Here's Why L Brands' (LB) Q3 Earnings Are Likely to Decline

L Brands, Inc. LB is scheduled to release third-quarter fiscal 2019 results on Nov 20, after the market closes. In the last reported quarter, this specialty retailer of women’s intimate and other apparel, beauty, and personal care products delivered a positive earnings surprise of 26.3%. We note that this Columbus, OH-based company has outperformed the Zacks Consensus Estimate in the trailing four quarters.

The Zacks Consensus Estimate for third-quarter earnings is pegged at 2 cents, suggesting a sharp decline from earnings of 16 cents reported in the year-ago quarter. Notably, the consensus mark has moved down by a penny in the past seven days. For revenues, the consensus estimate stands at $2,690 million, indicating a decline of 3.1% from the year-ago quarter’s reported figure.

Key Factors to Note

L Brands’ Victoria’s Secret brand has been witnessing soft sales for quite some time now, on account of stiff competition and consumers’ changing preferences. Analysts have pointed out that wrong merchandising actions and the company’s inability to keep up with its strong brand image have led to Victoria’s Secret’s failure. This has been weighing upon the company’s top line performance.

In the last earnings call, management projected a decline of low-single digits to a slight improvement in third-quarter comps. The company forecasts changes of about 2 points lower than the comp result for third-quarter total sales, thanks to the loss of La Senza and Henri Bendel sales, offset by square footage growth at Bath & Body Works.

Further, L Brands has been grappling with strained margins for the past few quarters. Management guided gross margin contraction for the quarter under review owing to lower merchandise margin rate and buying and occupancy expense deleverage. Moreover, increase in SG&A expense rate due to negative comps is also a concern.

The impact of aforementioned factors is likely to reflect on the bottom line. L Brands envisioned third-quarter bottom line in the range of a loss of 5 cents to earnings of 5 cents a share. This is in sharp contrast to earnings of 16 cents reported in the prior-year period.

Nevertheless, L Brands remains focused on cost containment, inventory management, and merchandise and speed-to-market initiatives. Also, its concerted efforts to tap international markets are likely to have offered some cushion. The company has relaunched Victoria Secret’s swimwear category which is likely to have boost traffic. Apart from these, it has been benefitting from strength of its Bath & Body Works brand.

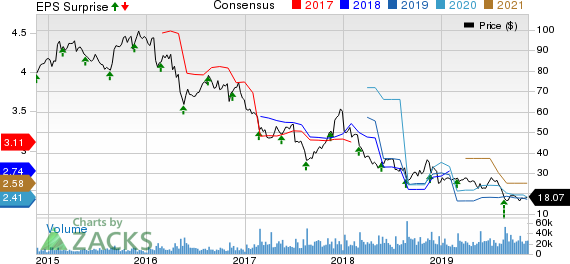

L Brands, Inc. Price, Consensus and EPS Surprise

L Brands, Inc. price-consensus-eps-surprise-chart | L Brands, Inc. Quote

What the Zacks Model Unveils

Our proven model predicts an earnings beat for L Brands this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the chances of an earnings beat. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

L Brands has a Zacks Rank #3 and an Earnings ESP of +4.17%.

Stocks With Favorable Combination

Here are some other companies you may want to consider as our model shows that these too have the right combination of elements to post an earnings beat:

Dollar General DG has an Earnings ESP of +2.34% and a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank stocks here.

Burlington Stores BURL has an Earnings ESP of +2.75% and a Zacks Rank #2.

Tiffany TIF has an Earnings ESP of +3.49% and a Zacks Rank #3.

7 Best Stocks for the Next 30 Days

Just released: Experts distill 7 elite stocks from the current list of 220 Zacks Rank #1 Strong Buys. They deem these tickers “Most Likely for Early Price Pops.”

Since 1988, the full list has beaten the market more than 2X over with an average gain of +24.5% per year. So be sure to give these hand-picked 7 your immediate attention.

See them now >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

L Brands, Inc. (LB) : Free Stock Analysis Report

Dollar General Corporation (DG) : Free Stock Analysis Report

Burlington Stores, Inc. (BURL) : Free Stock Analysis Report

Tiffany & Co. (TIF) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance