Hartford Financial (HIG) Q1 Earnings Beat Estimates, Up Y/Y

The Hartford Financial Services Group, Inc. HIG reported first-quarter 2018 adjusted operating earnings of $1.27 per share, beating the Zacks Consensus Estimate by 17.6%. The bottom line also increased 67% year over year on higher revenues.

Total operating revenues came in at $4.7 billion, up 14% year over year. This upside was primarily driven by a rise in earned premiums and higher fee revenues as well as net investment income.

Quarterly Segment Results

Property & Casualty (P&C)

Commercial Line

During the quarter under review, the segment’s total revenues were $2 billion, up 1% year over year.

Net income of $298 million rose 29% year over year. Core earnings of $302 million increased 35% over the prior-year quarter on the back of a higher underwriting gain and net investment income as well as lower income taxes.

The segment’s underlying combined ratio of 90.4 improved 50 basis points year over year owing to margin improvement in auto and an essentially flat expense ratio.

Current accident year catastrophe loss came in at $69 million before tax, down from $71 million in the year-ago quarter.

Personal Lines

Personal Lines total revenues were $928 million, down 7.4% year over year.

This segment generated net income of $89 million, up from $33 million in the year-ago quarter. Core earnings also came in at of $89 million compared with $32 million in the first quarter of 2017. This upside was driven by lower catastrophe loss, higher favorable PYD and improved underlying auto underwriting results.

Current accident year catastrophe loss came in at $34 million before tax, down from $79 million in the year-ago quarter.

The underlying combined ratio of 89.8 improved 140 basis points from the prior-year quarter owing to an improvement in the current accident year loss ratio before catastrophes, largely on auto liability, partially offset by an increase in the expense ratio due to marketing spending.

P&C Other Ops

Revenues of this segment came in at $23 million, down 35% year over year.

Net income and core earnings, both came in at $17 million, down 29% and 19%, respectively, from the year-ago quarter.

Group Benefits

Group Benefits’ total revenues of $1.5 billion surged 59% year over year.

This segment generated net income of $54 million, up 20% year over year. Core earnings came in at $85 million, up from $40 million in first-quarter 2018 on the back of higher premium volume, higher net investment income and the lower U.S. corporate income tax rate.

The total loss ratio of 77.4% improved 30 bps over the year-earlier quarter, driven by an improvement in the group disability loss ratio.

Mutual Funds

Mutual Funds operating revenues grew 8.8% year over year to $259 million.

Hartford Financial reported Mutual Funds net income and core earnings of $34 million, each up 47% year over year, primarily driven by a higher fee income, courtesy of growth in Mutual Funds segment assets under management (AUM) and a favorable impact from lower U.S. corporate taxes.

Average AUM increased 22% to $99.1 billion.

Corporate

Corporate segment operating revenues grew to $13 million from $4 million in the year-ago quarter.

Corporate net income was $105 million, up from $22 million in the year-ago quarter owing to higher income from discontinued operations.

The Corporate segment recorded core losses of $66 million, wider than core losses of $52 million in the prior-year quarter, primarily due to a lower tax benefit, partially offset by higher net investment income and lower expenses compared with the first quarter of 2017.

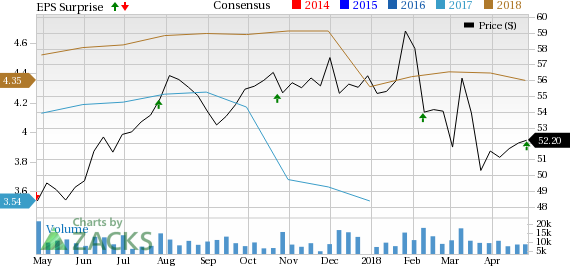

The Hartford Financial Services Group, Inc. Price, Consensus and EPS Surprise

The Hartford Financial Services Group, Inc. Price, Consensus and EPS Surprise | The Hartford Financial Services Group, Inc. Quote

Financial Update

Book value per share as of Mar 31, 2018 dipped 3% to $36.06 from the level as of Dec 31, 2017.

Core earnings’ return on equity rose 270 bps to 7.8%.

Zacks Rank and Performance of Other Insurers

Hartford Financial has a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Among other players from the insurance industry having reported first-quarter earnings so far, the bottom line of Brown & Brown, Inc. BRO, MGIC Investment Corporation MTG and The Progressive Corporation PGR beat the respective Zacks Consensus Estimate.

Looking for Stocks with Skyrocketing Upside?

Zacks has just released a Special Report on the booming investment opportunities of legal marijuana.

Ignited by new referendums and legislation, this industry is expected to blast from an already robust $6.7 billion to $20.2 billion in 2021. Early investors stand to make a killing, but you have to be ready to act and know just where to look.

See the pot trades we're targeting>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Brown & Brown, Inc. (BRO) : Free Stock Analysis Report

The Hartford Financial Services Group, Inc. (HIG) : Free Stock Analysis Report

MGIC Investment Corporation (MTG) : Free Stock Analysis Report

The Progressive Corporation (PGR) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Yahoo Finance

Yahoo Finance