Here's Why You Should Hold on to Green Dot (GDOT) Stock

Green Dot Corporation GDOT is currently benefiting from prudent investments and a long-standing relationship with Walmart WMT.

The company’s earnings for 2021 and 2022 are expected to grow at the rates of 6.2% and 17.3%, respectively, on a year-over-year basis.

Factors That Auger Well

Green Dot continues to invest in and expand its suite of consumer banking products available digitally as well as across its retail network. Such moves are helping the company to increase brand awareness and consumer confidence.

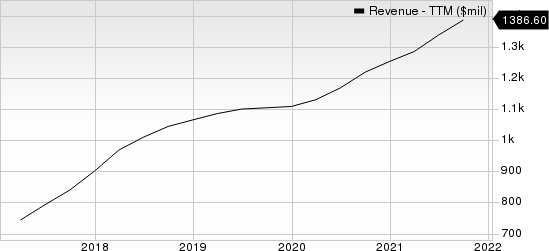

Green Dot Corporation Revenue (TTM)

Green Dot Corporation revenue-ttm | Green Dot Corporation Quote

Green Dot’s long-standing relationship with Walmart remains a key driver of its operating revenues. The company’s operating revenues derived from products and services offered through Walmart represented 27%, 34% and 36% of total operating revenues for 2020, 2019 and 2018, respectively.

Green Dot is expanding its addressable market with the help of its banking-as-a-service (BaaS) account programs. The company partners with some top consumer and technology companies to design and develop their fintech banking solutions through its BaaS platform. These solutions are then made available by these companies to their consumers and partners again through integration with the BaaS program, eventually expanding Green Dot’s spectrum of consumers.

Some Risks

Green Dot is seeing an increase in expenses as it continues to invest in its banking platform. For the third quarter, total operating expenses rose 12.6% year over year to $330.7 million.

Green Dot faces tough competition from companies across financial services, financial technology services, retail banking, transaction processing and consumer technology industries.

Zacks Rank and Stocks to Consider

Green Dot currently carries a Zacks Rank #3 (Hold).

Investors interested in the broader Zacks Business Services sector can consider stocks like Avis Budget CAR and Cross Country Healthcare CCRN.

Avis Budget has an expected earnings growth rate of 459.9% for 2021. CAR has a trailing four-quarter earnings surprise of 76.9%, on average.

Avis Budget’s shares have surged 392.3% in the past year. It has a long-term earnings growth of 19.4%. CAR sports a Zacks #1 Rank (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Cross Country Healthcare has an expected earnings growth rate of 500% for 2021. CCRN has a trailing four-quarter earnings surprise of 75%, on average.

Cross Country Healthcare’s shares have surged 156.3% in the past year. It has a long-term earnings growth of 21.5%. CCRN sports a Zacks #1 Rank.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Avis Budget Group, Inc. (CAR) : Free Stock Analysis Report

Walmart Inc. (WMT) : Free Stock Analysis Report

Green Dot Corporation (GDOT) : Free Stock Analysis Report

Cross Country Healthcare, Inc. (CCRN) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance