Here's Why You Should Buy Republic Services (RSG) Shares

Republic Services, Inc. RSG, a leading provider of non-hazardous solid waste collection, transfer, disposal, recycling and energy services, is banking on increasing environmental awareness and growing industrialization.

Let’s delve into the factors that make RSG an investment-worthy stock.

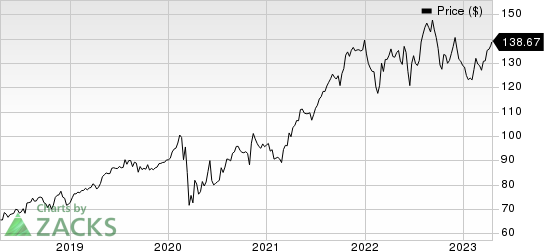

Price Performance

RSG has outperformed the Zacks Waste Removal Services industry year to date. The stock has rallied 7.5% compared with the industry's 6.4% increase in the same time frame.

Republic Services, Inc. Price

Republic Services, Inc. price | Republic Services, Inc. Quote

Solid Rank

RSG currently carries a Zacks Rank #2 (Buy). Our research shows that stocks with a Zacks Rank #1 (Strong Buy) or 2 offer the most attractive investment opportunities.

Earnings Expectations

Earnings growth and stock price gains often indicate a company’s prospects. The Zacks Consensus Estimate for 2023 earnings is pegged at $5.18, up 5.1% from the year-ago figure. It has been revised upward 2.2% in the past 60 days.The favorable estimate revision reflects the confidence of brokers.

Earnings Surprise History

The company has an impressive earning surprise history beating the Zacks Consensus Estimate in all four trailing quarters. RSG has an average surprise of 10.5%.

Other Positive Factors

Republic Services is benefiting from increased environmental concerns, rapid industrialization and government measures to curb illegal waste dumping. These tailwinds led to 20% growth in 2022 revenues from the year-ago reported figure. The company is also taking measures to reduce its fleet operating cost and improve operational efficiency. The adoption of the RISE platform is supporting such efforts.

Republic Services has a strategy of acquiring private recycling and solid waste companies and environmental solutions businesses. In 2022, the company acquired US Ecology, Inc. a leading provider of environmental solutions. The company seeks to grow through public-private partnerships and focusing on recycling and waste operations in municipal and other local governments. RSG expects to spend nearly $500 million in value-creating acquisitions in 2023. In 2022, around 10% of the total revenue growth was led by acquisitions.

Republic Services has been consistent with its dividend-paying and share-repurchasing strategy. In 2022, 2021 and 2020, the company paid $592.9 million, $552.6 million and $522.5 million in dividends and repurchased shares worth $203.5 million, $252.2 million and $98.8 million, respectively.

Other Stocks to Consider

Investors interested in the broader Zacks Business Service sector may consider the following stocks:

Avis Budget Group CAR, carrying a Zacks Rank of 2, delivered an earnings surprise of 52.7% in the last reported quarter. You can see the complete list of today’s Zacks #1 Rank stocks here.

CAR came up with an average four-quarter earnings surprise of 78%. Revenues are expected to be $2.5 billion for the first quarter of 2023, implying a 3% year-over-year increase. The Zacks Consensus Estimate for the company’s earnings is pegged at $3.27 for the first quarter and $28.46 for the full year.

ICF International ICFI, sporting a Zacks Rank of 1, delivered an earnings surprise of 4.7% in the last reported quarter. It came up with an average four-quarter earnings surprise of 9.2%. Revenues are expected to be $478.24 million for the first quarter of 2023, suggesting a 15.7% year-over-year increase. The Zacks Consensus Estimate for ICFI’s earnings is pegged at $1.41 for the first quarter and $6.3 for the full year, indicating growth of 7.6% and 9.2%, respectively.

Gartner, Inc. IT, sporting a Zacks Rank of 1, delivered an earnings surprise of 44% in the last reported quarter. It came up with an average surprise of 33%. Revenues are expected to be $1.39 billion for the first quarter of 2023, indicating a 10.2% year-over-year increase. The Zacks Consensus Estimate for IT’s earnings is pegged at $2.04 for the first quarter and $9.49 for the full year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Avis Budget Group, Inc. (CAR) : Free Stock Analysis Report

Republic Services, Inc. (RSG) : Free Stock Analysis Report

Gartner, Inc. (IT) : Free Stock Analysis Report

ICF International, Inc. (ICFI) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance