Here's Why You Should Retain FMC Corp (FMC) in Your Portfolio

FMC Corporation FMC is gaining from favorable demand for its herbicides and insecticides and its efforts to expand product portfolio and boost market position amid certain challenges including significant currency headwinds.

The company’s shares are up 25.3% over a year compared with the 4.9% rise of its industry.

Let’s find out why this Zacks Rank #3 (Hold) stock is worth retaining at the moment.

What’s Going in FMC’s Favor?

FMC is gaining from healthy demand for its products, its portfolio strength and new product launches. In Latin America, the company witnessed strong demand for its insecticides and herbicides from sugarcane growers in Brazil as well as solid demand for herbicides in Argentina in wheat and soybean applications in the second quarter of 2020. It is also seeing strong sales for the Lucento fungicide in North America. In Asia, demand for herbicides also remain strong in India.

The company also remains focused on boosting its market position and strengthening its product portfolio. It is focused on investing in technologies and products as well as new launches to enhance value to farmers. Product introductions are expected to support its results in this year. The company anticipates new products to contribute 1.5% of revenue growth in 2020 with the biggest contribution expected from EMEA (Europe, Middle East and Africa).

FMC also remains committed to return value to its shareholders leveraging healthy cash flows. The company, in late 2019, hiked its quarterly dividend by 10% to 44 cents per share. FMC expects to generate free cash flow of $425-$525 million in 2020 and maintain its dividend payout.

A Few Concerns

The company faces significant headwind from unfavorable currency translation. Currency had an unfavorable impact of 7% on its sales and $62 million on adjusted EBITDA in the second quarter due to a stronger U.S. dollar. The company now sees currency headwind on EBITDA of $230 million for full-year 2020, higher than its previous guidance of $170 million. The impact on revenues is forecast to be 6% in 2020. Currency impact on EBITDA for the third quarter is also projected to be $60 million.

Moreover, FMC faces some challenges from higher supply chain costs due to coronavirus-led disruptions. The company witnessed higher costs associated with certain logistic challenges in the second quarter. It sees $10 million cost headwind on its adjusted EBITDA in the third quarter. Moreover, headwind for the fourth quarter is projected to be $23 million.

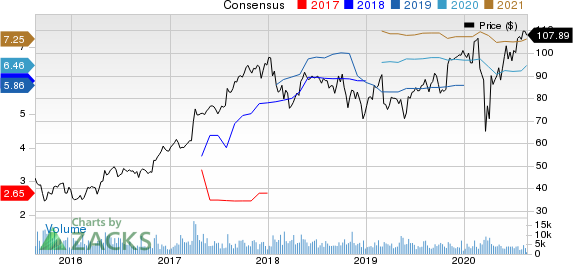

FMC Corporation Price and Consensus

FMC Corporation price-consensus-chart | FMC Corporation Quote

Stocks to Consider

Better-ranked stocks worth considering in the basic materials space include Barrick Gold Corporation GOLD, Yamana Gold Inc. AUY and Eldorado Gold Corporation EGO.

Barrick Gold has a projected earnings growth rate of 80.4% for the current year. The company’s shares have gained around 59% in a year. It currently has a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Yamana Gold has a projected earnings growth rate of 76.9% for the current year. The company’s shares have rallied roughly 85% in a year. It currently carries a Zacks Rank #2 (Buy).

Eldorado Gold has an expected earnings growth rate of 2,225% for the current year. The company’s shares have gained around 33% in the past year. It presently carries a Zacks Rank #2.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2021.

Click here for the 6 trades >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

FMC Corporation (FMC) : Free Stock Analysis Report

Barrick Gold Corporation (GOLD) : Free Stock Analysis Report

Yamana Gold Inc. (AUY) : Free Stock Analysis Report

Eldorado Gold Corporation (EGO) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance