Here's Why You Should Hold Onto Reliance Steel (RS) Stock Now

Reliance Steel & Aluminum Co. RS is gaining from its focus on high-margin products, continued demand strength across aerospace and automotive end-markets and contributions of strategic acquisitions.

Shares of the metals service center company, which currently carries a Zacks Rank #3 (Hold), have gained 37.9% so far this year, outperforming the 7.1% rise of its industry.

What’s Going in RS’s Favor?

Reliance Steel is witnessing strong demand in the aerospace and automotive markets. The company is seeing demand strength for its heat-treated aluminum products in the aerospace market. It remains committed to boost its market share in aerospace.

Strong demand is also witnessed in the automotive market, backed by increased use of aluminum in the industry. The company is seeing healthy demand for its processing services in this market and remains committed to invest in facilities and value-added processing equipment to address the rising demand for the services it offers.

Reliance Steel, in its second-quarter call, said that it is optimistic about business conditions for the third quarter. It expects steady end-market demand in the quarter.

Reliance Steel also continues with its aggressive acquisition strategy to tap growth opportunities. In particular, the buyout of All Metals Holding complements Reliance Steel’s growth strategy and meets its criteria of buying high quality businesses that are immediately accretive to its earnings. All Metals’ focus on high return, toll processing and logistics services further bolsters Reliance Steel’s solid position in these areas.

A Few Concerns

The company is facing pressure on its sales volumes. Its overall sales volume fell roughly 5% year over year to around 1.5 million tons in the second quarter due to lower shipments. Volume pressure will likely continue in the third quarter as indicated by the company’s guidance. Reliance Steel expects tons sold to be down 4-6% sequentially in the third quarter factoring in normal seasonal patterns that include lower shipping volumes due to customer shutdowns and vacation schedules.

Reliance Steel is also likely to face some pressure on metal pricing in the third quarter. As metal prices (particularly for carbon steel) declined through the second quarter, Reliance Steel expects average selling price per ton for the third quarter to be down 1.5-2.5% compared with second-quarter tally.

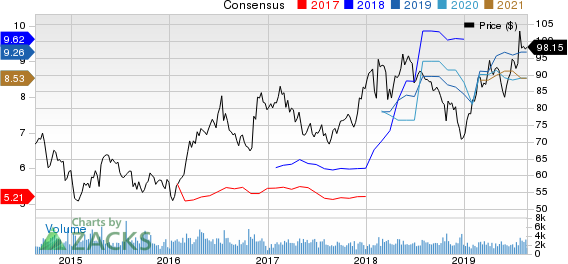

Reliance Steel & Aluminum Co. Price and Consensus

Reliance Steel & Aluminum Co. price-consensus-chart | Reliance Steel & Aluminum Co. Quote

Stocks Worth a Look

A few better-ranked stocks worth considering in the basic materials space include Kinross Gold Corporation KGC, NewMarket Corporation NEU and SSR Mining Inc. SSRM.

Kinross has projected earnings growth rate of 150% for the current year and carries a Zacks Rank #1 (Strong Buy). The company’s shares have surged around 63% in a year’s time. You can see the complete list of today’s Zacks #1 Rank stocks here.

NewMarket has an expected earnings growth rate of 16.2% for the current year and carries Zacks Rank #1. Its shares have gained around 22% in the past year.

SSR Mining has an estimated earnings growth rate of 165.2% for the current year and carries a Zacks Rank #2 (Buy). Its shares have shot up roughly 85% in the past year.

It’s Illegal in 42 States, But Investors Will Make Billions Legally

In addition to the companies you read about above, today you get details on the newly-legalized industry that’s tapping into a “habit” that Americans spend an estimated $150 billion on every year.

That’s twice as much as they spend on marijuana, legally or otherwise.

Zacks special report revealing how investors can profit from this new opportunity. As more states legalize this activity, the industry could expand by as much as 15X. Zacks’ has just released a Special Report revealing 5 top stocks to watch in this space.

See these 5 “sin stocks” now>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

NewMarket Corporation (NEU) : Free Stock Analysis Report

Kinross Gold Corporation (KGC) : Free Stock Analysis Report

Reliance Steel & Aluminum Co. (RS) : Free Stock Analysis Report

Silver Standard Resources Inc. (SSRM) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance