Here's What We Learned About The CEO Pay At Alexium International Group Limited (ASX:AJX)

This article will reflect on the compensation paid to Bob Brookins who has served as CEO of Alexium International Group Limited (ASX:AJX) since 2018. This analysis will also assess whether Alexium International Group pays its CEO appropriately, considering recent earnings growth and total shareholder returns.

View our latest analysis for Alexium International Group

Comparing Alexium International Group Limited's CEO Compensation With the industry

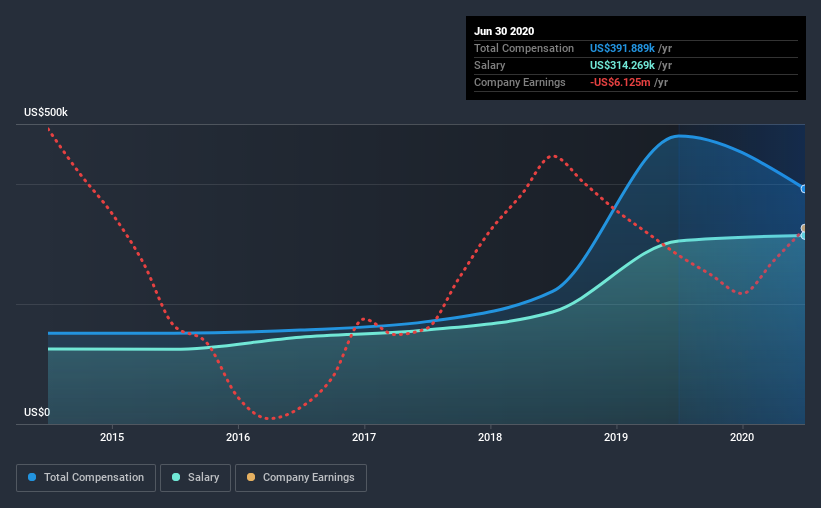

At the time of writing, our data shows that Alexium International Group Limited has a market capitalization of AU$40m, and reported total annual CEO compensation of US$392k for the year to June 2020. That's a notable decrease of 18% on last year. In particular, the salary of US$314.3k, makes up a huge portion of the total compensation being paid to the CEO.

For comparison, other companies in the industry with market capitalizations below AU$272m, reported a median total CEO compensation of US$258k. This suggests that Bob Brookins is paid more than the median for the industry. What's more, Bob Brookins holds AU$394k worth of shares in the company in their own name.

Component | 2020 | 2019 | Proportion (2020) |

Salary | US$314k | US$305k | 80% |

Other | US$78k | US$175k | 20% |

Total Compensation | US$392k | US$480k | 100% |

On an industry level, roughly 69% of total compensation represents salary and 31% is other remuneration. Alexium International Group is paying a higher share of its remuneration through a salary in comparison to the overall industry. If salary dominates total compensation, it suggests that CEO compensation is leaning less towards the variable component, which is usually linked with performance.

Alexium International Group Limited's Growth

Alexium International Group Limited's earnings per share (EPS) grew 9.6% per year over the last three years. In the last year, its revenue is up 20%.

This revenue growth could really point to a brighter future. And the modest growth in EPS isn't bad, either. Although we'll stop short of calling the stock a top performer, we think the company has potential. Although we don't have analyst forecasts, you might want to assess this data-rich visualization of earnings, revenue and cash flow.

Has Alexium International Group Limited Been A Good Investment?

With a three year total loss of 80% for the shareholders, Alexium International Group Limited would certainly have some dissatisfied shareholders. Therefore, it might be upsetting for shareholders if the CEO were paid generously.

In Summary...

As previously discussed, Bob is compensated more than what is normal for CEOs of companies of similar size, and which belong to the same industry. While we have not been overly impressed by the business performance, the shareholder returns have been utterly depressing, over the last three years. And the situation doesn't look all that good when you see Bob is remunerated higher than the industry average. With such poor returns, we would understand if shareholders had concerns related to the CEO's pay.

CEO pay is simply one of the many factors that need to be considered while examining business performance. We did our research and identified 3 warning signs (and 1 which is potentially serious) in Alexium International Group we think you should know about.

Switching gears from Alexium International Group, if you're hunting for a pristine balance sheet and premium returns, this free list of high return, low debt companies is a great place to look.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

Yahoo Finance

Yahoo Finance