Here's Why Investors May Bet on Voya Financial (VOYA) Stock

Voya Financial Inc. VOYA is poised for growth on the back of solid performance across Wealth Solutions, Investment Management and Health Solutions. Effective capital deployment, upbeat guidance and favorable growth estimates make VOYA worth adding in one’s portfolio.

VOYA has a decent track record of beating earnings estimates in the last five reported quarters, the average beat being 36.62%

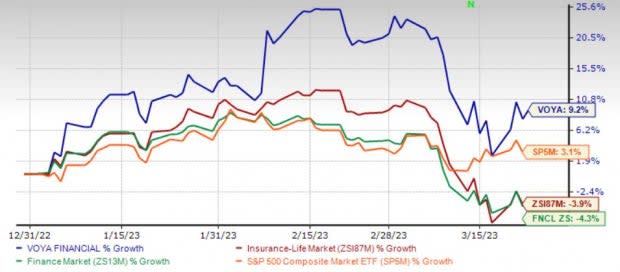

Zacks Rank & Price Performance

Voya Financial currently carries a Zacks Rank #2 (Buy). The stock has gained 9.2% year to date against the 3.9% and 4.3% decline of the industry and the Finance sector, respectively. The Zacks S&P 500 composite has risen 3.1% in the same period.

Image Source: Zacks Investment Research

Optimistic Growth Projections

The Zacks Consensus Estimate for VOYA’s 2023 earnings is pegged at $8.13 per share, indicating a 7.3% increase on 6.9% higher revenues of $1.2 billion. The consensus estimate for 2024 earnings is pegged at $9.18, suggesting an increase of 13% on 4.4% higher revenues of $1.3 billion.

The expected long-term earnings growth rate is pegged at 14.1%, outperforming the industry average of 11%.

Business Tailwinds

Voya Financial remains focused on accelerating growth, banking on ramping up commercial momentum, strengthening existing partnerships and fueling operational efficiency. The company boasts leadership at scale and has outpaced peers in organic growth.

Solid performance across Wealth Solutions, Investment Management and Health Solutions should continue to drive growth. These are higher-growth, higher-return, capital-light businesses boasting a solid presence.

Voya Financial and Allianz Global Investors (AllianzGI) have inked a long-term strategic partnership that has added scale and diversification to Voya Investment Management. The transaction is expected to be accretive to Voya’s adjusted operating EPS, estimated at 6-8% for 2023. In addition, Voya IM’s adjusted operating margin is expected to increase to 29-31% in 2023 and 30-32% in 2024.

Voya could significantly diversify its asset management business, Voya Investment Management, and transform it into a global provider of investment solutions to clients across numerous attractive asset classes and markets. The transaction has also added considerable scale to business with $90 billion in new assets under management. Additionally, it has provided access to AllianzGI's extensive global footprint to distribute Voya’s investment strategies outside of the United States and Canada.

Health Solutions should continue to benefit from market growth in Stop Loss and Voluntary, competitive advantage and digitalization.

Effective Capital Deployment

Voya Financial primarily uses excess capital to buy back shares. At the same time, the insurer stays focused on maintaining dividend yield of atleast 1%.

Upbeat 2024 Financial Targets

Voya Financial has unveiled its financial plan for 2024. This leading health, wealth and investment company estimates annual adjusted operating earnings per share growth of about 12-17%. Net revenue growth of 4-6%, margin expansion of 1-2% and prudent capital management should help Voya Financial achieve the target. The growth rate is based on estimated 2021 adjusted operating earnings of approximately $6.00 per share.

Voya Financial expects net annual revenue growth of 2-4% in Wealth Solutions, 7-10% in Investment Management and 5-7% in Health Solutions segments to contribute to total net revenue growth. The company’s prudent capital management includes the realization of 90-100% free cash flow conversion in the next three years and operating return on equity between 14% and 16%.

Attractive Valuation

VOYA shares are trading at a price to book value multiple of 1.1, lower than the industry average of 1.2. It also has a Value Score of B. This style score helps find the most attractive value stocks. Back-tested results have shown that stocks with a Value Score of A or B, when combined with a Zacks Rank #1 (Strong Buy) or #2, offer better returns.

Other Stocks to Consider

Some other top-ranked stocks from the life insurance industry are Brighthouse Financial BHF, Primerica Inc. PRI and Sun Life Financial SLF.

Brighthouse Financial delivered a trailing four-quarter average earnings surprise of 2.07%. Year to date, BHF has lost 18%.

The Zacks Consensus Estimate for BHF’s 2023 and 2024 earnings indicates a respective year-over-year increase of 33.5% and 11.5%. The insurer sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Primerica delivered earnings surprises in two of the last four reported quarters while missing in other two. Year to date, PRI has lost 14.1%.

The Zacks Consensus Estimate for PRI’s 2023 and 2024 earnings indicates a respective year-over-year increase of 29.4% and 11.5%. The insurer sports a Zacks Rank #1.

Sun Life’s earnings surpassed estimates in each of the last four quarters, the average being 9.14%. Year to date, SLF has lost 5.9%.

The Zacks Consensus Estimate for SLF’s 2024 earnings implies a year-over-year rise of 8.1%. The insurer carries a Zacks Rank #2.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Primerica, Inc. (PRI) : Free Stock Analysis Report

Sun Life Financial Inc. (SLF) : Free Stock Analysis Report

Voya Financial, Inc. (VOYA) : Free Stock Analysis Report

Brighthouse Financial, Inc. (BHF) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance