Hartford Financial (HIG) Q4 Earnings Beat on P&C Earned Premiums

The Hartford Financial Services Group, Inc. HIG reported fourth-quarter 2022 adjusted operating earnings of $2.31 per share, which beat the Zacks Consensus Estimate by 24.2%. The bottom line advanced 14% year over year.

Operating revenues of HIG improved 8.4% year over year to $4,007 million in the quarter under review. The top line also beat the consensus mark by 3.6%.

The decline in excess mortality losses within group life coupled with growing property and casualty (P&C) earned premium and Group Benefits fully-insured ongoing premium contributed to the strong quarterly results. Increased net investment income and an improved group disability loss ratio were also tailwinds for HIG. However, the upside was partly offset by elevated catastrophe losses stemming from the Winter Storm Elliott and an elevated expense level.

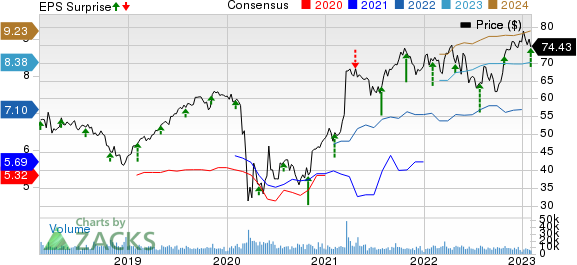

The Hartford Financial Services Group, Inc. Price, Consensus and EPS Surprise

The Hartford Financial Services Group, Inc. price-consensus-eps-surprise-chart | The Hartford Financial Services Group, Inc. Quote

Q4 Operations

Net earned premiums of $5,019 million rose 8.4% year over year in the fourth quarter, which came higher than the Zacks Consensus Estimate of $4,959 million and our estimate of $4,978.5 million.

The net investment income of Hartford Financial climbed 11.7% year over year to $640 million, thanks to growing yields on variable rate securities. The reported figure surpassed the consensus mark of $520 million and our estimate of $546.8 million. Net investment income witnessed a year-over-year increase across the Commercial Lines, Personal Lines, Group Benefits and Hartford Funds segments.

Total benefits and expenses of $5,284 million escalated 7.5% year over year in the quarter under review, higher than our estimate of $5,136.3 million.

HIG reported a pretax income of $732 million, which declined 18.7% year over year but outpaced our estimate of $615.8 million.

Segmental Update

P&C

Commercial Lines

The segment reported revenues of $3,187 million, which improved 5.8% year over year in the fourth quarter. Core earnings dropped 10% year over year to $562 million, lower than our estimate of $638.8 million. The metric declined due to elevated catastrophe losses and a decrease in favorable prior accident year development (PYD) within core earnings.

The underlying combined ratio of 87.4% improved 150 basis points (bps) year over year on the back of improvements in the underlying loss and loss adjustment expense ratio.

Personal Lines

Revenues of the segment inched up 1% year over year to $822 million in the quarter under review. Core earnings of $42 million plunged 40% year over year due to increased severity in auto liability and physical damage.

The underlying combined ratio deteriorated 30 bps year over year to 96.2% due to escalating catastrophe losses.

P&C Other Ops

Revenues of $18 million tumbled 21.7% year over year in the fourth quarter.

Group Benefits

The segment recorded revenues of $1,701 million, which grew 4.7% year over year and came higher than the Zacks Consensus Estimate of $1,513 million. It reported core earnings of $141 million in the quarter under review against the prior-year quarter’s core loss of $12 million. The significant improvement in the metric stemmed from growing net investment income, higher fully insured ongoing premiums, lower excess mortality losses and improved group disability loss ratio.

The loss ratio improved 1,040 bps year over year to 73.6% in the fourth quarter courtesy of a decline in excess mortality losses within group life and reduced COVID-related short-term disability losses.

Hartford Funds

Revenues in the segment decreased 18.7% year over year to $252 million and fell shy of the consensus mark of $271 million. Core earnings of $39 million slashed 35% year over year and lagged our estimate of $54.7 million in the quarter under review. The decline resulted from reduced fee income and variable expenses, which in turn, stemmed from reduced daily average assets under management (AUM).

Daily average AUM of the segment came in at $124.1 billion, which tumbled 21% year over year due to lower market values and net outflows.

Corporate

Operating revenues of $36 million advanced 16.1% year over year in the fourth quarter and surpassed the Zacks Consensus Estimate of $21.9 million. The segment incurred a core loss of $33 million, narrower than the prior-year quarter’s loss of $41 million on the back of a decline in interest expenses.

Financial Update (as of Dec 31, 2022)

Hartford Financial exited the fourth quarter with cash of $229 million, which increased 11.7% from the figure in 2021 end. Total investments of $52.6 billion declined 9% from the 2021-end level.

Total assets slid 4.6% from the 2021-end figure to $73 billion.

Debt amounted to $4,357 million, which decreased 11.9% from the figure as of Dec 31, 2021.

Total stockholders’ equity of $13,631 million dropped 23.6% from the 2021-end level.

Book value per share fell 19% year over year to $41.53.

Core earnings’ return on equity during the trailing 12 months of 14.4% improved 170 bps year over year.

Share Repurchase Update

Hartford Financial rewarded its shareholders with $473 million comprising share buybacks of $350 million and common dividends worth $123 million. HIG had nearly $2.8 billion left under its buyback authorization as of Dec 31, 2022.

Full-Year Update

Adjusted operating earnings of Hartford Financial came in at $7.56 per share for 2022, which climbed 23% year over year. Revenues of $22,362 million dipped 0.1% year over year.

Net earned premiums rose 7.7% year over year to $19,390 million in 2022. Net investment income of $2,177 million slipped 5.9% year over year.

Outlook

HIG continues to expect cumulative savings from the Hartford Next initiative of $625 million in 2023.

Zacks Rank

Hartford Financial currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Performances of Other Insurers

Of the insurance industry players that have reported fourth-quarter results so far, The Travelers Companies, Inc. TRV, The Progressive Corporation PGR and AXIS Capital Holdings Limited AXS beat the respective Zacks Consensus Estimate for earnings.

RLI reported fourth-quarter 2022 operating earnings of $1.53 per share, beating the Zacks Consensus Estimate by 41.7%. The bottom line improved 26.4% from the prior-year quarter. Operating revenues for the reported quarter of RLI were $329.5 million, up 19.4% year over year, driven by 16.7% higher net premiums earned and 59% higher net investment income. The top line beat the Zacks Consensus Estimate by 0.4%.

Progressive’s fourth-quarter 2022 earnings per share of $1.50 beat the Zacks Consensus Estimate of $1.49. The bottom line improved 42.9% year over year. Net premiums written of PGR were $12.5 billion in the quarter, up 16% from $10.7 billion a year ago. The combined ratio — the percentage of premiums paid out as claims and expenses — improved 80 bps from the prior-year quarter’s level to 93.9.

AXIS Capital posted a fourth-quarter 2022 operating income of $1.95 per share, which beat the Zacks Consensus Estimate by about 14.7%. The bottom line dropped 8.5% year over year. AXS’s operating revenues of $1.5 billion increased 8.6% year over year on higher net premiums earned and net investment income. The top line beat the consensus estimate as well as our estimate of $1.4 billion. Net investment income decreased 14.8% year over year to $147.1 million.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

The Hartford Financial Services Group, Inc. (HIG) : Free Stock Analysis Report

The Travelers Companies, Inc. (TRV) : Free Stock Analysis Report

Axis Capital Holdings Limited (AXS) : Free Stock Analysis Report

The Progressive Corporation (PGR) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance