Here's Why You Should Retain Ashland (ASH) Stock for Now

Ashland Inc. ASH is gaining from strong demand across its key end markets and disciplined pricing actions amid headwinds from raw material cost inflation.

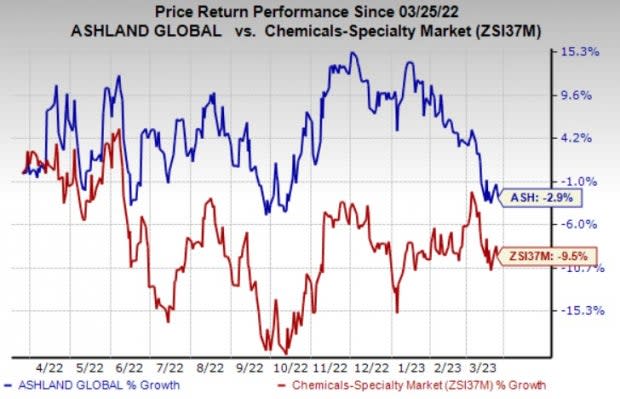

The company’s shares are down 2.9% in a year, compared with 9.5% decline recorded by its industry.

Image Source: Zacks Investment Research

Let’s find out why this Zacks Rank #3 (Hold) stock is worth retaining at the moment.

What’s Aiding ASH?

Ashland is benefiting from the strength in its global pharma business. Strong demand for pharmaceutical ingredients is driving sales in its Life Sciences segment. Sales in the segment climbed 22% year over year in the first quarter of fiscal 2023, aided by double-digit growth to pharmaceutical customers. Ashland is also seeing a recovery across personal care ingredients and architectural coatings additives. ASH is also gaining from the contributions from the Schulke & Mayr acquisition.

The company is also taking a number of actions, including reduction of operating costs to boost profitability. Cost-reduction measures are expected to support its margins in fiscal 2023. The company’s pricing measures are also contributing to its top-line growth. Its pricing and mix improvement actions are expected to cover the current inflation.

Ashland also remains committed to boosting its cash flows and returning value to shareholders. The company remains focused on expanding margins and improving free cash flow conversion. It is executing share buybacks under the $500-million evergreen stock repurchase program.

A Few Headwinds

Tight raw material supply conditions are a concern. The company faces challenges from the availability of raw materials. It is seeing inflation in raw material and energy costs. Raw material and energy inflation, especially in Europe, are expected to continue in the short haul.

Ashland is also facing headwinds from global logistics and shipping constraints. It is witnessing higher freight and logistics costs. The supply chain and logistics challenges are expected to persist over the near term. Demand weakness in China due to lingering impacts of COVID-related measures and the economic slowdown in Europe partly due to the Russia-Ukraine conflict are other concerns.

Ashland Inc. Price and Consensus

Ashland Inc. price-consensus-chart | Ashland Inc. Quote

Stocks to Consider

Better-ranked stocks worth considering in the basic materials space include Steel Dynamics, Inc. STLD, Olympic Steel, Inc. ZEUS and Yamana Gold Inc. AUY.

Steel Dynamics currently sports a Zacks Rank #1 (Strong Buy). The Zacks Consensus Estimate for STLD's current-year earnings has been revised 26.4% upward in the past 60 days. You can see the complete list of today’s Zacks #1 Rank stocks here.

Steel Dynamics’ earnings beat the Zacks Consensus Estimate in each of the last four quarters. It has a trailing four-quarter earnings surprise of roughly 11.3%, on average. STLD has gained around 20% in a year.

Olympic Steel currently sports a Zacks Rank #1. The Zacks Consensus Estimate for ZEUS's current-year earnings has been revised 60.6% upward in the past 60 days.

Olympic Steel’s earnings beat the Zacks Consensus Estimate in each of the last four quarters. It has a trailing four-quarter earnings surprise of roughly 26.2%, on average. ZEUS has rallied around 33% in a year.

Yamana Gold currently carries a Zacks Rank #2 (Buy). The Zacks Consensus Estimate for AUY’s current-year earnings has been revised 3.8% upward in the past 60 days.

Yamana Gold beat Zacks Consensus Estimate in each of the last four quarters. It delivered a trailing four-quarter earnings surprise of 22.5% on average. AUY’s shares have gained roughly 3% in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Steel Dynamics, Inc. (STLD) : Free Stock Analysis Report

Ashland Inc. (ASH) : Free Stock Analysis Report

Yamana Gold Inc. (AUY) : Free Stock Analysis Report

Olympic Steel, Inc. (ZEUS) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance