Haemonetics (HAE) Banks on Plasma Arm Growth Amid Rising Costs

Haemonetics’ HAE major growth drivers include Plasma and the Hospital business. However, rising costs are a concern. The stock carries a Zacks Rank #3 (Hold) currently.

Haemonetics’ Plasma business unit focuses on the collection of source plasma for pharmaceutical manufacturers using apheresis devices that only collect plasma. The demand for source plasma has been growing due to an expanding end-user market for plasma-derived biopharmaceuticals. The business also offers software solutions to support the operations of dedicated source plasma collection centers.

Plasma revenues grew 8% in the third quarter of fiscal 2024, driven primarily by volume. The collection environment in the United States continued to be favorable, with disposables growing 7% in the quarter and 17% year to date. The rollout of Persona — the company’s proprietary technology proven to increase yield from 9% to 12% on average — continues to gain momentum, with more than 25 million collections.

Haemonetics’ hospital portfolio is evolving and helping to create new opportunities for growth and diversification. Each of the four product lines has a leading market position and a mission of helping hospitals and clinicians provide the highest standard of patient care while at the same time reducing operating and procedural costs and helping decision-makers at hospitals optimize blood acquisition, storage and usage in critical settings. The company is taking impactful steps to support growth in the Hospital business, which contributes to broadening its global presence and retaining industry leadership.

In terms of performance in the fiscal third quarter, hospital revenues increased 22%, driven by the continued success of Vascular Closure and hemostasis management. Vascular Closure grew 28%, driven by new account openings, both in electrophysiology and interventional cardiology. The company has been seeing higher utilization rates, backed by its clinical efforts and increased procedure volumes in United States hospitals.

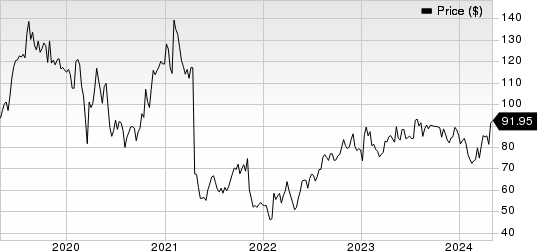

Haemonetics Corporation Price

Haemonetics Corporation price | Haemonetics Corporation Quote

On the flip side, continued uncertainty due to inflationary pressure, rising interest rates and macroeconomic conditions have increased the risk of creating new economic challenges or exacerbating the existing ones. While Haemonetics implemented cost containment measures, selective price increases and other actions to offset these inflationary pressures in its global supply chain, the company may not be able to offset all the increases in its operational costs completely.

Climate change (including laws or regulations passed in response thereto) could increase supply costs, including energy and transportation/freight-related expenses, or reduce the availability of raw materials. In the fiscal third quarter, Haemonetics registered an increase of 8% in the cost of goods sold.

In addition, Haemonetics operates in a very competitive environment, both for manual and automated systems, which includes companies like MAK Systems, ROTEM analyzers, Medtronic, e Fresenius, MacoPharma and Terumo, among others. Slower-than-expected product adoption by customers, especially the American Red Cross, might reduce the company’s revenues and profits.

Key Picks

Some better-ranked stocks in the broader medical space are Inspire Medical System INSP, HCA Healthcare HCA and DexCom DXCM.

Inspire Medical System has an estimated 2024 earnings growth rate of 51.4% compared with the industry’s 20.3%. INSP’s earnings surpassed estimates in each of the trailing four quarters, the average surprise being 353.55%. Its shares have decreased 7% compared with the industry’s 19.7% fall in the past year.

INSP sports a Zacks Rank #1 (Strong Buy) at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

HCA Healthcare, carrying a Zacks Rank #2 (Buy) at present, has an estimated long-term earnings growth rate of 10.1% compared with the industry’s 9.9%. Shares of the company have increased 9.7% compared with the industry’s 7.8% rise over the past year.

HCA’s earnings surpassed estimates in three of the trailing four quarters and missed in one, the average surprise being 5.64%. In the last reported quarter, it delivered an average earnings surprise of 6.99%.

DexCom, sporting a Zacks Rank #1 at present, has an estimated long-term earnings growth rate of 33.1% compared with the industry’s 14.8%. Shares of DXCM have increased 6.2% compared with the industry’s 2.1% rise over the past year.

DXCM’s earnings surpassed estimates in each of the trailing four quarters, the average surprise being 34.10%. In the last reported quarter, it delivered an average earnings surprise of 18.52%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Haemonetics Corporation (HAE) : Free Stock Analysis Report

DexCom, Inc. (DXCM) : Free Stock Analysis Report

HCA Healthcare, Inc. (HCA) : Free Stock Analysis Report

Inspire Medical Systems, Inc. (INSP) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance