Here's Why Gildan Activewear (TSE:GIL) Can Manage Its Debt Responsibly

David Iben put it well when he said, 'Volatility is not a risk we care about. What we care about is avoiding the permanent loss of capital. It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. Importantly, Gildan Activewear Inc. (TSE:GIL) does carry debt. But should shareholders be worried about its use of debt?

Why Does Debt Bring Risk?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. If things get really bad, the lenders can take control of the business. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. The first step when considering a company's debt levels is to consider its cash and debt together.

See our latest analysis for Gildan Activewear

What Is Gildan Activewear's Debt?

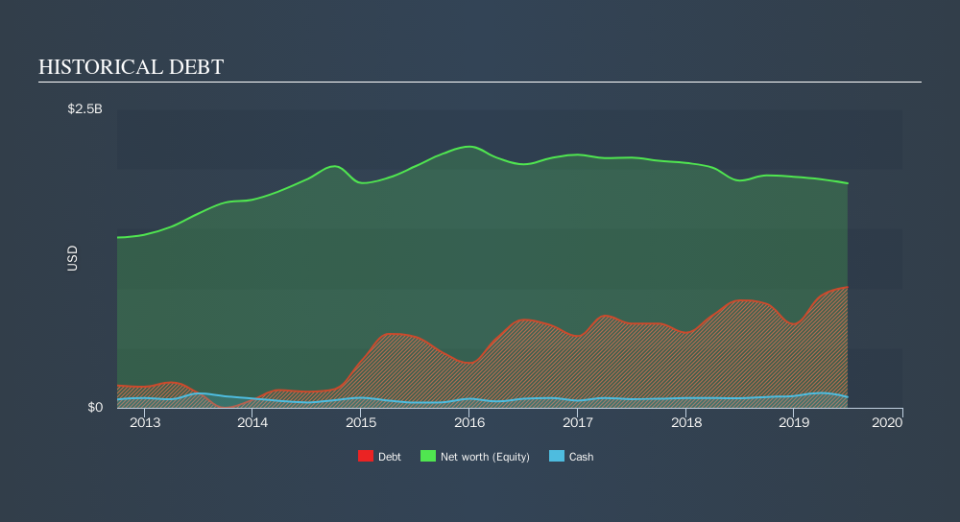

You can click the graphic below for the historical numbers, but it shows that as of June 2019 Gildan Activewear had US$1.01b of debt, an increase on US$900.0m, over one year. However, it does have US$90.8m in cash offsetting this, leading to net debt of about US$919.9m.

How Healthy Is Gildan Activewear's Balance Sheet?

The latest balance sheet data shows that Gildan Activewear had liabilities of US$379.5m due within a year, and liabilities of US$1.08b falling due after that. Offsetting this, it had US$90.8m in cash and US$511.9m in receivables that were due within 12 months. So its liabilities total US$853.8m more than the combination of its cash and short-term receivables.

Since publicly traded Gildan Activewear shares are worth a total of US$7.21b, it seems unlikely that this level of liabilities would be a major threat. However, we do think it is worth keeping an eye on its balance sheet strength, as it may change over time.

We use two main ratios to inform us about debt levels relative to earnings. The first is net debt divided by earnings before interest, tax, depreciation, and amortization (EBITDA), while the second is how many times its earnings before interest and tax (EBIT) covers its interest expense (or its interest cover, for short). The advantage of this approach is that we take into account both the absolute quantum of debt (with net debt to EBITDA) and the actual interest expenses associated with that debt (with its interest cover ratio).

We'd say that Gildan Activewear's moderate net debt to EBITDA ratio ( being 1.7), indicates prudence when it comes to debt. And its commanding EBIT of 13.2 times its interest expense, implies the debt load is as light as a peacock feather. While Gildan Activewear doesn't seem to have gained much on the EBIT line, at least earnings remain stable for now. When analysing debt levels, the balance sheet is the obvious place to start. But it is future earnings, more than anything, that will determine Gildan Activewear's ability to maintain a healthy balance sheet going forward. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

Finally, a business needs free cash flow to pay off debt; accounting profits just don't cut it. So we clearly need to look at whether that EBIT is leading to corresponding free cash flow. Over the last three years, Gildan Activewear recorded free cash flow worth a fulsome 93% of its EBIT, which is stronger than we'd usually expect. That positions it well to pay down debt if desirable to do so.

Our View

The good news is that Gildan Activewear's demonstrated ability to cover its interest expense with its EBIT delights us like a fluffy puppy does a toddler. And the good news does not stop there, as its conversion of EBIT to free cash flow also supports that impression! Taking all this data into account, it seems to us that Gildan Activewear takes a pretty sensible approach to debt. While that brings some risk, it can also enhance returns for shareholders. Of course, we wouldn't say no to the extra confidence that we'd gain if we knew that Gildan Activewear insiders have been buying shares: if you're on the same wavelength, you can find out if insiders are buying by clicking this link.

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

Yahoo Finance

Yahoo Finance