Here's Why Abundante (SGX:570) Has Caught The Eye Of Investors

Investors are often guided by the idea of discovering 'the next big thing', even if that means buying 'story stocks' without any revenue, let alone profit. Unfortunately, these high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson. Loss making companies can act like a sponge for capital - so investors should be cautious that they're not throwing good money after bad.

If this kind of company isn't your style, you like companies that generate revenue, and even earn profits, then you may well be interested in Abundante (SGX:570). While this doesn't necessarily speak to whether it's undervalued, the profitability of the business is enough to warrant some appreciation - especially if its growing.

View our latest analysis for Abundante

How Quickly Is Abundante Increasing Earnings Per Share?

Generally, companies experiencing growth in earnings per share (EPS) should see similar trends in share price. That makes EPS growth an attractive quality for any company. Abundante's shareholders have have plenty to be happy about as their annual EPS growth for the last 3 years was 41%. While that sort of growth rate isn't sustainable for long, it certainly catches the eye of prospective investors.

Top-line growth is a great indicator that growth is sustainable, and combined with a high earnings before interest and taxation (EBIT) margin, it's a great way for a company to maintain a competitive advantage in the market. It was a year of stability for Abundante as both revenue and EBIT margins remained have been flat over the past year. That's not a major concern but nor does it point to the long term growth we like to see.

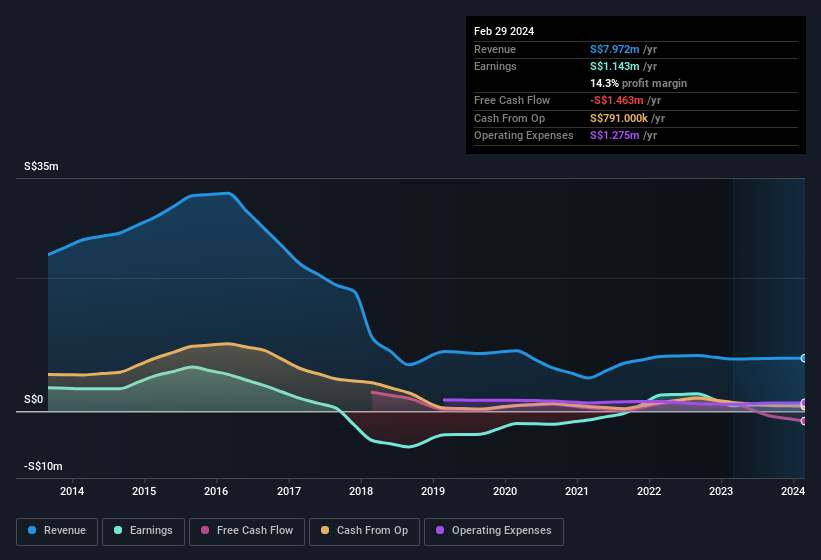

In the chart below, you can see how the company has grown earnings and revenue, over time. Click on the chart to see the exact numbers.

Abundante isn't a huge company, given its market capitalisation of S$21m. That makes it extra important to check on its balance sheet strength.

Are Abundante Insiders Aligned With All Shareholders?

Investors are always searching for a vote of confidence in the companies they hold and insider buying is one of the key indicators for optimism on the market. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

We do note that, in the last year, insiders sold S$3.3m worth of shares. But that's far less than the S$5.3m insiders spent purchasing stock. This bodes well for Abundante as it highlights the fact that those who are important to the company having a lot of faith in its future. We also note that it was the company insider, Tingting Xun, who made the biggest single acquisition, paying S$2.8m for shares at about S$0.21 each.

These recent buys aren't the only encouraging sign for shareholders, as a look at the shareholder registry for Abundante will reveal that insiders own a significant piece of the pie. In fact, they own 100% of the company, so they will share in the same delights and challenges experienced by the ordinary shareholders. This should be seen as a good thing, as it means insiders have a personal interest in delivering the best outcomes for shareholders. In terms of absolute value, insiders have S$21m invested in the business, at the current share price. So there's plenty there to keep them focused!

Should You Add Abundante To Your Watchlist?

Abundante's earnings per share growth have been climbing higher at an appreciable rate. To make matters even better, the company insiders who know the company best have put their faith in the its future and have been buying more stock. This quick rundown suggests that the business may be of good quality, and also at an inflection point, so maybe Abundante deserves timely attention. Before you take the next step you should know about the 3 warning signs for Abundante (2 are concerning!) that we have uncovered.

There are plenty of other companies that have insiders buying up shares. So if you like the sound of Abundante, you'll probably love this curated collection of companies in SG that have an attractive valuation alongside insider buying in the last three months.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Yahoo Finance

Yahoo Finance