Here's Why You Should Hold on to Becton, Dickinson Stock Now

Becton, Dickinson and Company BDX, also known as BD, is likely to gain from solid fourth-quarter fiscal 2019 results and a series of product launches. However, the company expects to witness tariff-related headwinds in the current fiscal.

In a year’s time, shares of BD have gained 1.3% against the industry’s 4.6% decline. Meanwhile, the S&P 500 Index rallied 17.9% in the same timeframe.

With a market capitalization of $67.03 billion, BD is engaged in the development, manufacture and sale of medical devices, instrument systems and reagents. The company’s earnings are anticipated to grow 11.3% over the next five years. In the trailing four quarters, it delivered an average positive earnings surprise of 0.5%.

Let’s delve deeper into the factors that substantiate BD’s Zacks Rank #3 (Hold) at present.

Factors to Boost BD

In the recently reported fiscal fourth quarter, BD delivered a positive earnings surprise of 0.3%.

Notably, the company delivered adjusted earnings per share (EPS) of $3.31, which outpaced the Zacks Consensus Estimate by a penny. The bottom line also improved 13% on a year-over-year basis and rose 12.3% at constant currency (cc). On the top-line front, BD’s fourth-quarter revenues of $4.58 billion surpassed the Zacks Consensus Estimate of $4.57 billion. The figure increased 4.1% year over year and 6.2% at cc.

Solid show by core segments — BD Medical, BD Life Sciences and BD Interventional — led to the upside. Additionally, international growth in the quarter was strong, especially in APAC and EMEA.

Reflective of these, BD issued a solid guidance for fiscal 2020.

The company expects revenue growth of 4-4.5% year over year and 5-5.5% at cc. Adjusted EPS is expected between $12.50 and $12.65, indicating 7-8.5% growth from fiscal 2019. At cc, growth is expected in the range of 9.5-11%.

These apart, a series of product launches are expected to further expand BD’s customer base.

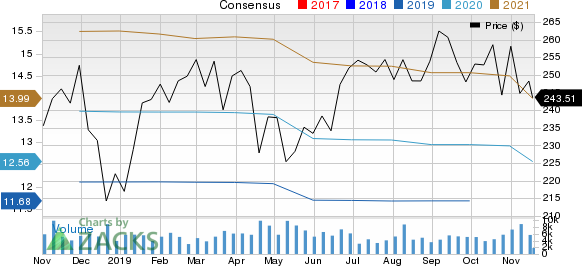

Becton, Dickinson and Company Price and Consensus

Becton, Dickinson and Company price-consensus-chart | Becton, Dickinson and Company Quote

At present, BD is looking forward to the launch of BD Intevia — the company’s first device to combine syringe and auto injector technology. In the Life Science segment, the company plans to launch BD COR high throughput molecular system for which management continues to seek regulatory authorizations. At the Interventional segment, the launch of Arctic Sun Stat will boost BD's informatics capabilities.

What’s Deterring the Stock?

Management at BD expects a few headwinds to mar the company’s prospects in fiscal 2020.

In fiscal 2020, tariffs are expected to impact BD’s growth by 100 basis points while foreign exchange can impact growth by 250 bps.

Resultantly, BD expects lower-than-expected fiscal first-quarter EPS between $2.55 and $2.65.

Which Way Are Estimates Headed?

For fiscal 2020, the Zacks Consensus Estimate for revenues is pegged at $18.01 billion, indicating an improvement of 4.2% from the year-ago quarter’s reported figure. For adjusted earnings, the same stands at $12.57 per share, suggesting growth of 7.6% from the year-ago reported figure.

Stocks to Consider

Some better-ranked stocks from the broader medical space are Conmed Corporation CNMD, Cardinal Health, Inc. CAH and DENTSPLY SIRONA Inc. XRAY, each currently carrying a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Conmed Corporation has a long-term earnings growth rate of 17%.

Cardinal Health has a long-term earnings growth rate of 6.2%.

DENTSPLY SIRONA has a long-term earnings growth rate of 11.6%.

Biggest Tech Breakthrough in a Generation

Be among the early investors in the new type of device that experts say could impact society as much as the discovery of electricity. Current technology will soon be outdated and replaced by these new devices. In the process, it’s expected to create 22 million jobs and generate $12.3 trillion in activity.

A select few stocks could skyrocket the most as rollout accelerates for this new tech. Early investors could see gains similar to buying Microsoft in the 1990s. Zacks’ just-released special report reveals 8 stocks to watch. The report is only available for a limited time.

See 8 breakthrough stocks now>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

DENTSPLY SIRONA Inc. (XRAY) : Free Stock Analysis Report

CONMED Corporation (CNMD) : Free Stock Analysis Report

Becton, Dickinson and Company (BDX) : Free Stock Analysis Report

Cardinal Health, Inc. (CAH) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance