Here's How Simon Property (SPG) Looks Ahead of Q2 Earnings

Simon Property Group’s SPG second-quarter 2021 results are scheduled to be out on Aug 2, after the bell. The company’s quarterly results will likely display growth in both revenues and funds from operations (FFO) per share.

In the last reported quarter, this Indianapolis, IN-based retail real estate investment trust (REIT) delivered a surprise of 10.22% in terms of FFO per share. This performance was backed by better-than-expected top-line growth.

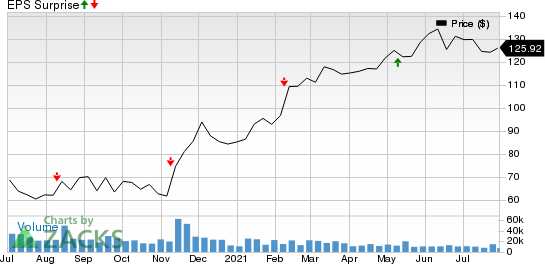

In the last four quarters, the company beat the Zacks Consensus Estimate on one occasion and missed in the other three. It has a trailing four-quarter negative surprise of 1.95%, on average. This is depicted in the graph below:

Simon Property Group, Inc. Price and EPS Surprise

Simon Property Group, Inc. price-eps-surprise | Simon Property Group, Inc. Quote

Let’s see how things have shaped up prior to this announcement.

Factors at Play

The retail real estate market had already been battling dwindling traffic issues, store closures and retailer bankruptcies, and then the pandemic had only aggravated its woes. However, per a report from CBRE Group CBRE, amid an improving economy and solid consumer demand, total retail sales jumped 31%, year over year, in the second quarter.

The total retail availability rate shrunk 30 basis points (bps), quarter over quarter, to 6.2%. There have been wide variations in availability rates by markets, with suburban and secondary markets outperforming urban cores. The second-quarter net absorption remained positive for the third straight quarter, highlighting continued demand recovery from the pandemic-induced disruptions.

Moreover, average retail asking rent expanded 20 bps, sequentially, and 10 bps, year over year, to $20.86 per square feet. While retail completions increased 48% quarter over quarter to 7.1 million square feet during the April-June period, the figure is down 10% from the prior year.

Simon Property too is anticipated to have benefited from the recovery in the retail real estate market. This retail REIT behemoth has a wide exposure to different retail assets, including premium malls, lifestyle centers and other retail properties across the United States.

The vaccination program acceleration, government stimulus measures, and the reopening of the retail sector have encouragingly brought relief. The economy is improving, and the bounce back in consumer demand is boosting retail sales, which, in turn, is driving demand for the retail real estate space. Tenants now stand in a better position to generate revenues and meet their rent payments. Therefore, pressure on retail landlords might have reduced and the company’s rent-collection figures are anticipated to have improved.

Further, adoption of an omni-channel strategy and successful tie-ups with premium retailers have been a major focus of Simon Property. The REIT has also been tapping growth opportunities by assisting digital brands enhance their brick-and-mortar presence. The company capitalized on buying out recognized retail brands in bankruptcy. With the brands generating decent amount from digital sales, investments in the same seem strategic for Simon Property. Also, the company is expected to have maintained its decent financial strength during the June-end quarter.

The Zacks Consensus Estimate for second-quarter lease income is pegged at $1.09 billion, indicating an increase of 7.5% from the prior-year period. In addition, the consensus mark for quarterly revenues is currently pinned at $1.18 billion, suggesting a jump of 11.1%, year over year. Occupancy of its total portfolio is projected at 91% in the quarter.

Lastly, Simon Property’s activities during the April-June quarter were adequate to gain analyst confidence. The Zacks Consensus Estimate for the FFO per share moved 1.7% north in the past two months and is currently pinned at $2.37. The figure also calls for 11.8% growth from the year-earlier period quarter.

Here is What our Quantitative Model Predicts

Our proven model does not conclusively predict a beat in terms of FFO per share for Simon Property this season. The combination of a positive Earnings ESP, and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold), increases the odds of a FFO beat. But that’s not the case here. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Simon Property currently carries a Zacks Rank #3 and has Earnings ESP of 0.00%.

Stocks That Warrant a Look

Here are a few stocks in the REIT sector that you may want to consider, as our model shows that these have the right combination of elements to report surprises this quarter:

Realty Income Corporation O, scheduled to announce quarterly numbers on Aug 2, currently has an Earnings ESP of +1.14% and carries a Zacks Rank of 3. You can see the complete list of today’s Zacks #1 Rank stocks here.

Federal Realty Investment Trust FRT, set to report quarterly results on Aug 4, has an Earnings ESP of +1.83% and carries a Zacks Rank of 2, at present.

Note: Anything related to earnings presented in this write-up represent funds from operations (FFO) — a widely used metric to gauge the performance of REITs.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Simon Property Group, Inc. (SPG) : Free Stock Analysis Report

Federal Realty Investment Trust (FRT) : Free Stock Analysis Report

Realty Income Corporation (O) : Free Stock Analysis Report

CBRE Group, Inc. (CBRE) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Yahoo Finance

Yahoo Finance