Here's Why Investors Can Consider Investing in IDEX (IEX)

IDEX Corporation IEX is well-poised for growth, courtesy of strength across its end markets, strong product portfolio, acquisitions and a sound capital-deployment strategy.

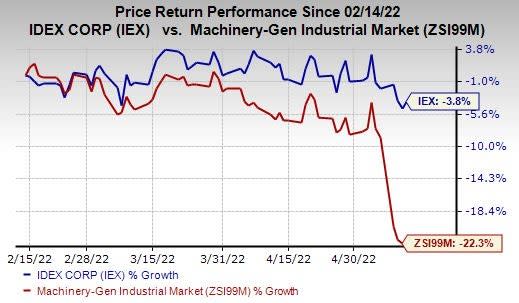

Image Source: Zacks Investment Research

The Zacks Rank #2 (Buy) company has a market capitalization of $14 billion. In the past three months, it has lost 3.8% compared with the industry’s decline of 22.3%.

Let’s delve into the factors that make investment in the company a smart choice at the moment.

Strength in End Markets: IDEX’s diversified business structure and a strong portfolio of products help it in mitigating the adverse impact of weakness in one end market with strength across others. Strength across the company’s industrial, semiconductor and life sciences end markets is likely to drive its performance in the quarters ahead. Also, improvements in automotive, chemical and energy end markets are likely to be favorable. For the second quarter of 2022, organic sales are anticipated to increase 8-9% on a year-over-year basis.

Benefits From Acquisitions: IEX strengthens and expands its businesses by adding assets. The company’s acquisition of Nexsight and its WinCan, Envirosight, MyTana and Pipeline Renewal Technologies businesses (March 2022) has strengthened its position and customer base in the intelligent water technologies market. Also, its buyout of KZValve (May 2022) is expected to boost fluid management solutions in IDEX’s Banjo Corporation business. The company anticipates buyout synergies to increase sales by 6% for the second quarter and 4% for 2022.

Shareholder-Friendly Policies: IDEX remains committed to rewarding shareholders through dividend payouts. In first-quarter 2022, the company paid out dividends worth $41.4 million and repurchased shares worth $26.3 million. Also, in May 2022, it announced a hike of 11% in its quarterly dividend rate.

Estimate Revisions: In the past 30 days, the Zacks Consensus Estimate for its 2022 earnings has moved up from $7.45 to $7.69 on six upward estimate revisions against none downward. Further, the consensus estimate for its 2023 earnings has increased from $8.09 to $8.38 on six upward estimate revisions versus none downward.

Other Key Picks

Some other top-ranked companies from the same space are discussed below.

Applied Industrial Technologies, Inc. AIT presently sports a Zacks Rank #1 (Strong Buy). AIT delivered a trailing four-quarter earnings surprise of 25.4%, on average. You can see the complete list of today’s Zacks #1 Rank stocks here.

AIT’s earnings estimates have increased 5.9% for fiscal 2022 (ending June 2022) in the past 30 days. Its shares have rallied 9% in the past three months.

Roper Technologies, Inc. ROP presently has a Zacks Rank #2. Its earnings surprise in the last four quarters was 2%, on average.

In the past 30 days, ROP’s earnings estimates have increased 1.1% for 2022. The stock has declined 3% in the past three months.

Ferguson plc FERG is presently Zacks #2 Ranked. FERG’s earnings surprise in the last four quarters was 14.2%, on average.

In the past 30 days, the stock’s earnings estimates have been stable for fiscal 2022 (ending July 2022). The stock has declined 18.4% in the past three months.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Roper Technologies, Inc. (ROP) : Free Stock Analysis Report

Applied Industrial Technologies, Inc. (AIT) : Free Stock Analysis Report

IDEX Corporation (IEX) : Free Stock Analysis Report

Wolseley PLC (FERG) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance