Here's Why AB InBev (BUD) Continues to Outpace Its Industry

Anheuser-Busch InBev SA/NV BUD, or alias AB InBev, has been witnessing an uptrend for continued business momentum due to relentless execution, investment in its brands and accelerated digital transformation.

AB InBev reported better-than-anticipated earnings in the third quarter of 2022. Moreover, earnings and sales improved year over year. Results benefited from the continued consumer demand for its brand portfolio.

The expansion of the Beyond Beer portfolio and investments in B2B platforms, e-commerce and digital marketing also bode well. The premiumization of the beer industry has been a key growth opportunity for AB InBev.

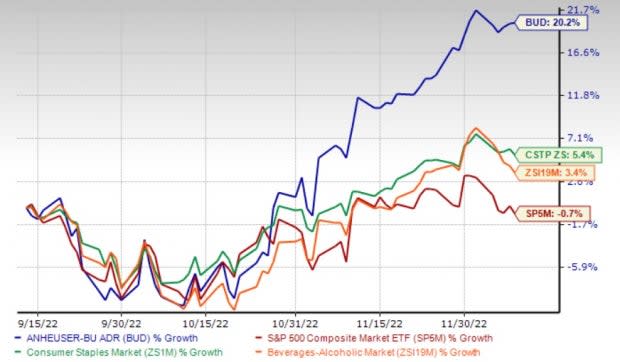

This Zacks Rank #3 (Hold) stock has rallied 20.2% in the past three months, outperforming the industry’s and the Consumer Staple sector’s growth of 3.4% and 5.4%, respectively. The stock’s performance also compared favorably against the S&P 500’s fall of 0.7% in the same period.

The Zacks Consensus Estimate for AB InBev’s 2022 sales and earnings suggests growth of 7.6% and 6.3%, respectively, from the year-ago period’s reported numbers.

Image Source: Zacks Investment Research

Factors to Aid Growth

AB InBev is anticipated to retain the strong business momentum on continued premiumization efforts and favorable industry trends. The company has been investing in a diverse portfolio of global and international, and crafts and specialty premium brands in its markets. Apart from the premium brands, BUD’s global brands lead the way in premiumization.

The company’s above core portfolio grew revenues in the low teens in the third quarter of 2022. This was led by double-digit growth in Michelob ULTRA in the United States and Mexico and the expansion of Spaten in Brazil.

AB InBev’s three global brands — Budweiser, Corona and Stella Artois — advanced 12.7% outside their respective home markets in the third quarter. The Corona brand grew 23.5%, Stella Artois improved 7%, and Budweiser rose 8.9%.

BUD is also steadfastly growing its Beyond Beer portfolio, including products like Ready-to-Drink Beverages like Canned Wine and Canned Cocktails, Hard Seltzers, Cider and Flavored Malt Beverages. This is likely to boost its market share.

The Beyond Beer trend has been recently gaining popularity due to a rise in the demand for low-alcoholic or non-alcoholic drinks. The company remains focused on expanding its Beyond Beer portfolio, which has also been aiding the top line.

AB InBev’s Beyond Beer portfolio contributed more than $400 million to total revenues in the third quarter. The global Beyond Beer business’ revenues improved more than 10% in the third quarter.

Moreover, the company witnessed double-digit volume growth in Brutal Fruit and Flying Fish in South Africa. In the United States, the company’s portfolio witnessed growth ahead of the industry in the spirit-based-ready-to-drink segment, driven by its Cutwater and NUTRL vodka seltzer.

Coming to digital expansion, AB InBev is witnessing an acceleration in B2B platforms, e-commerce and digital marketing trends, which has been aiding growth in the past few months. Its digital transformation initiatives remain on track, with B2B digital platforms generating about 57% of its revenues in the third quarter.

The company’s proprietary B2B platform, BEES, is now live in 19 markets and has reached a monthly active user base of 3.1 million as of Sep 30, 2022. BEES captured $7.7 billion in gross merchandise value, representing growth of more than 40% year over year.

In the third quarter, the company’s direct-to-consumer (DTC) ecosystem generated more than $385 million in revenues and approximately 17 million e-commerce orders. The DTC e-commerce platform, including Ze Delivery, TaDa and PerfectDraft, generated more than $100 million in revenues and 17 million orders in the quarter.

On a combined basis, the company’s omnichannel DTC ecosystem of digital and physical DTC products generated revenues of more than $1 billion in the nine months of 2022, mid-teens growth versus the nine months of 2021.

Backed by the continued business momentum, AB InBev raised its view for 2022. For 2022, BUD expects EBITDA growth of 6-8% compared with the 4-8% growth stated earlier. It anticipates revenue growth to be higher than EBITDA growth, driven by strong volumes and pricing. Over the medium term, the company anticipates EBITDA growth of 4-8%.

Headwinds to Overcome

While AB InBev has been gaining from improving trends in key markets and continued premiumization in the majority of its markets, commodity cost inflation and higher supply-chain costs in some markets continue to be major headwinds. Higher commodity costs mainly resulted from increased aluminum and barley prices.

Like others in the industry, the company expects higher commodity costs to continue, exerting pressure on input costs. BUD’s presence across various countries exposes it to negative currency translations. The company anticipates foreign currency to remain volatile.

Stocks to Consider

We have highlighted three better-ranked stocks from the Consumer Staple sector, namely Coca-Cola FEMSA KOF, Campbell Soup CPB and Ambev ABEV.

Coca-Cola FEMSA produces, markets and distributes soft drinks throughout the metropolitan area of Mexico City in Southeastern Mexico and the metropolitan region in Buenos Aires, Argentina. KOF has a trailing four-quarter earnings surprise of 33.6%, on average. It currently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today's Zacks #1 Rank stocks here.

Shares of Coca-Cola FEMSA have risen 4.1% in the past three months. The Zacks Consensus Estimate for Coca-Cola FEMSA’s current financial-year sales and earnings suggests growth of 15.6% and 6.2%, respectively, from the year-ago period's reported figures. KOF has an expected EPS growth rate of 10.3% for three to five years.

Campbell Soup is a worldwide manufacturer and marketer of high-quality, branded convenience food products. It currently has a Zacks Rank #2 (Buy). The company has an expected EPS growth rate of 3.4% for three to five years. Shares of CPB have increased 17.7% in the past three months.

The Zacks Consensus Estimate for Campbell’s current financial-year sales and earnings per share suggests growth of 7.6% and 4.9%, respectively, from the year-ago period’s reported figures. CPB has a trailing four-quarter earnings surprise of 8.7%, on average.

Ambev is engaged in producing, distributing and selling beer, carbonated soft drinks, and other non-alcoholic and non-carbonated products in many countries across the Americas. ABEV currently has a Zacks Rank #2. Ambev has a trailing four-quarter earnings surprise of 4.4%, on average. Shares of ABEV have declined 0.7% in the past three months.

The Zacks Consensus Estimate for Ambev’s current financial-year sales and earnings suggests growth of 19.4% and 6.7%, respectively, from the year-ago period’s reported figures. ABEV has an expected EPS growth rate of 9.1% for three to five years.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Campbell Soup Company (CPB) : Free Stock Analysis Report

AnheuserBusch InBev SANV (BUD) : Free Stock Analysis Report

Coca Cola Femsa S.A.B. de C.V. (KOF) : Free Stock Analysis Report

Ambev S.A. (ABEV) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance