HCA Healthcare (HCA) Q3 Earnings Beat Estimates, Improve Y/Y

HCA Healthcare, Inc. HCA reported third-quarter 2019 adjusted earnings of $2.23 per share, surpassing the Zacks Consensus Estimate by 4.2%.

Moreover, the bottom line inched up nearly 3.2% year over year on the back of higher revenues.

The company’s net income per share of $1.76 in the quarter under review was down 18% year over rear.

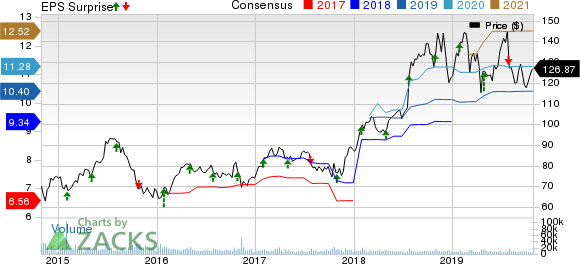

HCA Healthcare, Inc. Price, Consensus and EPS Surprise

HCA Healthcare, Inc. price-consensus-eps-surprise-chart | HCA Healthcare, Inc. Quote

Quarterly Details

HCA Healthcare generated revenues of $12.7 billion, beating the Zacks Consensus Estimate by 1.6%. The reported figure was up 10.9% from the year-ago period.

Same facility equivalent admissions increased 4.2% year over year while same facility admissions rose 3.2%. Same facility revenue per equivalent admission also grew 2%.

Salaries and benefits, supplies and other operating expenses increased 11.2 % year over year to $10.4 billion.

Adjusted EBITDA totaled $2.3 billion, up 9% year over year.

As of Sep 30, 2019, HCA Healthcare operated 184 hospitals and around 2000 sites of care including surgery centers, freestanding emergency rooms, urgent care centers and physician clinics.

Financial Update

As of Sep 30, 2019, the company had cash and cash equivalents of about $559 million, total debt of $34.2 billion and total assets of $43.9 billion.

During the reported quarter, capital expenditures totaled $1.1 billion excluding acquisitions. Cash flows provided by operating activities were $2.1 billion, up 23.5% year over year.

Dividend and Share Repurchase Update

HCA Healthcare announced a quarterly cash dividend of 40 cents per share payable Dec 27 to stockholders of record at the close of business on Dec 2.

The company bought back shares worth $239 million in the third quarter and had shares worth $1.5 billion remaining under its current repurchase authorization as of Sep 30, 2019.

2019 Outlook

The company still expects its 2019 revenues in the band of$50.5-$51.5 billion. Adjusted EBITDA is tapered to a new range of $9.65-$9.85 billion from the earlier band of $9.60-$9.85 billion. Capital expenditures are anticipated to be around $3.8 billion. The company upped the lower end of its earlier EPS guidance from $10.25-$10.65 to $10.30-$10.65.

Zacks Rank

HCA Healthcare carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Releases From the Medical Sector

Among other players from the medical sector having already reported third-quarter earnings, the bottom-line results of UnitedHealth Group Incorporated UNH, Anthem Inc. ANTM and Centene Corporation CNC topped the respective Zacks Consensus Estimate.

Breakout Biotech Stocks with Triple-Digit Profit Potential

The biotech sector is projected to surge beyond $775 billion by 2024 as scientists develop treatments for thousands of diseases. They’re also finding ways to edit the human genome to literally erase our vulnerability to these diseases.

Zacks has just released Century of Biology: 7 Biotech Stocks to Buy Right Now to help investors profit from 7 stocks poised for outperformance. Our recent biotech recommendations have produced gains of +98%, +119% and +164% in as little as 1 month. The stocks in this report could perform even better.

See these 7 breakthrough stocks now>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Anthem, Inc. (ANTM) : Free Stock Analysis Report

Centene Corporation (CNC) : Free Stock Analysis Report

UnitedHealth Group Incorporated (UNH) : Free Stock Analysis Report

HCA Healthcare, Inc. (HCA) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Yahoo Finance

Yahoo Finance