If You Had Bought Berkeley Energia (ASX:BKY) Shares A Year Ago You'd Have Earned 147% Returns

Berkeley Energia Limited (ASX:BKY) shareholders might understandably be very concerned that the share price has dropped 41% in the last quarter. Despite this, the stock is a strong performer over the last year, no doubt about that. During that period, the share price soared a full 147%. So some might not be surprised to see the price retrace some. The real question is whether the business is trending in the right direction.

Check out our latest analysis for Berkeley Energia

We don't think Berkeley Energia's revenue of AU$2,340,000 is enough to establish significant demand. So it seems that the investors focused more on what could be, than paying attention to the current revenues (or lack thereof). For example, they may be hoping that Berkeley Energia finds fossil fuels with an exploration program, before it runs out of money.

Companies that lack both meaningful revenue and profits are usually considered high risk. You should be aware that there is always a chance that this sort of company will need to issue more shares to raise money to continue pursuing its business plan. While some companies like this go on to deliver on their plan, making good money for shareholders, many end in painful losses and eventual de-listing. Berkeley Energia has already given some investors a taste of the sweet gains that high risk investing can generate, if your timing is right.

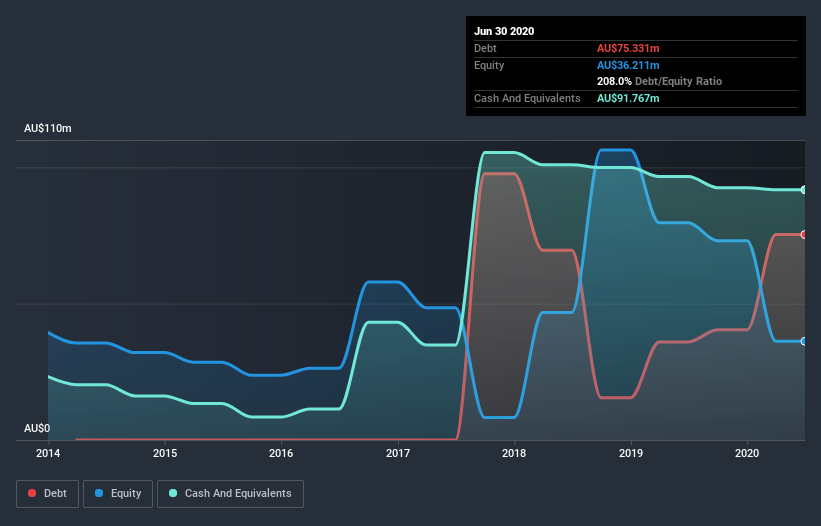

When it last reported its balance sheet in June 2020, Berkeley Energia had cash in excess of all liabilities of AU$13m. While that's nothing to panic about, there is some possibility the company will raise more capital, especially if profits are not imminent. Given the share price has increased by a solid 85% in the last year , it's fair to say investors remain excited about the future, despite the potential need for cash. You can see in the image below, how Berkeley Energia's cash levels have changed over time (click to see the values).

It can be extremely risky to invest in a company that doesn't even have revenue. There's no way to know its value easily. One thing you can do is check if company insiders are buying shares. It's usually a positive if they have, as it may indicate they see value in the stock. Luckily we are in a position to provide you with this free chart of insider buying (and selling).

A Different Perspective

It's good to see that Berkeley Energia has rewarded shareholders with a total shareholder return of 147% in the last twelve months. Since the one-year TSR is better than the five-year TSR (the latter coming in at 4% per year), it would seem that the stock's performance has improved in recent times. Given the share price momentum remains strong, it might be worth taking a closer look at the stock, lest you miss an opportunity. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Even so, be aware that Berkeley Energia is showing 2 warning signs in our investment analysis , you should know about...

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on AU exchanges.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

Yahoo Finance

Yahoo Finance