Here’s how your property value changed last year

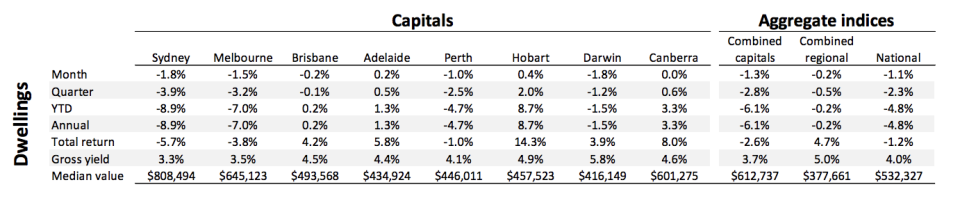

The results are in: Australian property values dropped 4.8 per cent in 2018, making it the worst year for the housing market since the global financial crisis in 2008.

But while the traditional big-hitters of Sydney and Melbourne made negative changes of -8.9 per cent and -7.0 per cent respectively, other capital cities stepped up to the plate.

In fact, Hobart dwellings increased 8.7 per cent, bringing its median dwelling value to $457,523.

Canberra properties increased 3.3 per cent, while Adelaide properties made 1.3 per cent.

Break it down

While Adelaide, Hobart and Canberra posted positive growth, the figures are still quite subdued, CoreLogic head of research Tim Lawless said.

“Such a soft result amongst the best performing areas highlights that housing market weakness is broad-based and not just confined to Sydney and Melbourne,” he said.

And these cities are also home to traditionally more affordable properties.

“The stronger performance across lower value properties likely reflects both affordability challenges and lending policies focused on reducing exposure to borrowers with high debt to income ratios,” Lawless said.

“These factors, as well as incentives for first home buyers in New South Wales and Victoria, are likely channeling market activity towards the lower range of dwelling values.”

What does it mean?

As values fall and more properties enter the market, the buyer is in the driver’s seat.

“Vendors will need to be cognisant of market conditions and set their price expectations and marketing strategies accordingly.

”An important litmus test for the market will occur in February, typically at this time we see the number of advertised listings ramp-up following the Christmas/New Year slowdown. If listing levels return to or exceed levels from late 2018 it could lead to even weaker housing conditions as buyers are spoilt for choice,” Lawless said.

This environment is likely to persist for the near future, especially as we head towards a federal election in which property policy is a core debate.

Lawless warned confidence is likely to be impacted, but added that there is still good news.

“Interest rates are set to remain close to historic lows and migration is likely to remain high (albeit lower than last year), which will help to keep a floor under housing demand.”

Make your money work with Yahoo Finance’s daily newsletter. Sign up here and stay on top of the latest money, news and tech news.

Now read: Yahoo Finance’s markets and economics outlook snapshot for 2019

Now read: 17 things we learnt about the Aussie property market in 2018

Yahoo Finance

Yahoo Finance