Hennessy Japan Fund Amplifies Stake in Daikin Industries, Impacting Portfolio by 2.15%

Insightful Adjustments in Q2 2024 Highlight Strategic Shifts

Established on October 31, 2003, the Hennessy Japan Fund (Trades, Portfolio) is renowned for its strategic investments in Japanese equities, aiming for long-term capital appreciation. The fund invests primarily in companies that exhibit solid business fundamentals, exceptional management, and attractive valuations. Hennessy's investment approach combines quantitative analysis with rigorous on-site research, focusing on market potential, management quality, earnings, and financial robustness. The fund's latest N-PORT filing for the second quarter of 2024 reveals significant adjustments in its portfolio, reflecting its dynamic investment strategy.

Key Position Increases

During the second quarter of 2024, Hennessy Japan Fund (Trades, Portfolio) increased its holdings in eight stocks, with notable adjustments including:

Daikin Industries Ltd (TSE:6367): Added 58,900 shares, bringing the total to 122,000 shares. This 93.34% increase in shares now represents a 2.15% impact on the portfolio, with a total value of 16,651,940.

Renesas Electronics Corp (TSE:6723): Added 289,900 shares, increasing the total to 867,500 shares. This 50.19% increase in shares has significantly enhanced the fund's stake, valued at 14,084,510.

Key Position Reductions

The fund also reduced its positions in nine stocks, with significant reductions in:

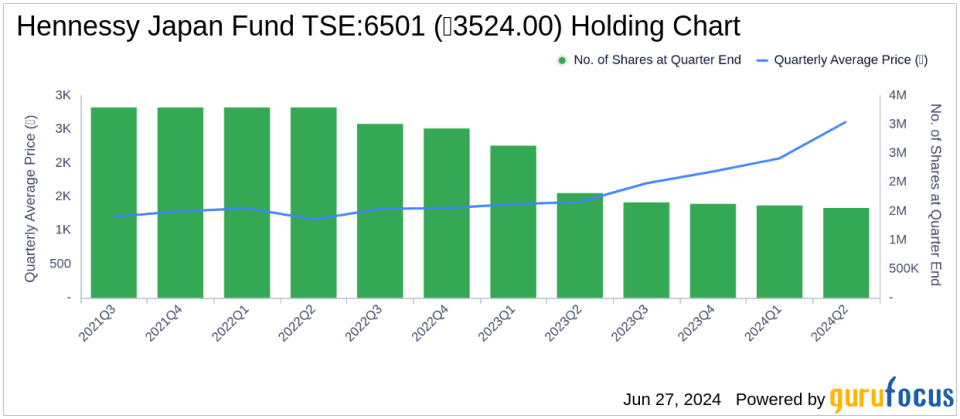

Hitachi Ltd (TSE:6501): Reduced by 9,100 shares, resulting in a 2.84% decrease in shares and a 0.21% impact on the portfolio. Hitachi's stock price averaged 2,614.55 during the quarter, with a three-month return of -74.28% and a year-to-date return of -65.10%.

Mitsubishi Corp (TSE:8058): Reduced by 34,700 shares, marking a 2.83% reduction in shares and a 0.18% impact on the portfolio. Mitsubishi traded at an average price of 3,275.61 during the quarter, with a three-month return of -10.10% and a year-to-date gain of 40.51%.

Portfolio Overview

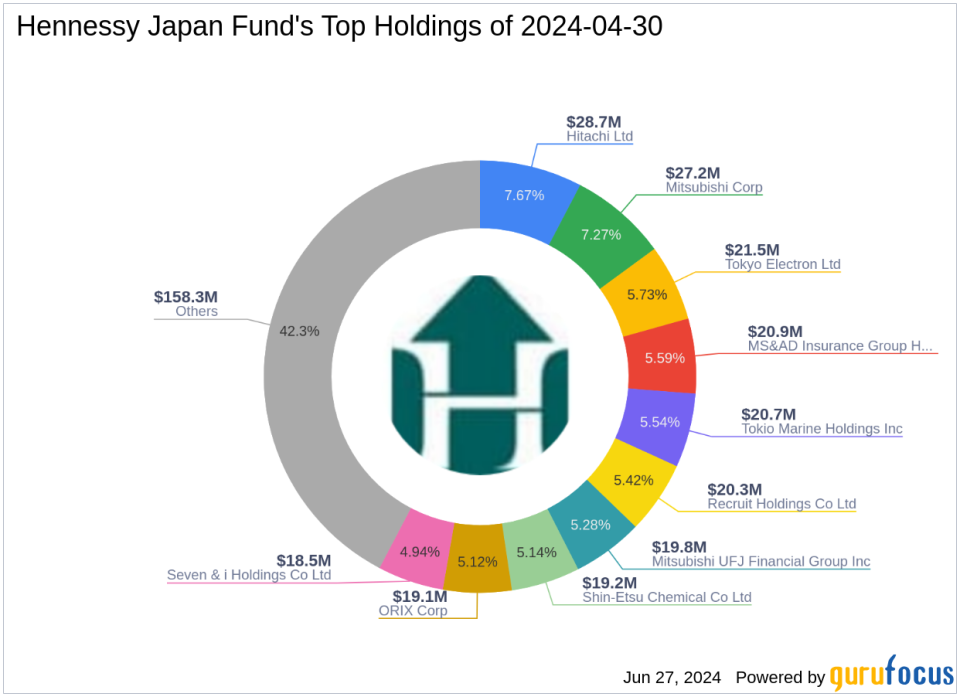

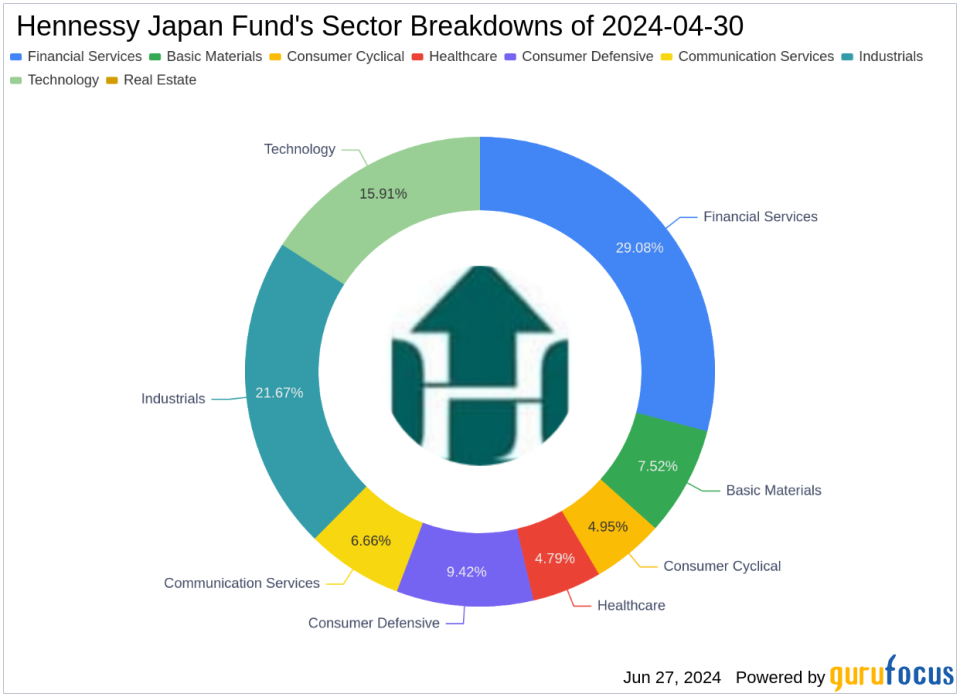

As of the second quarter of 2024, Hennessy Japan Fund (Trades, Portfolio)'s portfolio comprised 27 stocks. The top holdings included 7.67% in Hitachi Ltd, 7.27% in Mitsubishi Corp, 5.73% in Tokyo Electron Ltd, 5.59% in MS&AD Insurance Group Holdings Inc, and 5.54% in Tokio Marine Holdings Inc. The fund's investments are predominantly concentrated in eight industries: Financial Services, Industrials, Technology, Consumer Defensive, Basic Materials, Communication Services, Consumer Cyclical, and Healthcare.

This strategic positioning and recent portfolio adjustments underscore Hennessy Japan Fund (Trades, Portfolio)'s commitment to capitalizing on market dynamics and enhancing shareholder value through meticulous stock selection and portfolio management.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance