Here's Why You Should Retain Nevro (NVRO) Stock for Now

Nevro Corp. NVRO is well-poised for growth in the coming quarters, courtesy of its research and development (R&D) edge. The optimism, led by a solid first-quarter 2024 performance and continued strength in its flagship Senza platform, is expected to contribute further. However, stiff competition and dependence on third-party payors persist.

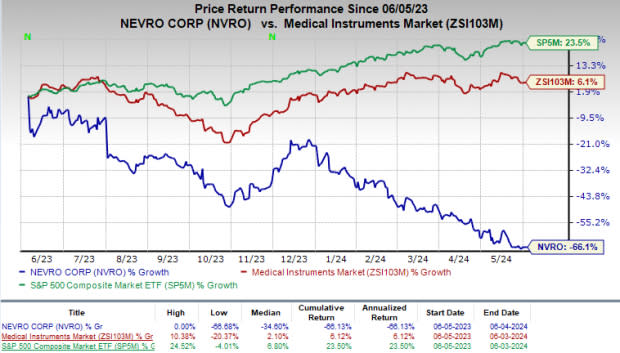

In the past year, this Zacks Rank #3 (Hold) stock has lost 66.1% against the industry’s 6.1% growth. The S&P 500 rallied 23.5% in the same time frame.

The renowned global medical device company has a market capitalization of $343.4 million. The company projects 13.8% growth for 2024 and expects to maintain its strong performance in the future. Nevro’s earnings surpassed the Zacks Consensus Estimate in three of the trailing four quarters and missed once, the average surprise being 28.87%.

Image Source: Zacks Investment Research

Let’s delve deeper.

R&D Edge: Nevro aims to continue to improve patient outcomes and expand patient access to HF10 therapy through enhancements to Senza and the development of newer indications, raising our optimism. Since the launch of the initial Senza system, the company has introduced several product enhancements, like active anchors with improved performance, among others. NVRO continues to make enhancements to Senza to boost its performance.

Per management, there has been a continued increase in the adoption of Nevro’s newest generation SCS system, HFX iQ, since its full market launch. HFX iQ represented 58% of the company’s permanent implant procedures in the first quarter of 2024 and the adoption is likely to grow throughout 2024.

In the first-quarter earnings call, management confirmed that Nevro had entered the fast-growing SI joint fusion market through the acquisition of Vyrsa and is focused on ramping up that business. This addition of the newly acquired SI Joint Fusion business is likely to bring additional revenues in the second half of 2024.

In February 2024, Nevro announced that the FDA cleared its SI joint fusion device, which will be marketed as Nevro1, without the need to include the screw (NevroFix).

Strength in Senza: We are optimistic about Nevro’s continued strength in its flagship Senza platform. Based on the analysis from the company’s SENZA- Randomized Controlled Trial (RCT) and European studies and the SENZA-PDN (Painful Diabetic Neuropathy) and SENZA-NSRBP (non-surgical refractory back pain) RCTs, Nevro believes the 10 kHz therapy can be an attractive treatment option for patients.

Per the first-quarter earnings call, 24 months of data from Nevro’s SENZA-PDN RCT demonstrated improvement in sensory function that can lower the risk of diabetes-related ulcerations and traumatic amputations for patients suffering from severe side effects of diabetes.

In November, Nevro published 24-month data from the SENZA Nonsurgical Refractory Back Pain (NSRBP) multicenter randomized controlled trial (RCT) in the Journal of Neurosurgery: Spine. The published 24-month data indicated that patients in the high-frequency SCS group experienced significant improvements in pain, function and quality of life, along with reduced opioid use, unlike the CMM arm at 24 months. The long-term data also provides evidence of the benefits of high-frequency SCS in managing patients with NSRBP.

Strong Q1 Results: Nevro exited the first quarter of 2024 with better-than-expected results and an improvement in revenues. The company’s robust domestic revenues were also impressive. An uptick was observed in total U.S. permanent implant procedures. The strong uptake of its new-generation SCS platform, HFX iQ, was also encouraging.

The company’s restructuring initiative looks promising as it is likely to support its long-term growth and profitability. Nevro is planning additional restructuring activities later this year.

Downsides

Dependence on Third-Party Payors: Nevro's ability to successfully sell its goods is primarily dependent on how well private health insurers, government health administrative agencies in the United States and other countries, and other organizations can pay for and reimburse customers for the costs of Nevro's products. It is imperative that third-party payors provide sufficient coverage and payment for spinal cord stimulation operations utilizing Senza for Nevro's consumers to accept its products.

Stiff Competition: Nevro operates in a highly-competitive medical device industry, which is subject to technological change. The company's capacity to gain a competitive edge in the neuromodulation market by gaining widespread consumer approval of its Senza and HF10 therapies for the management of recognized chronic pain syndromes is one factor contributing to its success.

Estimate Trend

Nevro has been witnessing a negative estimate revision trend for 2024. In the past 30 days, the Zacks Consensus Estimate for its loss has narrowed from $2.54 per share to $2.12.

The Zacks Consensus Estimate for the company’s second-quarter 2024 revenues is pegged at $107.1 million, indicating a 1.6% decline from the year-ago quarter’s reported number.

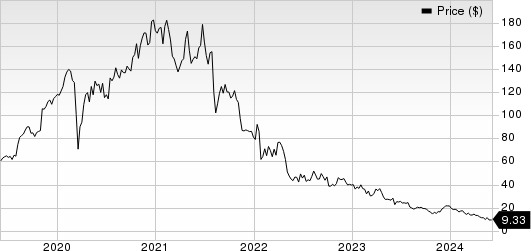

Nevro Corp. Price

Nevro Corp. price | Nevro Corp. Quote

Key Picks

Some better-ranked stocks in the broader medical space that have announced quarterly results are Align Technology, Inc. ALGN, Ecolab ECL and Boston Scientific Corporation BSX.

Align Technology, carrying a Zacks Rank of 2 (Buy), reported first-quarter 2024 adjusted earnings per share (EPS) of $2.14, which beat the Zacks Consensus Estimate by 8.1%. Revenues of $997.4 million outpaced the consensus mark by 2.6%. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Align Technology has a long-term estimated growth rate of 6.9%. ALGN’s earnings surpassed the Zacks Consensus Estimate in three of the trailing four quarters and missed once, the average surprise being 5.9%.

Ecolab, carrying a Zacks Rank of 2 at present, has an estimated long-term growth rate of 13.3%. ECL’s earnings surpassed estimates in each of the trailing four quarters, with the average surprise being 1.7%.

Ecolab’s shares have rallied 33.8% against the industry’s 9.3% decline in the past year.

Boston Scientific reported first-quarter 2024 adjusted EPS of 56 cents, which beat the Zacks Consensus Estimate by 9.8%. Revenues of $3.86 billion surpassed the Zacks Consensus Estimate by 4.9%. It currently carries a Zacks Rank #2.

Boston Scientific has a long-term estimated growth rate of 12.5%. BSX’s earnings surpassed estimates in all the trailing four quarters, the average surprise being 7.5%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Boston Scientific Corporation (BSX) : Free Stock Analysis Report

Ecolab Inc. (ECL) : Free Stock Analysis Report

Align Technology, Inc. (ALGN) : Free Stock Analysis Report

Nevro Corp. (NVRO) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance