Here's Why Hold Strategy is Apt for Newell (NWL) Stock Now

Newell Brands Inc. NWL is well-positioned for long-term growth due to its efforts to leverage its robust e-commerce capabilities. The company has been gaining from solid demand, product innovation and robust core sales growth, aiding the quarterly results. Continued improvement in the Writing business also bodes well.

Despite cost inflation and supply-chain issues, results gained from solid demand, product innovation and robust core sales growth. In third-quarter 2021, Newell’s top line also surpassed the Zacks Consensus Estimate and grew year over year. Net sales advanced 8.5% from the third-quarter 2019 level. The uptick was driven by core sales growth of 3.2%, as every business unit and key region witnessed higher core sales. This marked the fifth successive quarter of core sales growth.

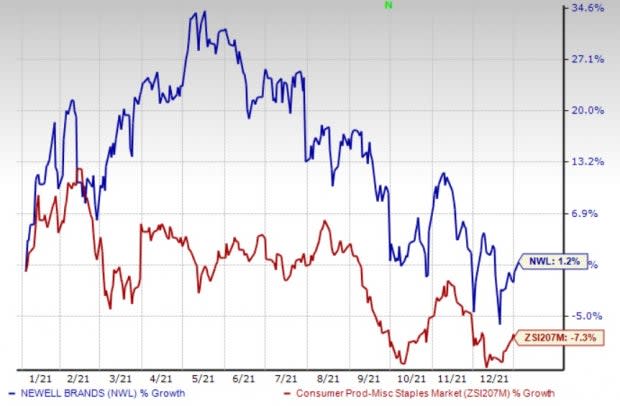

Shares of Newell have risen 1.2% in the past year against the industry's decline of 7.3%.

In the past 30 days, estimates for this Zacks Rank #3 (Hold) company's 2022 earnings per share have been unchanged at $1.89, suggesting 9.4% growth year over year. For 2022, its sales estimates are pegged at $10.56 billion, suggesting 1.03% growth from the year-ago period's reported figure.

Image Source: Zacks Investment Research

Here's Why Newell Should Retain the Momentum

Newell is on track to leverage its robust e-commerce capabilities, which have remained strong for some time now as consumers are increasingly shifting to the online platform. Capitalizing on the shift to digital consumption, the e-commerce business witnessed mid-single-digit sales growth, accounting for nearly 22% of total sales in the third quarter. The company launched buy online and pick up in stores as well as ship from store facilities in its Yankee Candle retail stores. This led to positive customer feedback. The company expects further digital penetration, driven by expanded omnichannel capabilities.

In third-quarter 2021, Newell witnessed healthy consumption trends in the United States as business trends normalized. This marked the sixth straight quarter of consumption growth, with robust consumption across all business units on a two-year basis. Trends in the food and commercial businesses, which witnessed a significant rise in demand last year, have moderated.

Meanwhile, consumption trends for the Baby business delivered double-digit growth, driven by solid consumption growth on a year-over-year and a two-year basis. Home Fragrance and Connected Home & Security businesses also witnessed strong consumption in the United States. The healthy consumption trend led management to lift the 2021 top-line view.

Newell has been witnessing continued improvement in the Writing Business, with core sales growth of double digits in this unit in the third quarter. Broad-based strength in the United States and international markets aided results. It reported strong back-to-school performance on the back of innovative products, including Sharpie S-Gel and Sharpie S-Note as well as robust merchandising plans and distribution gains. Strong demand for pens, pencils, glue, permanent markers, dry erase markers and highlighters also contributed to the strong back-to-school season.

On a two-year basis, the unit delivered significant growth. The Writing business witnessed improved consumption in the United States for the most of 2021, which accelerated sequentially in the third quarter.

Driven by the robust trends, management raised the 2021 view and issued upbeat fourth-quarter guidance. The company now anticipates 2021 sales of $10.38-$10.46 billion compared with the earlier mentioned $10.1-$10.35 billion. Core sales growth is likely to be 10-11%, up from the prior stated 7-10%. The normalized operating margin is expected to be slightly down from the previously communicated 11.1%. Normalized earnings per share are forecast to be $1.69-$1.73 for the year compared with the earlier mentioned $1.63-$1.73. The company envisions generating an operating cash flow of $1 billion.

For fourth-quarter 2021, net sales are envisioned to be $2.6-$2.68 billion, with core sales down 2% to up 1% year over year. For the quarter, the company expects a normalized operating margin of 8.7-9.2% and normalized earnings of 29-33 cents a share.

Hurdles to Overcome

Newell continues to witness elevated advertising and promotional expenses related to product launches and omni-channel investments. As a result, adjusted SG&A expenses rose 2.9% year over year in the third quarter of 2021. Higher costs weighed on third-quarter margins and the bottom line. Management anticipates inflationary cost pressure to escalate further in the fourth quarter, which is expected to hurt margins. The 2021 normalized operating margin is expected to be slightly down from the previously communicated 11.1%.

The company also remains exposed to port congestion, limited container availability, and shortage of labor and truck drivers. Significant inflation in freight costs and supply-chain disruptions remain concerning.

Stocks to Consider

We have highlighted some better-ranked stocks from the broader Consumer Staples space, namely Flowers Foods FLO, Nu Skin Enterprises NUS and United Natural Foods UNFI.

Flowers Foods currently sports a Zacks Rank #1 (Strong Buy). FLO has a trailing four-quarter earnings surprise of 15.4%, on average. Shares of the company have gained 21.1% in a year. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for FLO’s 2022 sales of $4.4 billion suggests growth of 1.9%. The consensus estimate for Flowers Foods’ 2022 earnings per share has been unchanged in the past 30 days at $1.25.

Nu Skin carries a Zacks Rank #2 (Buy) at present. NUS has a trailing four-quarter earnings surprise of 16.6%, on average. Shares of the company have declined 8.2% in the past year.

The Zacks Consensus Estimate for NUS’ 2022 sales and earnings per share suggests growth of 1.2% and 5.2%, respectively, from the year-ago period The consensus estimate for Nu Skin's 2022 earnings per share has been unchanged in the past 30 days at $4.19.

United Natural Foods, a Zacks Rank #2 stock at present, has a trailing four-quarter earnings surprise of 35.4%, on average. Shares of the company have gained 185.6% in the past year.

The Zacks Consensus Estimate for United Natural Foods’ fiscal 2022 sales and earnings per share suggests growth of 4.8% and 7.7%, respectively, from the year-ago period. The consensus estimates UNFI’s fiscal 2022 earnings per share has moved up 2.5% in the past 30 days.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Newell Brands Inc. (NWL) : Free Stock Analysis Report

Flowers Foods, Inc. (FLO) : Free Stock Analysis Report

United Natural Foods, Inc. (UNFI) : Free Stock Analysis Report

Nu Skin Enterprises, Inc. (NUS) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance