Here's Why Avery Dennison (AVY) Stock is an Attractive Bet Now

Rising demand for essential products in response to the coronavirus pandemic is aiding Avery Dennison Corporation AVY. Moreover, the company’s focus on growing high-value categories led by specialty labels, anticipated benefits from productivity initiatives, strong demand for essential products as well as cost-control actions position it as an attractive investment option.

The company currently carries a Zacks Rank #2 (Buy) and has a VGM Score of B. Our research shows that stocks with a VGM Score of A or B, when combined with a Zacks Rank #1 (Strong Buy) or 2, offer the best investment opportunities. You can see the complete list of today’s Zacks #1 Rank stocks here.

Let's delve deeper into the factors that make the Avery Dennison stock a compelling investment option at the moment.

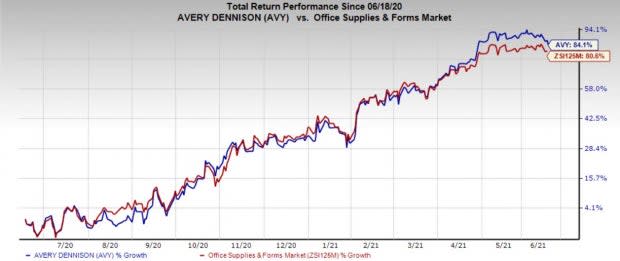

Impressive Price Performance

The stock has gained 84.1% over the past year, outperforming the industry’s growth of 80.6%.

Image Source: Zacks Investment Research

Upbeat Outlook

Avery Dennison projects current-year earnings per share between $8.40 and $8.80 compared with the prior guidance of $7.65-$8.05. The mid-point of the guidance reflects year-over-year growth of 21%.

Return on Equity (ROE)

Avery Dennison’s trailing 12-month ROE of 46.9% reinforces its growth potential. The company’s ROE is higher than the industry’s ROE of 9.6%, highlighting its efficiency in utilizing shareholder funds.

Positive Earnings Surprise Trend

The company has a trailing four-quarter average earnings surprise of 15.4%. Over the past five years, the company has generated earnings growth of 14.9%.

Upbeat Growth Projections

The Zacks Consensus Estimate for 2021 earnings per share is currently pegged at $8.74, indicating growth of 23.1% from the prior year. The same for 2022 is pinned at $9.32, suggesting a year-over-year improvement of 6.7%. The stock has an estimated long-term earnings growth rate of 7.9%.

Solid Financial Position

Avery Dennison’s balance sheet remains strong and has ample capacity to continue funding acquisitions, executing a disciplined capital-allocation strategy, investing in organic growth as well as returning cash to shareholders. In fact, the company generated free cash flow of $182 million in the first quarter as against cash outflow of $35.3 million seen in the year-ago quarter. The company expects to generate free cash flow of $675 million in the ongoing year.

Other Growth Drivers

Avery Dennison has been witnessing soaring demand for labelling of non-durable consumer goods like food, beverage, home and personal care products amid the pandemic. These products account for 40% of the company’s revenues. Over the long run, increasing demand from emerging markets on the back of the rising middle class, and the consequent surge in demand for packaged goods and shift in labelling technology to pressure-sensitive materials will fuel the company’s growth. Around 15% of the company’s revenues is tied to logistics and shipping, which will be aided by an e-commerce boom.

Avery Dennison’s Label and Packaging Materials segment is gaining from solid top-line performance and continued margin expansion, volume improvement, focus on high-value categories led by specialty labels, contributions from productivity initiatives and pandemic-driven demand for essential products. Also, healthy demand for consumer-packaged goods and e-commerce trends are fueling growth. The company’s Industrial and Healthcare Materials segment is gaining from strong demand for industrial products and focus on investments.

The company will continue to gain traction from its rapidly-growing high-value product categories, such as specialty labels and Radio-frequency identification (RFID). Continued strength in RFID and external embellishments will boost the Retail Branding and Information Solutions (RBIS) segment. Besides, Avery Dennison is focused on investing in digital identification technologies.

Moreover, Avery Dennison has undertaken temporary cost-containment actions to negate the impact of waning demand in some of the company’s businesses due to the pandemic. The company realized $19 million in pre-tax savings from restructuring efforts in the March-end quarter. Avery Dennison anticipates incremental savings from restructuring actions, net of transition costs of roughly $70 million in 2021.

Other Stocks to Consider

Some other top-ranked stocks in the industrial products sector are Tennant Company TNC, Encore Wire Corp. WIRE and Arconic Corp. ARNC. All of these stocks sport a Zacks Rank #1 at present.

Tennant has an anticipated earnings growth rate of 49.5% for 2021. The company’s shares have gained around 18%, year to date.

Encore Wire has an estimated earnings growth rate of 49.5% for the ongoing year. Year to date, the company’s shares have rallied nearly 36%.

Arconic has a projected earnings growth rate of 447% for the current year. The stock has appreciated around 21%, so far this year.

Time to Invest in Legal Marijuana

If you’re looking for big gains, there couldn’t be a better time to get in on a young industry primed to skyrocket from $17.7 billion back in 2019 to an expected $73.6 billion by 2027.

After a clean sweep of 6 election referendums in 5 states, pot is now legal in 36 states plus D.C. Federal legalization is expected soon and that could be a still greater bonanza for investors. Even before the latest wave of legalization, Zacks Investment Research has recommended pot stocks that have shot up as high as +285.9%

You’re invited to check out Zacks’ Marijuana Moneymakers: An Investor’s Guide. It features a timely Watch List of pot stocks and ETFs with exceptional growth potential.

Today, Download Marijuana Moneymakers FREE >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Avery Dennison Corporation (AVY) : Free Stock Analysis Report

Encore Wire Corporation (WIRE) : Free Stock Analysis Report

Tennant Company (TNC) : Free Stock Analysis Report

Arconic Corporation (ARNC) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance