If You Had Bought Kiddieland International (HKG:3830) Shares A Year Ago You'd Have A Total Return Of 16%

It's understandable if you feel frustrated when a stock you own sees a lower share price. But often it is not a reflection of the fundamental business performance. The Kiddieland International Limited (HKG:3830) is down 41% over a year, but the total shareholder return is 16% once you include the dividend. That's better than the market which returned -20% over the last year. We wouldn't rush to judgement on Kiddieland International because we don't have a long term history to look at. The share price has dropped 61% in three months.

See our latest analysis for Kiddieland International

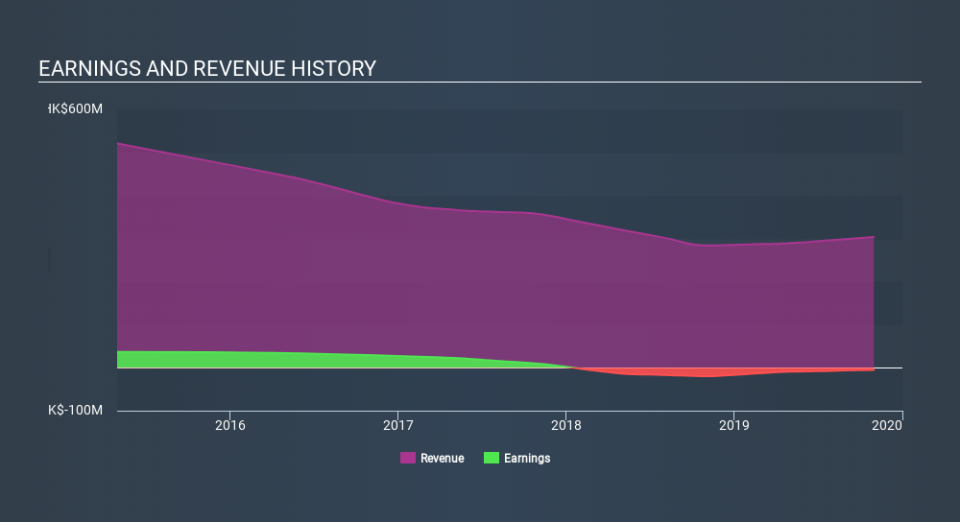

Given that Kiddieland International didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Shareholders of unprofitable companies usually expect strong revenue growth. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

Kiddieland International grew its revenue by 7.0% over the last year. While that may seem decent it isn't great considering the company is still making a loss. Given this lacklustre revenue growth, the share price drop of 41% seems pretty appropriate. In a hot market it's easy to forget growth is the life-blood of a loss making company. But if you buy a loss making company then you could become a loss making investor.

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

This free interactive report on Kiddieland International's balance sheet strength is a great place to start, if you want to investigate the stock further.

What about the Total Shareholder Return (TSR)?

We'd be remiss not to mention the difference between Kiddieland International's total shareholder return (TSR) and its share price return. Arguably the TSR is a more complete return calculation because it accounts for the value of dividends (as if they were reinvested), along with the hypothetical value of any discounted capital that have been offered to shareholders. Kiddieland International hasn't been paying dividends, but its TSR of 16% exceeds its share price return of -41%, implying it has either spun-off a business, or raised capital at a discount; thereby providing additional value to shareholders.

A Different Perspective

Kiddieland International shareholders should be happy with the total gain of 16% over the last twelve months. Unfortunately the share price is down 61% over the last quarter. It may simply be that the share price got ahead of itself, although there may have been fundamental developments that are weighing on it. It's always interesting to track share price performance over the longer term. But to understand Kiddieland International better, we need to consider many other factors. Even so, be aware that Kiddieland International is showing 4 warning signs in our investment analysis , and 2 of those are significant...

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

Yahoo Finance

Yahoo Finance