Has real estate in your area peaked?

Residential areas within Australia have been analysed to see exactly where they are in the property boom-bust cycle.

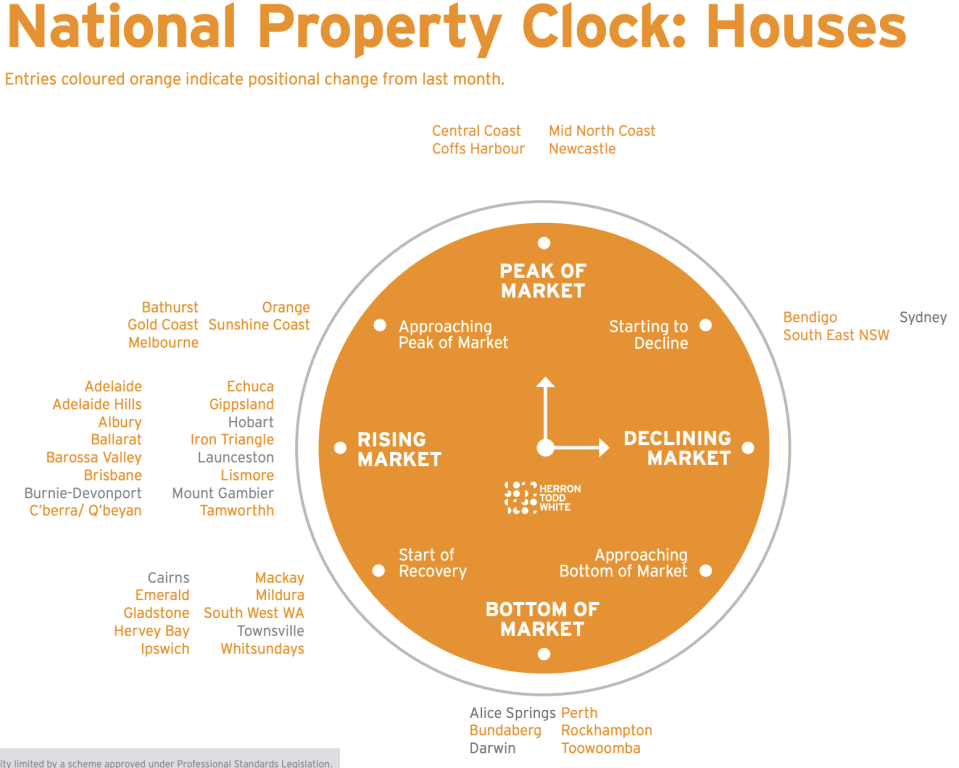

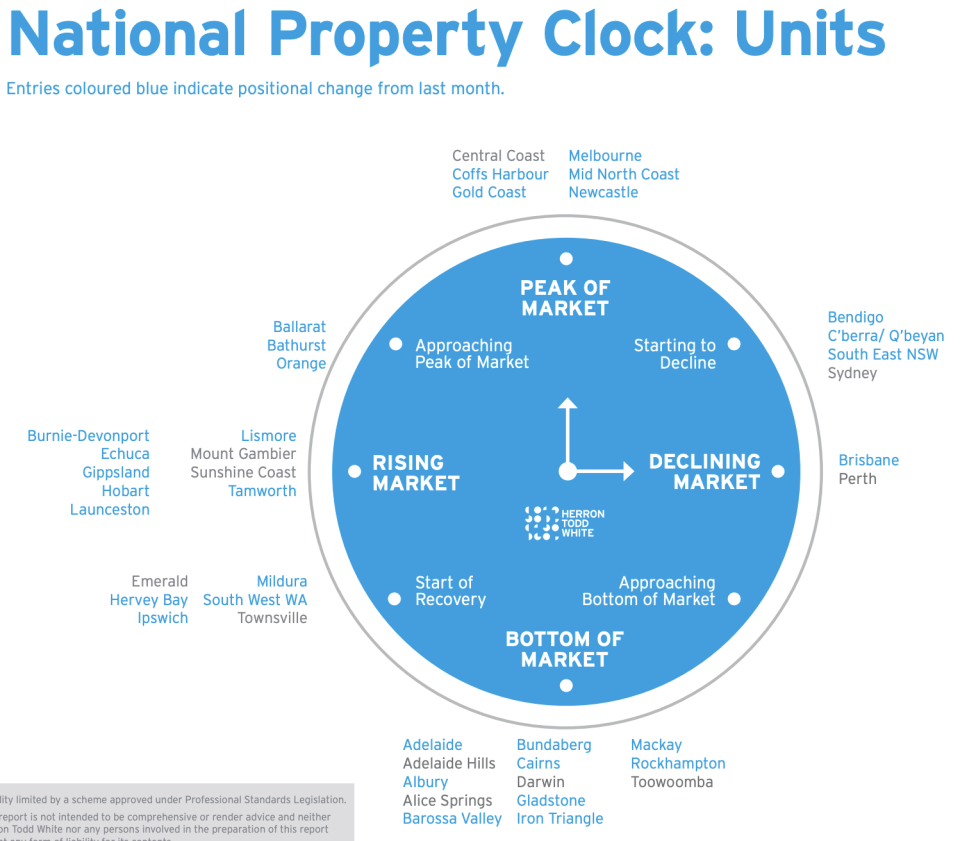

In two fascinating infographics, property valuation firm Herron Todd White has placed areas on a "national property clock" to show which areas are at the bottom of the price cycle, rising, at peak, or declining.

The NSW coast north of Sydney seems to be doing well at the moment, with the Central Coast, Newcastle, Mid North Coast and Coffs Harbour regions all considered to be at their peak for house prices.

For apartments it's a similar story, with Melbourne and the Gold Coast also joining the NSW coastal areas at the top of the price cycle.

Sydney itself has passed the peak and is on the decline, along with south-east NSW and Bendigo.

At the other end of the cycle, bargains can be found at Perth, Darwin, Alice Springs, Bundaberg, Rockhampton and Toowoomba, as they're all currently at the bottom of the price cycle.

Adelaide and Albury join those areas at rock-bottom, when flats are taken into account.

A trend that Herron Todd White has detected in most areas is a pick-up in renovation activity to increase the value of homes.

"While most of us were locked away in our fortresses of solitude... there were some property owners using those extra hours to improve their lot," read its Month In Review report.

"The [queues] filled outside Bunnings as we looked to tackle a little DIY around our homes, such as sprucing up the streetscape to repainting the spare room."

The slowdown in the construction industry during the coronavirus crisis has meant even those looking to complete larger projects were in a prime position to pull it off.

"There’s been reports contractors in some parts of the country are struggling to refill their pipeline of work after the COVID crisis halted plans," stated the report.

“This has created an opportunity for property owners to take advantage of the competitive landscape and lock in a tradesperson for some substantial remodelling.”

“Recent incentives announced by the federal government have only made the idea more enticing for those who qualify.”

Follow Yahoo Finance Australia on Facebook, Twitter, Instagram and LinkedIn.

Yahoo Finance

Yahoo Finance