Here's What We Make Of South32's (ASX:S32) Returns On Capital

When it comes to investing, there are some useful financial metrics that can warn us when a business is potentially in trouble. Businesses in decline often have two underlying trends, firstly, a declining return on capital employed (ROCE) and a declining base of capital employed. This reveals that the company isn't compounding shareholder wealth because returns are falling and its net asset base is shrinking. Having said that, after a brief look, South32 (ASX:S32) we aren't filled with optimism, but let's investigate further.

What is Return On Capital Employed (ROCE)?

Just to clarify if you're unsure, ROCE is a metric for evaluating how much pre-tax income (in percentage terms) a company earns on the capital invested in its business. The formula for this calculation on South32 is:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.0065 = US$81m ÷ (US$14b - US$1.3b) (Based on the trailing twelve months to June 2020).

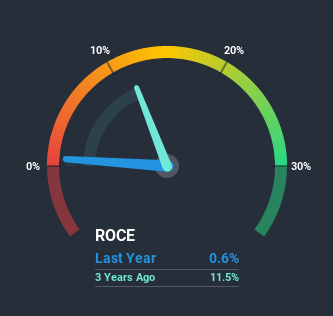

Therefore, South32 has an ROCE of 0.6%. In absolute terms, that's a low return and it also under-performs the Metals and Mining industry average of 9.6%.

See our latest analysis for South32

Above you can see how the current ROCE for South32 compares to its prior returns on capital, but there's only so much you can tell from the past. If you'd like, you can check out the forecasts from the analysts covering South32 here for free.

So How Is South32's ROCE Trending?

We are a bit worried about the trend of returns on capital at South32. About five years ago, returns on capital were 1.7%, however they're now substantially lower than that as we saw above. And on the capital employed front, the business is utilizing roughly the same amount of capital as it was back then. This combination can be indicative of a mature business that still has areas to deploy capital, but the returns received aren't as high due potentially to new competition or smaller margins. If these trends continue, we wouldn't expect South32 to turn into a multi-bagger.

In Conclusion...

In the end, the trend of lower returns on the same amount of capital isn't typically an indication that we're looking at a growth stock. Yet despite these concerning fundamentals, the stock has performed strongly with a 80% return over the last five years, so investors appear very optimistic. In any case, the current underlying trends don't bode well for long term performance so unless they reverse, we'd start looking elsewhere.

South32 could be trading at an attractive price in other respects, so you might find our free intrinsic value estimation on our platform quite valuable.

For those who like to invest in solid companies, check out this free list of companies with solid balance sheets and high returns on equity.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

Yahoo Finance

Yahoo Finance