The Hanover Insurance Group Inc (THG) Surpasses Analyst Revenue Forecasts in Q1 2024

Earnings Per Share (EPS): Reported a net income of $3.18 per diluted share, significantly surpassing the estimated earnings per share of $2.71.

Net Income: Achieved $115.5 million, exceeding estimates of $98.54 million.

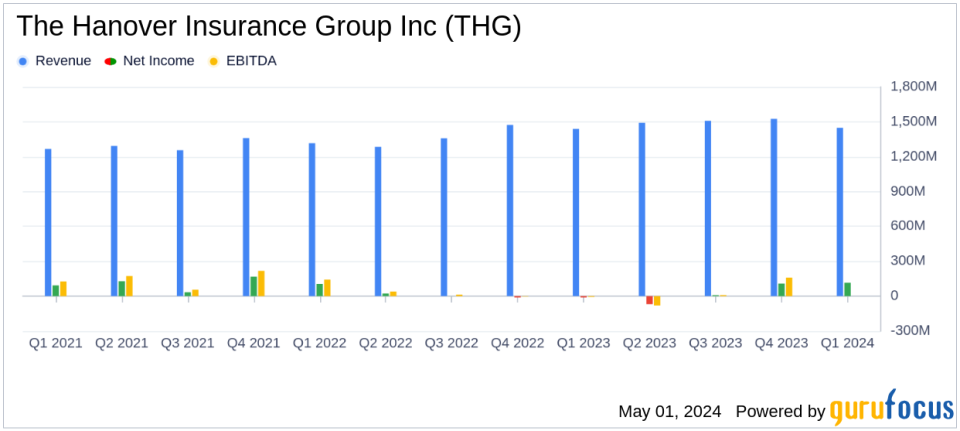

Revenue: Posted $1,448.6 million in net premiums earned, did not meet the estimated revenue of $1465.00 million.

Combined Ratio: Reported a combined ratio of 95.5%, showing improved underwriting efficiency from the prior year's 104.4%.

Investment Income: Net investment income rose to $89.7 million, up 14.0% year-over-year, driven by higher bond reinvestment rates and partnership income.

Book Value Per Share: Increased to $70.22, reflecting a 1.9% growth since the end of the previous year.

Market Positioning: Renewal price increases noted significant growth, with Personal Lines at 22.8%, Core Commercial at 11.5%, and Specialty at 11.0%.

The Hanover Insurance Group Inc (NYSE:THG) released its 8-K filing on May 1, 2024, showcasing a robust financial performance for the first quarter of the year. The company reported a net income of $115.5 million, or $3.18 per diluted share, a significant recovery from a net loss of $12.0 million in the prior-year quarter. These results notably exceeded analyst expectations, which had estimated earnings per share at $2.71 and net income at $98.54 million.

The Hanover Insurance Group Inc, a prominent player in the property and casualty insurance sector, operates through a network of independent agents and brokers in the U.S., and internationally through Chaucer Holdings Limited. The company's business is segmented into Commercial Lines, Personal Lines, and Other, with a significant portion of its operations focused on fixed-income securities investments.

Financial Highlights and Performance Analysis

THG's first quarter was marked by a combined ratio of 95.5%, showing strong underwriting profitability, and an improvement from the 104.4% reported in the previous year. The company also saw a 2.3% increase in net premiums written, reaching $1,454.0 million. Notably, the renewal price increases were substantial across all segments, contributing to the quarter's success.

Operating income stood at $111.9 million, or $3.08 per diluted share, significantly up from $4.6 million in the prior-year quarter. Net investment income also rose by 14% to $89.7 million, primarily due to higher bond reinvestment rates and increased partnership income. These financial gains underscore THG's strategic investment and operational cash flow management, which continue to yield favorable results.

President and CEO John C. Roche highlighted the quarter's exceptional profitability, particularly in the Specialty segment, which achieved a sub-90s combined ratio. The disciplined growth strategy in Personal Lines and robust performance in Core Commercial also contributed to the quarter's strong outcomes.

Challenges and Strategic Initiatives

Despite the positive results, THG faced challenges, including managing catastrophe losses which amounted to $86.9 million. However, the effective pricing and margin recapture strategies helped mitigate these impacts, as evidenced by the improved combined ratios. The company continues to focus on enhancing underwriting margins and maintaining disciplined growth, particularly in regions vulnerable to catastrophes.

Moreover, THG is transitioning the management of its investment-grade fixed maturity portfolio to an external manager and plans to exit the business operations of Opus Investment Management, Inc. These strategic moves are expected to streamline operations and have an immaterial impact on financial results.

Outlook and Forward Strategy

Looking ahead, THG is well-positioned to maintain its momentum with a clear strategy for achieving a long-term return on equity target of 14% or higher. The company remains committed to delivering superior returns for its shareholders through strategic pricing, underwriting excellence, and prudent capital management.

The Hanover Insurance Group Inc continues to leverage its strong market position and robust financial health to navigate challenges and seize growth opportunities effectively. As the company moves forward, its strategic initiatives and consistent financial performance are expected to continue driving value for shareholders and strengthening its market position.

For detailed insights and further information, investors and stakeholders are encouraged to view the full earnings report and listen to the earnings conference call scheduled for May 2, 2024.

Explore the complete 8-K earnings release (here) from The Hanover Insurance Group Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance