Here's Why You Should Buy McKesson (MCK) Stock Right Now

McKessonCorporation MCK is well-poised for growth, backed by strategic collaborations and strength in the distribution solutions segment. However, the company’s opioid-related litigation expenses pose a threat.

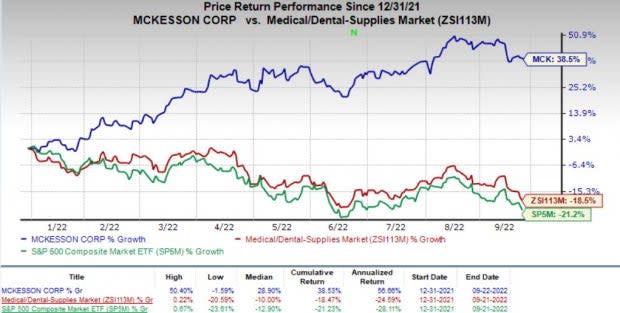

Shares of this Zacks Rank #2 (Buy) stock have gained 38.5% so far this year against the industry’s decline of 18.5%. The S&P 500 Index has fallen 21.2% in the same time frame.

The company — with a market capitalization of $53.3 billion — is a health care services and information technology company. Its earnings are anticipated to improve 10.1% over the next five years. The company beat earnings estimates in three of the trailing four quarters and missed once, the average surprise being 13%. The company’s earnings yield of 7.1% also compares favorably with the industry’s 4.7%.

Image Source: Zacks Investment Research

What’s Favoring It?

McKesson continues to actively pursue deals, divestitures and acquisitions to drive growth. In April 2022, the company completed the divestiture of its retail and distribution businesses in the United Kingdom to Aurelius. During the fiscal fourth quarter of 2022, the company completed the sale of its Austrian business to Quadrifolia management and the sale of its remaining share of its German joint venture to Walgreens Boots Alliance. The company is currently progressing with the divestiture of its European business. These divestitures will allow the company to focus on its key growth market — the United States.

In June, McKesson formed a joint venture with HCA Healthcare HCA to create a fully integrated oncology research organization. Per the deal, McKesson and HCA Healthcare will integrate their respective research units — US Oncology Research (USOR) and Sarah Cannon Research Institute (SCRI). The newly created entity with the combined capabilities of SCRI and USOR is expected to boost clinical research, ramp up the development of drugs, lead to better data and analytics capabilities, and pave the way for a wider portfolio of clinical trials. The deal between McKesson and HCA Healthcare is likely to be completed later this year.

McKesson is a major player in the pharmaceutical and medical supplies distribution market. The Distribution Solutions segment caters to a wide range of customers and businesses and stands to benefit from increased generic utilization, inflation in generics, courtesy of several patent expirations in the next few years, and an aging population.

During the fiscal first quarter of 2023, McKesson’s growth was led by its strong performance across all segments, except the International segment, which was marred by unfavorable currency movement. The divestiture of McKesson’s Austrian business also hurt growth.

The company removed a major overhang during the fiscal first quarter by settling or signing a settlement agreement related to the opioid-related claims of all 50 states, as well as the District of Columbia and all eligible territories. These developments will close long-pending litigations that have been hurting the company’s goodwill and will also reduce legal expenses.

McKesson’s agreements with the U.S. government for COVID-19 vaccine distribution, kitting and storage programs and COVID-19 tests are an added benefit.

What’s Hurting the Stock?

McKesson’s broad settlement of opioid-related claims of states and municipalities is likely to drive expenses for the company in the short term. The company recorded a pre-tax charge of $74 million during the fiscal first quarter of 2023 related to the settlement of an opioid-related claim with certain states and counties.

McKesson Corporation Price

McKesson Corporation price | McKesson Corporation Quote

Estimates Trend

For fiscal 2023, the Zacks Consensus Estimate for revenues is pegged at $276.9 billion, indicating an improvement of 4.9% from the year-ago period’s reported figure. The same for adjusted earnings per share stands at $24.42, suggesting growth of 3.1% from the prior-year reported figure.

Other Stocks to Consider

A couple of other top-ranked stocks in the broader medical space are ShockWave Medical SWAV and AMN Healthcare Services AMN.

AMN Healthcare surpassed earnings estimates in each of the trailing four quarters, the average surprise being 15.7%. The company currently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Estimates for AMN Healthcare Services have improved from earnings of $10.41 to $11.26 for 2022 and $7.94 to $8.30 for 2023 in the past 60 days. AMN stock has declined 13.8% so far this year.

Estimates for ShockWave Medical’s 2022 and 2023 earnings per share rose from $2.02 to $2.57 and from $2.95 to $3.42, respectively, in the past 60 days. The Zacks Rank #1 company has gained 55.8% so far this year.

ShockWave Medical delivered an earnings surprise of 180.14%, on average, in the last four quarters.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

McKesson Corporation (MCK) : Free Stock Analysis Report

AMN Healthcare Services Inc (AMN) : Free Stock Analysis Report

HCA Healthcare, Inc. (HCA) : Free Stock Analysis Report

ShockWave Medical, Inc. (SWAV) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance