Here's Why Investors Should Retain Hasbro (HAS) Stock Now

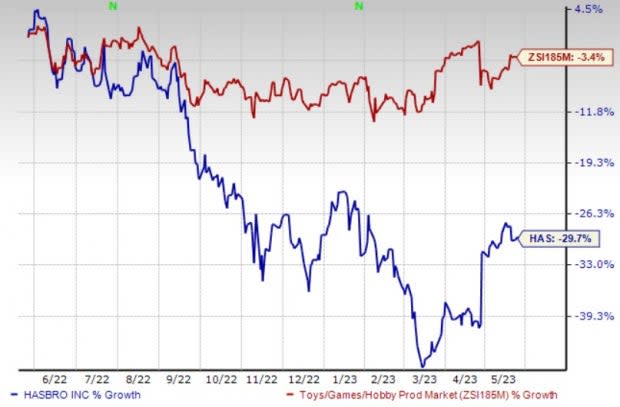

Shares of Hasbro, Inc. HAS, which have declined 29.7% in the past year, have witnessed some improvement in the recent times. In the last three months, the stock gained 9.5% compared with the industry’s growth of 8.5%. It is benefiting from higher contributions from top brands like MAGIC: THE GATHERING and Wizards of the Coast, and the Digital Gaming segment.

Also, focus on eOne content and initiation of the Operational Excellence program bode well. However, high freight expenses, product costs and sales allowances affect HAS’ margins.

Growth Catalysts

Hasbro is witnessing strong gaming demand. With a supreme product portfolio, it is refining gaming experiences across a multitude of platforms like face-to-face gaming, tabletop gaming and digital gaming experiences in mobile.

Backed by strong product lineup and a greater focus on entertainment-backed products, HAS’ Entertainment and Licensing segment is poised for growth. The company stated that it is currently investing in longer-term larger game play.

The Zacks Rank #3 (Hold) company's gaming category, which includes Magic: The Gathering, NERF, Peppa Pig, My Little Pony, Transformers, Play-Doh, and Hasbro products for Marvel portfolio are performing well. In first-quarter 2023 (ended Apr 2), net revenues from total Gaming category were $386.5 million, up 2% year over year. MAGIC: THE GATHERING contributed $229.1 million, up 16.2% year over year.

Coming to unscripted live-action, it has nearly 40 active productions for Canada, the United States and United Kingdom. HAS expects feature films, such as Transformers: Rise of the Beasts and Dungeons & Dragons, to be driving factors to boost revenues and operating profits in 2023.

Meanwhile, the eOne team continues to develop Hasbro IPs of more than 200 projects for TV, film and animation. The company said that the eOne team is working on more than 35 projects for Hasbro brands.

Management is optimistic about growth opportunities over the next three years. It anticipates operating growth of 50% for the same timeframe. It has further plans to increase its operating profit margin to 20% by 2027.

Per management, the Operational Excellence program will deliver $250-$300 million in run-rate cost savings by the end of 2025. By 2023 end, the company expects cost savings of $150 million.

Image Source: Zacks Investment Research

Concerns

Hasbro's initiatives, including product launches and a shift toward more technology-driven toys for reviving its brands and boosting sales, are likely to drive profits in the long term. However, costs related to these initiatives might prove detrimental in the near term. It has shouldered high freight expenses, product costs, sales allowances, and various toys and gaming products closeouts.

HAS anticipates inflationary pressures to persist for the majority of 2023. During the first quarter of fiscal 2023, Hasbro's cost of sales (as a percentage of net revenues) were 28.5%, remaining unchanged from the prior-year quarter. Selling, distribution and administration expenses (as a percentage of net revenues) were 31.7% compared with 26.4% in the prior-year quarter.

Key Picks

Some better-ranked stocks from the Zacks Consumer Discretionary sector are Royal Caribbean Cruises RCL, Bluegreen Vacations BVH and The Madison Square Garden Company MSGS, each sporting a Zacks Rank #1 (Strong Buy) presently. You can see the complete list of today’s Zacks #1 Rank stocks here.

Royal Caribbean Cruises has a trailing four-quarter earnings surprise of 28.1%, on average. The stock has gained 36.7% in the past year.

The Zacks Consensus Estimate for RCL’s 2023 sales and EPS indicates rises of 20.4% and 42.9%, respectively, from the year-ago period’s levels.

Bluegreen Vacations has a trailing four-quarter earnings surprise of 28.4%, on average. The stock has increased 4.2% in the past year.

The Zacks Consensus Estimate for BVH’s 2023 sales and EPS indicates gains of 11.7% and 26.5%, respectively, from the year-ago period’s levels.

The Madison Square Garden Company has a trailing four-quarter earnings surprise of 16.4%, on average. The stock has risen 54% in the past year.

The Zacks Consensus Estimate for MSGS’s 2023 sales and EPS indicates improvements of 17% and 14%, respectively, from the year-ago period’s levels.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Hasbro, Inc. (HAS) : Free Stock Analysis Report

Royal Caribbean Cruises Ltd. (RCL) : Free Stock Analysis Report

The Madison Square Garden Company (MSGS) : Free Stock Analysis Report

Bluegreen Vacations Holding Corporation (BVH) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance