Here's Why You Should Avoid Knight-Swift (KNX) Stock Now

Knight-Swift Transportation Holdings Inc. KNX is currently mired in multiple headwinds, which, we believe, have made it an unimpressive investment option.

High costs related to driver wages, equipment, maintenance, fuel and other expenses are restricting Knight-Swift’s bottom-line growth. During the first quarter of 2024, salaries, wages and benefits expenses rose 29% year over year, while operations and maintenance expenses climbed 35.5%. Escalating fuel costs are flaring up the operating costs. Total operating expenses increased 20.8% year over year to $1.80 billion in first-quarter 2024. KNX expects net cash capital expenditures for 2024 in the $625-$675 million band.

Knight-Swift exited the first quarter of 2024 with cash and cash equivalents of $204.76 million, which is lower than its long-term debt (excluding current maturities) of $1.19 billion. This implies that the company does not have enough cash to meet its debt obligations.

KNX has a disappointing earnings surprise history. The company’s earnings lagged the Zacks Consensus Estimate in three of the last four quarters (outpaced the mark in the remaining quarter), delivering an average miss of 30.87%.

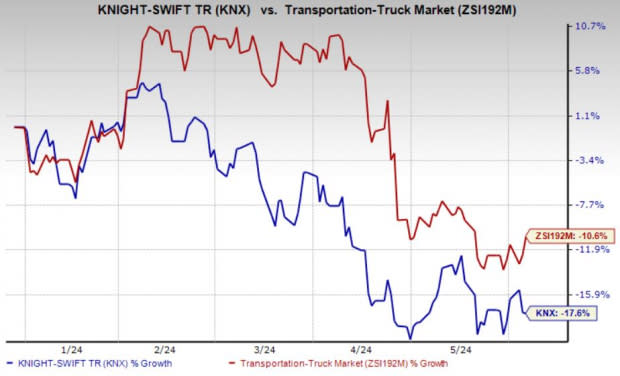

Partly due to these headwinds, shares of Knight-Swift have plunged 17.6% compared with the 10.6% loss of the industry it belongs to so far this year.

Image Source: Zacks Investment Research

On the flip side, KNX’s consistent measures to reward its shareholders through dividends and share buybacks are appreciative. Knight-Swift has raised its quarterly dividend five times in the past five years for a 167% overall increase. Highlighting its pro-investor stance, in February 2024, Knight-Swift's board of directors approved a dividend hike of 14.2%, thereby raising its quarterly cash dividend from 14 cents per share to 16 cents.

Zacks Rank and Stocks to Consider

Currently, Knight-Swift carries a Zacks Rank #5 (Strong Sell).

A couple of better-ranked stocks for investors’ consideration in the Zacks Transportation sector include GATX Corporation GATX and Trinity Industries, Inc. (TRN). Each stock currently carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

GATX has an encouraging earnings surprise history. The company has surpassed the Zacks Consensus Estimate in three of the last four quarters (missing the mark in the other). The average beat is 7.49%.

The Zacks Consensus Estimate for 2024 earnings has been revised 3% upward over the past 90 days. GATX has an expected earnings growth rate of 6.79% for 2024. Shares of the company have risen 18.4% in the past year.

Trinity raised 2024 earnings per share guidance to the range of $1.35 to $1.55 (which excludes items outside of the company’s core business operations) from $1.30 to $1.50 guided previously.

Over the past 30 days, the Zacks Consensus Estimate for TRN’s 2024 earnings has been revised 2.7% upward. For 2024, TRN’s earnings are expected to grow 8.70% year over year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Knight-Swift Transportation Holdings Inc. (KNX) : Free Stock Analysis Report

Trinity Industries, Inc. (TRN) : Free Stock Analysis Report

GATX Corporation (GATX) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance