Here's Why Garmin (GRMN) Is a Promising Portfolio Pick Now

Garmin GRMN has gained 27.3% year to date, outperforming the Zacks Computer & Technology sector’s growth of 18.1% and the S&P 500 index’s return of 11.5%.

The impressive share performance reflects the company’s robust financial performance. Garmin’s earnings per share surpassed the Zacks Consensus Estimate in the trailing four quarters, the average surprise being 18.9%. In its last reported quarterly results, the top and bottom lines beat the consensus mark and witnessed strong year-over-year growth.

Garmin is one stock investors should consider adding to their portfolios to benefit from its upside potential. The stock has further room for expansion, given the company’s growing efforts to bolster its portfolio strength.

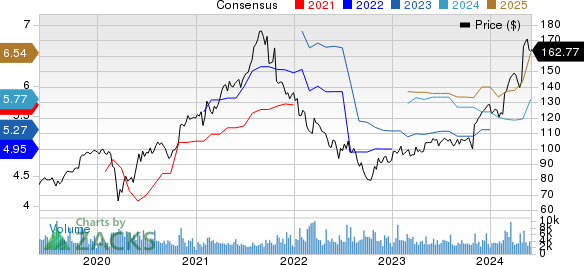

Garmin Ltd. Price and Consensus

Garmin Ltd. price-consensus-chart | Garmin Ltd. Quote

Garmin’s Prospects Ride on Strong Portfolio

The company’s compelling adventure watch, fitness watch, avionics, marine and auto offerings are noteworthy.

Its expanding Venu, Lily and vivoactive smartwatch series, which boasts new health and wellness features, including body battery energy monitoring, advanced sleep monitoring, stress, respiration and heart rate tracking, have been driving growth in its Fitness segment.

Garmin’s recent introduction of JL Audio Custom Fit speakers, which offer extended high-frequency response and feature DMA-optimized motor systems, is noteworthy. The company is well-poised to gain among various vehicle makers and owners on the back of these speakers.

The latest advancements in the FltPlan safety management system, which now comes with updated features of the Flight Risk Assessment, have added strength to GRMN’s aviation offerings.

The launch of the Forerunner 165 Series, an affordable GPS-running smartwatch featuring personalized training plans and health metrics on a bright AMOLED display, has strengthened Garmin’s adventure watch offerings.

GRMN introduced the Panoptix PS70, a live sonar system powered by the Garmin RapidReturn technology, providing real-time underwater visibility at greater depths. This has bolstered the company’s marine offerings.

Garmin unveiled the GPSMAP 16x3 chart plotters, featuring a high-resolution 16-inch touchscreen display with built-in navigation and sonar support to offer superior clarity and sunlight readability, even with polarized sunglasses.

GRMN introduced affordable COMM and NAV/COMM radios with a slim 1.3-inch bezel height form factor featuring a full-color LCD, intuitive user interface and worldwide frequency database.

Conclusion

We believe that Garmin’s growing efforts to expand its overall product portfolio will continue to drive its customer momentum in various end-markets, such as aviation, marine, automotive, and health and fitness, in the days ahead.

Moreover, consistent revenue growth, focus on innovation and robust financial health make GRMN a suitable pick for investors looking for solid returns.

The Zacks Consensus Estimate for 2024 revenues and earnings is pegged at $5.9 billion and $5.77 per share, respectively. This indicates year-over-year improvements of 12.9% in the top line and 3.2% in the bottom line. The EPS estimate has also moved 5.9% north over the past 30 days.

Garmin currently sports a Zacks Rank #1 (Strong Buy) and has a Growth Score of B, a combination that offers a good investment opportunity, per the Zacks proprietary methodology. You can see the complete list of today’s Zacks #1 Rank stocks here.

Some other top-ranked stocks in the broader technology sector are NVIDIA NVDA, Tyler Technologies TYL and Nutanix NTNX, each flaunting Zacks Rank #1 at present.

NVIDIA has surged 131.9% year to date. The Zacks Consensus Estimate for NVIDIA’s fiscal 2025 revenues is pinned at $116.4 billion, which indicates year-over-year growth of 91%. The consensus mark for earnings is pegged at $25.10 per share, which implies a 93.7% increase from that reported in fiscal 2024.

Tyler Technologies has gained 14.2% year to date. The Zacks Consensus Estimate for TYL’s fiscal 2024 revenues currently is pinned at $2.12 billion, which indicates year-over-year growth of 8.8%. The consensus mark for earnings is pegged at $9.19 per share, which implies a 17.8% increase from the fiscal 2023 actual.

Nutanix has gained 18.1% year to date. The Zacks Consensus Estimate for NTNX’s fiscal 2024 revenues is pegged at $2.14 billion, which indicates year-over-year growth of 14.7%. The consensus mark for earnings is pegged at $1.08 per share, which implies an 80% increase from fiscal 2023.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Garmin Ltd. (GRMN) : Free Stock Analysis Report

NVIDIA Corporation (NVDA) : Free Stock Analysis Report

Tyler Technologies, Inc. (TYL) : Free Stock Analysis Report

Nutanix (NTNX) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance