Here's Why You Should Retain Medtronic (MDT) Stock for Now

Medtronic plc MDT is likely to grow in the coming quarters, backed by remarkable progress within the Cardiovascular portfolio. The Cranial and Spinal technologies business within the company’s Neuroscience portfolio has been registering strong growth in recent quarters. Favorable solvency is highly encouraging.

Meanwhile, macroeconomic challenges may have an adverse impact on the company’s operations. Intense competition from peers is also concerning.

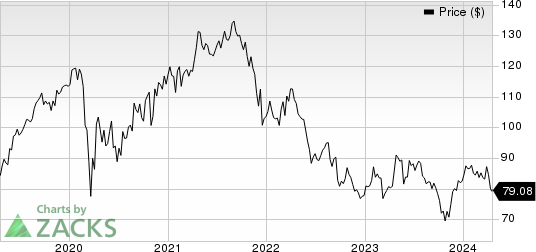

In the past year, this Zacks Rank #3 (Hold) stock has lost 6.8% compared with the industry’s 6.2% decline. The S&P 500 Composite witnessed a 21.7% increase in the same time frame.

The renowned medical device company has a market capitalization of $105.23 billion. Medtronic has an earnings yield of 6.56% compared with the industry’s yield of 0.10%. The company’s earnings surpassed estimates in each of the trailing four quarters, delivering an average surprise of 4.46%.

Image Source: Zacks Investment Research

Let’s delve deeper.

Tailwinds

Market Share Gains Within Cardiovascular to Continue: Medtronic is strongly expanding its global foothold within the company’s Cardiovascular business. One of the company’s largest businesses, cardiac rhythm management, continues to build on MDT’s category leadership. Medtronic’s Cardiac Pacing business is driving strong growth following the launch of the company’s next-generation Micra AV2 and VR2 devices in the United States.

The company has continued with the strong global growth of its Micra leadless pacemaker family as it enters new geographies and expands penetration in existing markets. Further, ICDs (Implantable cardioverter-defibrillators) within cardiac rhythm management are gaining in terms of market share following the FDA nod and CE Mark for the Aurora Extravascular ICD.

Within Structural Heart, MDT won TAVR (Transcatheter aortic valve replacement) share globally in the fiscal third quarter on the strength of Evolut FX. Specifically, in Europe, Evolut FX generated revenues for the first full quarter following its approval. In Japan, too, TAVR continued to win market share on the continued adoption of Evolut FX for patients with expanded end-stage renal disease indication.

The company also received FDA approval for its newest generation Evolt TAVR system and announced new data for the TVAR trial that demonstrates non-inferior clinical outcomes and superior valve performance for Evolut TAVR compared to Sapien at one year.

Neurosurgery Portfolio Shows Strong Growth Prospects: While the AiBLE ecosystem is still being adopted, the category experienced above-market growth in the fiscal third quarter. Thanks to AiBLE, Medtronic's global footprint — which now includes more than 10,000 systems — is more than four times larger than that of its closest rival. High single-digit increase in Core Spine, mid-teens growth in biologics, and high-single-digit growth in enabling technology were all achieved by the Cranial and Spinal technologies.

Furthermore, the company's hemorrhagic stroke flow diversion solutions are performing well, which is helping the Specialty Therapies business. The ENT business in the Neuroscience portfolio keeps making a good contribution to the division. The company is acquiring new implant shares in DBS (Deep Brain Stimulation) and pain Stim in neuromodulation. In January 2024, the FDA approved the Percept RC DBS system, the newest member of the Percept family.

Stable Liquidity Position: The company’s cash and cash equivalents were $8.32 billion at the end of the third quarter of fiscal 2024, while total debt (including the current portion) remained at $25.18 billion. The short-term payable debt of $1.03 billion remains lower than the short-term cash level. MDT’s times interest earned ratio of 8.9 compares with 9 at the end of the fiscal second quarter.

Downsides

Macroeconomic Issues Hamper Several Markets: Medtronic noted that while the impact of the COVID-19 resurgence has diminished, in several of its markets, supply constraint recovery is slow. With regard to procedural volumes, in addition to an incremental China VBP, the company is still seeing lower volumes in elective coronary PCI, GI procedures, TAVR, spinal cord stim and some less emergent surgical procedures. The slower-than-anticipated recovery in procedural volumes primarily occurred in developed markets as healthcare systems continued to work through staffing and other challenges.

Competitive Landscape: The medical device market is extremely competitive due to the vast number of companies. The segments that generate a majority of revenues for Medtronic are Spinal, Cardio Vascular, and CRDM. In the CRDM market, competitors like Boston Scientific Corporation present the company with fierce rivalry. Players like NuVasive, Zimmer, Johnson & Johnson, and Stryker Corporation have increased competitiveness, especially in the spinal market.

Estimate Trend

The Zacks Consensus Estimate for Medtronic’s fiscal 2024 earnings per share is pegged at $5.20.

The consensus estimate for the company’s fiscal 2024 revenues is pegged at $32.21 billion, a 3.16% increase from the year-ago reported number.

Medtronic PLC Price

Medtronic PLC price | Medtronic PLC Quote

Key Picks

Some better-ranked stocks in the broader medical space are DaVita Inc. DVA, Cardinal Health, Inc. CAH and LeMaitre Vascular, Inc. LMAT.

DaVita, flaunting a Zacks Rank #1 (Strong Buy) at present, has an estimated long-term growth rate of 12.1%. DVA’s earnings surpassed estimates in each of the trailing four quarters, with the average surprise being 35.6%. You can see the complete list of today’s Zacks #1 Rank stocks here.

DaVita’s shares have gained 61.6% compared with the industry’s 17.6% rise in the past year.

Cardinal Health, carrying a Zacks Rank of 2 (Buy) at present, has an estimated long-term growth rate of 14.2%. CAH’s earnings surpassed estimates in each of the trailing four quarters, with the average being 15.6%.

Cardinal Health has gained 38.1% compared with the industry’s 9.7% rise in the past year.

LeMaitre Vascular, sporting a Zacks Rank of 1 at present, has an estimated long-term growth rate of 14%. LMAT’s earnings surpassed estimates in each of the trailing four quarters, with the average surprise being 8.9%.

LeMaitre Vascular’s shares have rallied 20.8% compared with the industry’s 2.6% rise in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Medtronic PLC (MDT) : Free Stock Analysis Report

DaVita Inc. (DVA) : Free Stock Analysis Report

Cardinal Health, Inc. (CAH) : Free Stock Analysis Report

LeMaitre Vascular, Inc. (LMAT) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance