If You Had Bought Superior Lake Resources (ASX:SUP) Stock A Year Ago, You'd Be Sitting On A 77% Loss, Today

Even the best investor on earth makes unsuccessful investments. But it would be foolish to simply accept every extremely large loss as an inevitable part of the game. We wouldn't blame Superior Lake Resources Limited (ASX:SUP) shareholders if they were still in shock after the stock dropped like a lead balloon, down 77% in just one year. While some investors are willing to stomach this sort of loss, they are usually professionals who spread their bets thinly. To make matters worse, the returns over three years have also been really disappointing (the share price is 61% lower than three years ago). Shareholders have had an even rougher run lately, with the share price down 39% in the last 90 days. But this could be related to the weak market, which is down 29% in the same period.

View our latest analysis for Superior Lake Resources

Superior Lake Resources recorded just AU$66,891 in revenue over the last twelve months, which isn't really enough for us to consider it to have a proven product. You have to wonder why venture capitalists aren't funding it. So it seems shareholders are too busy dreaming about the progress to come than dwelling on the current (lack of) revenue. For example, investors may be hoping that Superior Lake Resources finds some valuable resources, before it runs out of money.

As a general rule, if a company doesn't have much revenue, and it loses money, then it is a high risk investment. We can see that they needed to raise more capital, and took that step recently despite the fact that it would have been dilutive to current holders. While some such companies do very well over the long term, others become hyped up by promoters before eventually falling back down to earth, and going bankrupt (or being recapitalized). Superior Lake Resources has already given some investors a taste of the bitter losses that high risk investing can cause.

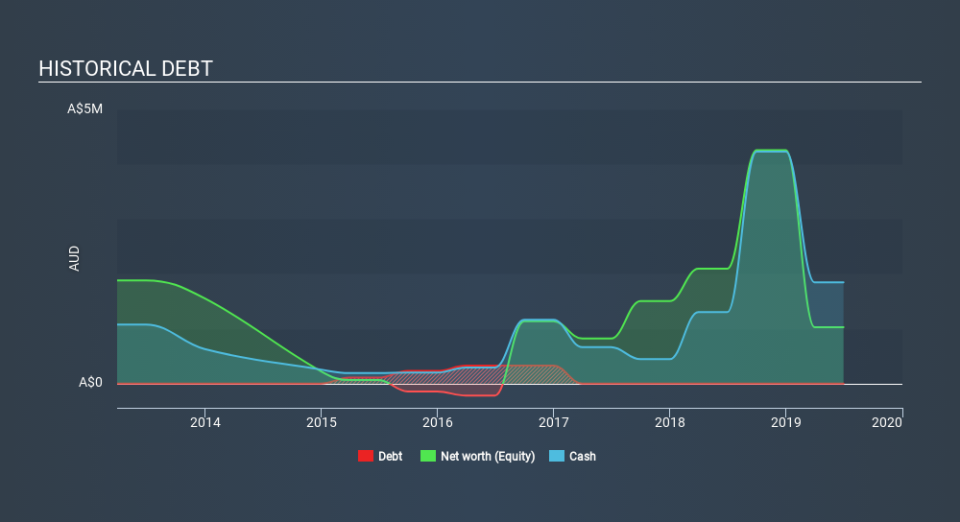

Superior Lake Resources had liabilities exceeding cash when it last reported, according to our data. That made it extremely high risk, in our view. But with the share price diving 77% in the last year , it's probably fair to say that some shareholders no longer believe the company will succeed or they are worried about dilution with the recent cash injection. You can click on the image below to see (in greater detail) how Superior Lake Resources's cash levels have changed over time.

Of course, the truth is that it is hard to value companies without much revenue or profit. Given that situation, would you be concerned if it turned out insiders were relentlessly selling stock? I'd like that just about as much as I like to drink milk and fruit juice mixed together. You can click here to see if there are insiders selling.

A Different Perspective

Superior Lake Resources shareholders are down 77% for the year, falling short of the market return. The market shed around 18%, no doubt weighing on the stock price. Shareholders have lost 27% per year over the last three years, so the share price drop has become steeper, over the last year; a potential symptom of as yet unsolved challenges. Although Baron Rothschild famously said to "buy when there's blood in the streets, even if the blood is your own", he also focusses on high quality stocks with solid prospects. It's always interesting to track share price performance over the longer term. But to understand Superior Lake Resources better, we need to consider many other factors. Like risks, for instance. Every company has them, and we've spotted 8 warning signs for Superior Lake Resources (of which 5 can't be ignored!) you should know about.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on AU exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

Yahoo Finance

Yahoo Finance