Here's Why Goldman (GS) Stock is a Lucrative Bet Right Now

The Goldman Sachs Group, Inc. GS is well-positioned for growth on the back of its focus on core operations, opportunistic buyouts and improving demand in global deal-making. Moreover, a deepening market presence and solid liquidity will further aid financials.

Over the past 60 days, the Zacks Consensus Estimate for 2024 and 2025 earnings has moved north by 3.3% and 2.6%, respectively. GS currently carries a Zacks Rank #2 (Buy).

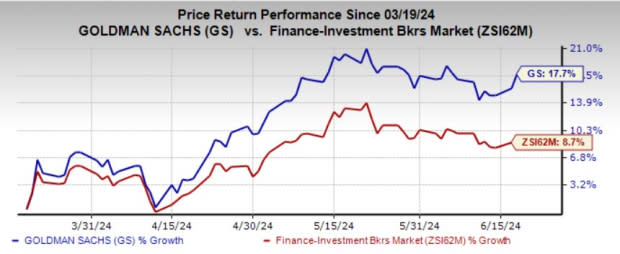

Over the past three months, shares of Goldman have gained 17.7%, outperforming the industry’s rise of 8.7%.

Image Source: Zacks Investment Research

Let’s dive deeper into the reasons that make GS stock worth betting on now.

Earnings Growth: Goldman witnessed earnings growth of 3.7% over the past three to five years. This was driven by strategic business streamlining efforts to boost investment banking and trading operations and efforts to improve the business mix toward recurring and durable revenues.

Also, the company has an impressive earnings surprise history. Its earnings surpassed the Zacks Consensus Estimate in three of the trailing four quarters and lagged in one, with the average beat being 22.78%.

Our projections for earnings indicate 57.4%, 8.6% and 1.1% growth on a year-over-year basis in 2024, 2025 and 2026, respectively.

Strategic Buyouts & Divestitures: Goldman remains engaged in strategic initiatives to boost its IB and trading businesses. In the past year, the company has completed the sale of GreenSky, divested its Personal Financial Management unit and sold a substantial portion of Marcus’s loan portfolio.

Additionally, GS acquired NN Investment and robo-advisor NextCapital. These boosted its global presence and wealth and asset management capabilities and helped further diversify fee-revenue streams and enhance top-line stability.

Revenue Strength: Driven by strategic initiatives and growth in non-interest revenues, Goldman’s net revenues witnessed a compound annual growth rate (CAGR) of 6.1% over the last four years (2019-2023). The trend continued in the first quarter of 2024 as well. Organic growth measures and an improving revenue mix are likely to support top-line expansion.

Further, a deepening market presence and improving global deal-making pipeline are likely to keep revenue growth healthy going forward.

Our estimates for net revenues indicate 11.6%, 4% and 2.2% growth in 2024, 2025 and 2026, respectively.

Strong Balance Sheet: As of Mar 31, 2024, Goldman’s total cash and cash equivalents were $209 billion. Total unsecured debt (comprising long-term and short-term borrowings) was $312 billion. Out of this, only $78 billion was in near-term borrowings. Hence, a solid liquidity position allows the company to address its near-term obligations.

Stock Seems Undervalued: GS’s price-to-book and price-to-earnings (F1) ratios of 1.35 and 12.31 are well below the industry average of 2.19 and 17.94, respectively. Thus, the stock seems to be available at a better valuation than its peers.

Other Investment Banking Stocks to Consider

Some other top-ranked stocks from the investment banking space worth a look are Piper Sandler Companies PIPR and BGC Group, Inc. BGC, each sporting a Zacks Rank #1 (Strong Buy) at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for PIPR’s current-year earnings has moved 5.8% north over the past 60 days. Shares of the company have risen 24.7% in the past six months.

The Zacks Consensus Estimate for BGC’s 2024 earnings has moved 1.1% upward in the past 60 days. Over the past six months, shares of the company have gained 23.7%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

The Goldman Sachs Group, Inc. (GS) : Free Stock Analysis Report

BGC Group, Inc. (BGC) : Free Stock Analysis Report

Piper Sandler Companies (PIPR) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance