If You Had Bought CyberArk Software (NASDAQ:CYBR) Shares Five Years Ago You'd Have Made 140%

When you buy shares in a company, it's worth keeping in mind the possibility that it could fail, and you could lose your money. But on the bright side, if you buy shares in a high quality company at the right price, you can gain well over 100%. One great example is CyberArk Software Ltd. (NASDAQ:CYBR) which saw its share price drive 140% higher over five years. And in the last month, the share price has gained -0.7%. We note that CyberArk Software reported its financial results recently; luckily, you can catch up on the latest revenue and profit numbers in our company report.

Check out our latest analysis for CyberArk Software

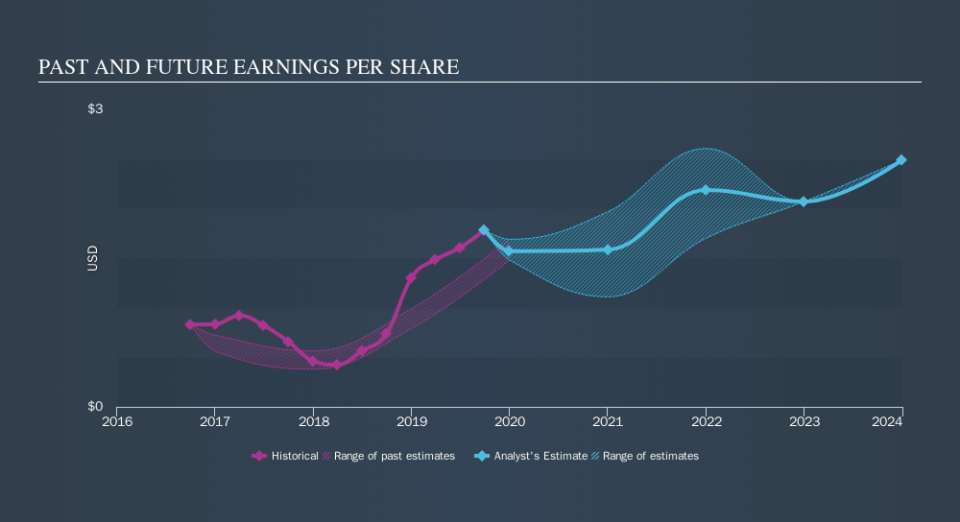

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

Over half a decade, CyberArk Software managed to grow its earnings per share at 56% a year. This EPS growth is higher than the 19% average annual increase in the share price. So it seems the market isn't so enthusiastic about the stock these days. Having said that, the market is still optimistic, given the P/E ratio of 63.32.

The graphic below depicts how EPS has changed over time (unveil the exact values by clicking on the image).

We know that CyberArk Software has improved its bottom line lately, but is it going to grow revenue? This free report showing analyst revenue forecasts should help you figure out if the EPS growth can be sustained.

A Different Perspective

We're pleased to report that CyberArk Software shareholders have received a total shareholder return of 67% over one year. That's better than the annualised return of 19% over half a decade, implying that the company is doing better recently. Someone with an optimistic perspective could view the recent improvement in TSR as indicating that the business itself is getting better with time. Is CyberArk Software cheap compared to other companies? These 3 valuation measures might help you decide.

But note: CyberArk Software may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

Yahoo Finance

Yahoo Finance