Here's Why You Should Hold on to Danaher (DHR) Stock Now

Danaher Corporation DHR is backed by multiple tailwinds despite headwinds from adverse foreign currency movements, supply chain issues and cost inflation.

This Zacks Rank #3 (Hold) company is seeing healthy demand across major end markets. Within the Biotechnology segment, robust customer activity in bioprocessing bodes well. Broad-based strength across instruments and consumables businesses is aiding the Life Sciences segment. Growth in the Life Sciences instrument business is supported by Leica Microsystems and Beckman Coulter Life Sciences. Segmental revenues increased 10% year over year in 2022. The company expects steady demand across end markets to drive growth of this segment in 2023.

Apart from the Life Sciences segment, Danaher is poised for growth on the back of continued momentum in the Diagnostics and Environmental & Applied Solutions segments. Strength in Cepheid business, Molecular Diagnostics, Leica Biosystems and demand for blood gas testing in China is supporting growth of the Diagnostics segment (revenues up 10.2% in 2022). Strength in Water Quality and Videojet businesses is a key catalyst to the growth of the Environmental & Applied Solutions segment. Revenues from the segment increased 3.8% in 2022.

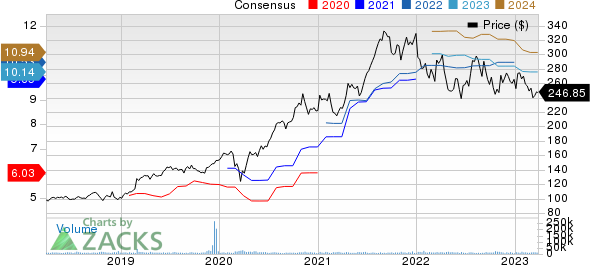

Danaher Corporation Price and Consensus

Danaher Corporation price-consensus-chart | Danaher Corporation Quote

With continued strength in its operations, Danaher expects adjusted base business core revenue growth in mid-single digits for the first quarter of 2023. For 2023, the company expects the same to be up in the high-single digits. Organic sales growth is estimated to be in mid-single digits in the first quarter and the full year.

The DBS (Danaher Business System) initiatives, which help Danaher focus more on product innovation, superior product quality, efficient workforce building and shareholder value enhancement, are fostering the company’s growth. DHR has been able to reduce the impact of supply-chain constraints and inflationary pressure through its DBS initiatives.

Disciplined cost management, productivity initiatives and pricing actions are supporting the company’s margin performance. In 2022, DHR’s operating profit margin (continuing operations) increased 230 basis points year over year to 27.6%.

Danaher’s commitment to reward shareholders through handsome dividend payments holds promise. In 2022, the company paid out dividends worth $818 million, up 10.2% on a year-over-year basis. In February 2023, the company hiked its dividend by 8% to 27 cents per share.

Key Picks

Some better-ranked Industrial stocks are as follows:

Deere & Company DE currently sports a Zacks Rank #1 (Strong Buy). The company pulled off a trailing four-quarter earnings surprise of 4.7%, on average. You can see the complete list of today’s Zacks #1 Rank stocks.

Deere has an estimated earnings growth rate of approximately 31% for the current fiscal year. The stock has gained 18.4% in the past six months.

Ingersoll Rand IR presently flaunts a Zacks Rank #1. The company delivered a trailing four-quarter earnings surprise of 8.5%, on average.

Ingersoll Rand has an estimated earnings growth rate of approximately 7% for the current year. The stock has rallied 29.4% in the past six months.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Danaher Corporation (DHR) : Free Stock Analysis Report

Deere & Company (DE) : Free Stock Analysis Report

Ingersoll Rand Inc. (IR) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance