Haemonetics (HAE) Hospital Arm Aids, Macro Issues Persist

Haemonetics’ HAE top-line growth rides on drivers like Plasma, TEG, Hemostasis Management as well as the Vascular Closure business. However, weakness in the Blood center franchise significantly affected Haemonetics’ results in the first quarter of fiscal 2023. The stock currently carries a Zacks Rank #3 (Hold).

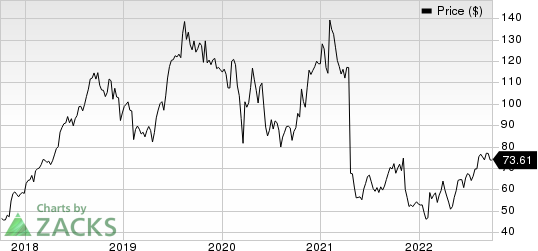

Over the past six months, Haemonetics has outperformed its industry. The stock has gained 13.8% against the industry's 51.5% fall. Haemonetics exited the first quarter of fiscal 2023 with better-than-expected earnings and revenues.

The robust performance of the Hospital business, on continued strength in the Hemostasis Management product line, instills optimism. Robust contributions from the Vascular Closure business also seem promising. The expansion of both margins is an added advantage. The company-adjusted gross margin was 54.4%, up 712 basis points (bps) year over year. The primary drivers of this improvement were strong volume growth in Plasma and Hospital and, price and additional savings from the Operational Excellence Program.

The adjusted operating margin was 14.9%, up 1314 bps from the year-ago quarter. Haemonetics continued to make additional investments to expand its manufacturing footprint in the reported quarter, including its new facility in Clinton, PA. The raised full-year outlook for revenues and earnings per share indicates continued growth momentum.

Haemonetics Corporation Price

Haemonetics Corporation price | Haemonetics Corporation Quote

The fiscal first quarter saw encouraging performance by Haemonetics’ businesses. The Hospital business revenues grew 12.7% (up 14.9% on an organic basis) in the quarter amid staffing shortages and budgetary constraints in U.S hospitals as well as continued lockdowns in China.

Under the Hospital segment, revenue growth in the Hemostasis Management and Vascular Closure product lines was 4.1% and 35.9% on a year-over-year basis, respectively. Within Vascular Closure, the company strengthened its leadership in the growing electrophysiology and interventional cardiology markets. Plasma collections also rebounded in the reported quarter, as the company continued to convert its U.S Plasma customers to the Nexus Plasma collection technology. Haemonetics expects to convert all its U.S. customers to the latest Nexus PCS and NexLynk DMS platform by the end of the second quarter of fiscal 2023.

Despite sluggish results in the Blood Center business, Whole Blood revenues grew 7%, led by favorable order timing among distributors in the Asia Pacific and EMEA, coupled with additional opportunities in North America.

On the flip side, the sluggish performance of the Blood Center business in the first quarter of fiscal 2023 amid blood shortages in a difficult collection environment is concerning. Blood Center revenues declined 7% in the fiscal first quarter. Moreover, Apheresis revenues fell 13% due to unfavorable order timing, lower revenues from convalescent Plasma, collection center staffing shortages in the United States and geopolitical risk.

A fall in short-term cash level raises apprehension. Weak solvency and stiff competition remain concerns. The company continues to be challenged by inflationary pressure in the global manufacturing and supply chain, including freight and raw material costs, previous divestitures and price adjustments.

Key Picks

Some better-ranked stocks in the broader medical space are ShockWave Medical SWAV, AMN Healthcare Services AMN and McKesson MCK. While ShockWave Medical and AMN Healthcare Services sport a Zacks Rank #1 (Strong Buy), McKesson carries a Zacks Rank of 2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Estimates for ShockWave Medical’s earnings per share rose from $2.02 to $2.57 for 2022 and from $2.95 to $3.42 for 2023 in the past 60 days. SWAV has gained 53.4% so far this year.

ShockWave Medical delivered an earnings surprise of 180.14%, on average, in the last four quarters.

Estimates for AMN Healthcare Services have improved from earnings of $10.41 to $11.26 for 2022 and $7.94 to $8.30 for 2023 in the past 60 days. AMN stock has declined 13.5% so far this year.

AMN Healthcare Services delivered an earnings surprise of 15.66%, on average, in the last four quarters.

McKesson’s earnings per share estimates increased from $23.27 to $24.42 for fiscal 2023 and $25.41 to $26.04 for fiscal 2024 in the past 60 days. MCK has gained 40.3% so far this year.

McKesson delivered an earnings surprise of 13.00%, on average, in the last four quarters.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

McKesson Corporation (MCK) : Free Stock Analysis Report

Haemonetics Corporation (HAE) : Free Stock Analysis Report

AMN Healthcare Services Inc (AMN) : Free Stock Analysis Report

ShockWave Medical, Inc. (SWAV) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance