Here's Why PVH Corp (PVH) is Rallying Ahead of Its Industry

PVH Corporation PVH seems to be well-poised, thanks to its robust initiatives and strong fundamentals. The company’s multi-year strategy PVH+ Plan to drive sustainable growth is working smoothly while expansion efforts in the international business continue. Its brand strength, particularly in Calvin Klein and TOMMY HILFIGER, is an added positive. Also, it sees strength in its direct-to-consumer (DTC) channel.

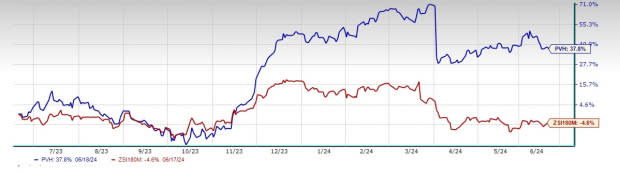

Buoyed by such endeavors, the clothing designer’s shares have gained 37.8% in the past year against the industry’s 4.6% fall.

Let’s Delve Deeper

The PVH+ Plan aims to accelerate growth by boosting core strengths while connecting Calvin Klein and TOMMY HILFIGER brands with consumers through five major drivers. These drivers are win with product; win with consumer engagement; win in the digitally-led marketplace; develop a demand- and data-driven operating model; and drive efficiencies and invest in growth.

PVH Corp strives to create the best products across its significant growth categories. It expects to strengthen its presence in the global markets where its iconic labels resonate well with consumers. Management reinforces the Calvin Klein and TOMMY HILFIGER brands so that these can cater well to consumers’ needs. PVH is focused on fueling digital growth by developing a holistic distribution strategy for its brands, driven by digital and direct-to-consumer channels and wholesale partnerships. Going forward, management remains confident about the underlying power of Calvin Klein and Tommy Hilfiger brands, which position the company's business to succeed amid the ever-changing consumer landscape.

Image Source: Zacks Investment Research

The company aims to develop a demand and data-driven operating model with a systematic and repeatable product creation model. This model will put the consumer first, thus leveraging data to offer fresh products. In the fiscal first quarter, DTC revenues increased 9% year over year both on a reported basis and a constant-currency basis. This was backed by consistent growth in all regions, including both the company's owned and operated stores, and digital-commerce operations. The digital commerce unit of the owned and operated stores rose 10% (9% on a constant-currency basis) year over year.

PVH Corp has been making constant efforts to expand its international business. The company has been boosting higher gross margins and further strengthening its unique brand position and pricing power in Europe. It has also been experiencing robust growth in the Asia Pacific region. The company is also focusing on boosting efficiencies to be cost-competitive and, in turn, reinvest in strategic plans.

Such efforts have helped the company deliver a sturdy performance in the fiscal first quarter. Both earnings and revenues topped the Zacks Consensus Estimate, while the former improved year over year. Results gained from the strong execution of the PVH+ Plan, which led to a robust gross margin expansion and double-digit adjusted earnings per share (EPS) growth. As a result, management envisions adjusted EPS to be in the band of $11.00-$11.25 for fiscal 2024, higher than $10.68 in fiscal 2023.

Analysts seem optimistic about the company. The Zacks Consensus Estimate for fiscal 2024 EPS is pegged at $11.22, indicating a year-over-year increase of 5.1%. A VGM Score of A for this Zacks Rank #3 (Hold) company speaks volumes.

Key Picks

Some better-ranked companies are G-III Apparel Group GIII, Royal Caribbean RCL and lululemon athletica LULU.

G-III Apparel Group sports a Zacks Rank #1 (Strong Buy) at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

G-III Apparel Group has a trailing four-quarter earnings surprise of 571.8%, on average. The Zacks Consensus Estimate for GIII’s fiscal 2024 sales indicates an increase of 3.3% from the year-ago period’s reported level.

Royal Caribbean sports a Zacks Rank of 1, currently. RCL has a trailing four-quarter earnings surprise of 18.3%, on average.

The consensus estimate for RCL’s 2024 sales and EPS indicates increases of 16.8% and 63.8%, respectively, from the year-ago period’s reported levels.

lululemon athletica is a yoga-inspired athletic apparel company. LULU presently carries a Zacks Rank # 2 (Buy).

The Zacks Consensus Estimate for lululemon athletica’s current financial-year sales and EPS indicates growth of 11.5% and 11.8%, respectively, from the year-ago corresponding figures. LULU has a trailing four-quarter earnings surprise of 7.4%, on average.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Royal Caribbean Cruises Ltd. (RCL) : Free Stock Analysis Report

lululemon athletica inc. (LULU) : Free Stock Analysis Report

PVH Corp. (PVH) : Free Stock Analysis Report

G-III Apparel Group, LTD. (GIII) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance