Here's Why You Should Hold Onto FMC Corp (FMC) Stock for Now

FMC Corporation FMC is gaining from strong demand for its herbicides and insecticides and its efforts to expand product portfolio and boost market position amid certain headwinds including cost inflation.

The company’s shares are up 23.7% over a year compared with 9.5% decline of its industry.

Let’s find out why this Zacks Rank #3 (Hold) stock is worth retaining at the moment.

What’s Favoring the Stock?

FMC is benefiting from higher demand for its products, its portfolio strength and new product launches, which is driving its topline.

The company is seeing healthy demand from cotton and sugarcane growers in Brazil as well as solid demand for insecticides in Argentina. Strong demand for herbicides and insecticides is also driving the company’s agriculture business in North America. FMC is witnessing strength in Rynaxypyr insect control product in that region. Demand for fungicides also remain strong in EMEA (Europe, Middle East, and Africa).

Moreover, FMC remains focused on boosting its market position and strengthening its product portfolio. It is focused on investing in technologies and products as well as new launches to enhance value to farmers. Product introductions are expected to support its results in this year. The company anticipates new products to contribute 1.5% of revenue growth in 2020 with the biggest contribution expected from EMEA. New product launches in Europe, North America and Asia are also expected to contribute to strong volume growth in the second quarter of 2020.

FMC also remains committed to return value to its shareholders leveraging healthy cash flows. The company, in late 2019, hiked its quarterly dividend by 10% to 44 cents per share. FMC expects to generate free cash flow of $425-$525 million in 2020 and maintain its dividend payout.

A Few Worries

The company faces significant headwind from unfavorable currency translation. Currency had an unfavorable impact of 4% on its sales and $45 million on adjusted EBITDA in the first quarter. The company now sees currency headwind on EBITDA of $170 million for full-year 2020, higher than its previous guidance of $45 million. The impact on revenues is forecast to be 5% in 2020. Currency impact on EBITDA for the second quarter is projected to be $45 million.

Moreover, FMC faces challenges from higher costs, partly due to coronavirus-led disruptions. It saw an unfavorable impact of $7 million from cost inflation on adjusted EBITDA in the first quarter. The company sees $26 million of cost headwind in 2020, partly reflecting coronavirus-induced impacts on supply chain costs.

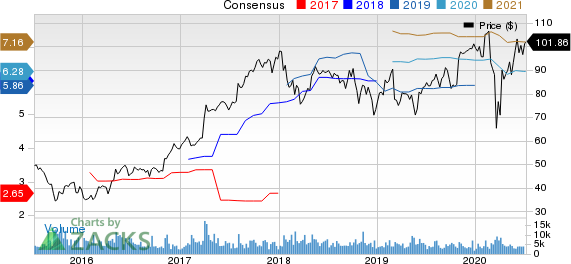

FMC Corporation Price and Consensus

FMC Corporation price-consensus-chart | FMC Corporation Quote

Stocks to Consider

Better-ranked stocks worth considering in the basic materials space include Sandstorm Gold Ltd SAND, Harmony Gold Mining Company Limited HMY and AngloGold Ashanti Limited AU.

Sandstorm Gold has a projected earnings growth rate of 55.6% for the current year. The company’s shares have rallied roughly 77% in a year. It currently carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Harmony Gold has an expected earnings growth rate of 264.3% for the current fiscal year. The company’s shares have shot up around 115% in the past year. It presently carries a Zacks Rank #2.

AngloGold has a projected earnings growth rate of 109.9% for the current year. The company’s shares have surged around 72% in a year. It currently has a Zacks Rank #2.

5 Stocks to Soar Past the Pandemic: In addition to the companies you learned about above, we invite you to learn about 5 cutting-edge stocks that could skyrocket from the exponential increase in demand for “stay at home” technologies. This could be one of the biggest buying opportunities of the decade.

See the 5 high-tech stocks now>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

FMC Corporation (FMC) : Free Stock Analysis Report

Sandstorm Gold Ltd (SAND) : Free Stock Analysis Report

AngloGold Ashanti Limited (AU) : Free Stock Analysis Report

Harmony Gold Mining Company Limited (HMY) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance