Here's Why You Should Add Veeva (VEEV) to Your Portfolio Now

Veeva Systems Inc. VEEV is likely to gain from solid fiscal third-quarter 2020 results and a slew of positive developments in recent times.

Shares of this company have rallied 59.4% compared with the industry’s 15.1% rise in a year’s time. The current level also compares favorably with the S&P 500 index’s 15.7% gain over the same time frame.

This $22.69-billion pharmacy innovation company currently has a Zacks Rank #2 (Buy). Veeva’s earnings are expected to grow 19% in the next five years. Also, the company has a trailing four-quarter positive earnings surprise of 11.7%, on average.

The stock also has a Momentum Score of A. Our research shows that stocks with a Momentum Score of A or B, when combined with a Zacks Rank #1 (Strong Buy) or 2, are better picks than most.

Let’s take a closer look at the factors that are working in favor of the company right now.

Q3 Results, Guidance & Developments

In the recently reported fiscal third quarter, Veeva came up with an earnings surprise of 11.1%.

The company reported earnings per share of 60 cents. The metric shot up 33.3% on a year-over-year basis.

Revenues totaled $280.9 million, outpacing the Zacks Consensus Estimate of $275.4 million. On a year-over-year basis, the top line improved 25%.

Notably, Veeva gained significantly from Subscription services and Professional services units. This also encouraged the company to raise its revenue guidance for fiscal 2020.

The company projects revenues within $1,088 million and $1,091 million, higher than the earlier projected range of $1,062 million to $1,065 million.

That’s not all. A series of developments is expected to aid the stock as well.

This month, German herbal remedy manufacturer Bionorica SE selected multichannel Veeva CRM to streamline business processes and improve customer interactions globally. The company also selected Veeva OpenData for reliable, complete customer data to help field teams deliver more focused interactions with healthcare professionals.

Earlier this month, Veeva announced the acquisition of Physicians World, a leading provider of bureau services. The collaboration is likely to provide a complete solution to plan and execute live and virtual events for healthcare professionals.

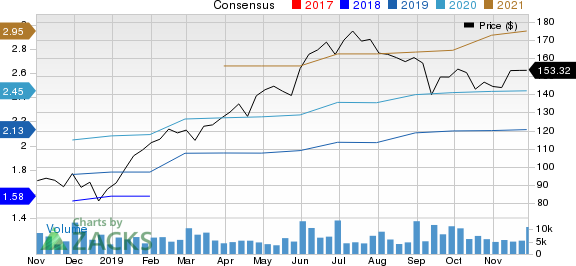

Veeva Systems Inc. Price and Consensus

Veeva Systems Inc. price-consensus-chart | Veeva Systems Inc. Quote

Additionally, Almirall, a Spanish pharmaceutical company recently selected multichannel Veeva CRM to deliver seamless customer experience across all channels as it shifts business focus to specialty medicine.

Given the trend, we can say that Veeva is successfully expanding its customer base in the global markets.

Which Way Are Estimates Headed?

For fiscal 2020, the Zacks Consensus Estimate for revenues is pegged at $1.09 billion, indicating an improvement of 26.4% from the year-ago quarter’s reported figure. For adjusted earnings, the same stands at $2.13 per share, suggesting growth of 30.7% from the year-ago reported figure.

Other Stocks to Consider

Other top-ranked stocks from the broader medical space are Conmed Corporation CNMD, Cardinal Health, Inc. CAH and DENTSPLY SIRONA Inc. XRAY, each currently carrying a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank stocks here.

Conmed Corporation has a long-term earnings growth rate of 17%.

Cardinal Health has a long-term earnings growth rate of 6.2%.

DENTSPLY SIRONA has a long-term earnings growth rate of 11.6%.

Today's Best Stocks from Zacks

Would you like to see the updated picks from our best market-beating strategies? From 2017 through Q3 2019, while the S&P 500 gained +39.6%, five of our strategies returned +51.8%, +57.5%, +96.9%, +119.0%, and even +158.9%.

This outperformance has not just been a recent phenomenon. From 2000 – Q3 2019, while the S&P averaged +5.6% per year, our top strategies averaged up to +54.1% per year.

See their latest picks free >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Veeva Systems Inc. (VEEV) : Free Stock Analysis Report

CONMED Corporation (CNMD) : Free Stock Analysis Report

DENTSPLY SIRONA Inc. (XRAY) : Free Stock Analysis Report

Cardinal Health, Inc. (CAH) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance