higher activity with OEM dealerships and a rise in sales of under-car equipment contributed to the segment’s organic sales growth. Further, the Financial Services business’ revenues rose 7.6% year over year to $99.6 million.

However, Snap-on has been witnessing ongoing challenges due to macroeconomic headwinds. The company has been grappling with the impacts of rising cost inflation, primarily driven by increased raw material expenses and other related costs. Nevertheless, management believes that the company’s markets and operations have considerable resilience against the uncertainties of the environment. In 2024, the company anticipates progress along its defined runways for growth.

Management expects continued progress by leveraging capabilities in the automotive repair arena, as well as expanding its customer base in automotive repair and across geographies, including critical industries.

Analysts seem optimistic about the company. The Zacks Consensus Estimate for 2024 sales and earnings per share (EPS) is currently pegged at $4.85 billion and $19.21, respectively, reflecting growth of 2.4% each.

Stocks to Consider

Some better-ranked companies are GIII Apparel GIII, lululemon athletica LULU and Royal Caribbean RCL.

GIII Apparel, an accessories dealer, sports a Zacks Rank #1 (Strong Buy), at present. GIII has a trailing four-quarter earnings surprise of 541.8%, on average. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for GIII Apparel’s current financial-year EPS suggests growth of 39.3% from the year-ago figure.

lululemon athletica is a yoga-inspired athletic apparel company. LULU carries a Zacks Rank # 2 (Buy), at present.

The consensus estimate for lululemon athletica’s current financial-year sales and EPS suggests growth of 18.4% and 23.7%, respectively, from the year-ago figures. LULU has a trailing four-quarter earnings surprise of 9.2%, on average.

Royal Caribbean carries a Zacks Rank of 2, at present. RCL has a trailing four-quarter earnings surprise of 28.3%, on average.

The Zacks Consensus Estimate for RCL’s 2024 sales and EPS indicates an increase of 13.7% and 38.1%, respectively, from the year-ago reported levels.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Royal Caribbean Cruises Ltd. (RCL) : Free Stock Analysis Report

Snap-On Incorporated (SNA) : Free Stock Analysis Report

lululemon athletica inc. (LULU) : Free Stock Analysis Report

G-III Apparel Group, LTD. (GIII) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance