If You Had Bought RPMGlobal Holdings (ASX:RUL) Stock Three Years Ago, You Could Pocket A 65% Gain Today

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

One simple way to benefit from the stock market is to buy an index fund. But if you pick the right individual stocks, you could make more than that. For example, the RPMGlobal Holdings Limited (ASX:RUL) share price is up 65% in the last three years, clearly besting than the market return of around 19% (not including dividends).

See our latest analysis for RPMGlobal Holdings

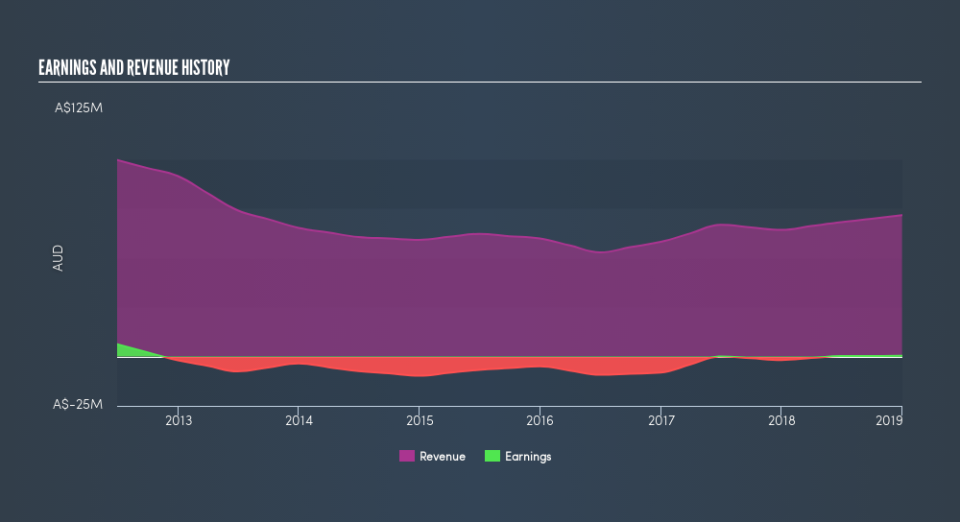

While RPMGlobal Holdings made a small profit, in the last year, we think that the market is probably more focussed on the top line growth at the moment. Generally speaking, we'd consider a stock like this alongside loss-making companies, simply because the quantum of the profit is so low. It would be hard to believe in a more profitable future without growing revenues.

RPMGlobal Holdings's revenue trended up 8.6% each year over three years. That's pretty nice growth. While the share price has done well, compounding at 18% yearly, over three years, that move doesn't seem over the top. If that's the case, then it could be well worth while to research the growth trajectory. Of course, it's always worth considering funding risks when a company isn't profitable.

Depicted in the graphic below, you'll see revenue and earnings over time. If you want more detail, you can click on the chart itself.

Take a more thorough look at RPMGlobal Holdings's financial health with this free report on its balance sheet.

A Different Perspective

While the broader market gained around 12% in the last year, RPMGlobal Holdings shareholders lost 9.8%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 0.3% per year over five years. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. Most investors take the time to check the data on insider transactions. You can click here to see if insiders have been buying or selling.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on AU exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

Yahoo Finance

Yahoo Finance