If You Had Bought Ambarella (NASDAQ:AMBA) Stock Five Years Ago, You'd Be Sitting On A 32% Loss, Today

In order to justify the effort of selecting individual stocks, it's worth striving to beat the returns from a market index fund. But even the best stock picker will only win with some selections. At this point some shareholders may be questioning their investment in Ambarella, Inc. (NASDAQ:AMBA), since the last five years saw the share price fall 32%. Furthermore, it's down 17% in about a quarter. That's not much fun for holders. However, one could argue that the price has been influenced by the general market, which is down 14% in the same timeframe.

See our latest analysis for Ambarella

Ambarella wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Shareholders of unprofitable companies usually expect strong revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

Over half a decade Ambarella reduced its trailing twelve month revenue by 4.3% for each year. While far from catastrophic that is not good. The stock hasn't done well for shareholders in the last five years, falling 7.4%, annualized. But it doesn't surprise given the falling revenue. It might be worth watching for signs of a turnaround - buyers are probably expecting one.

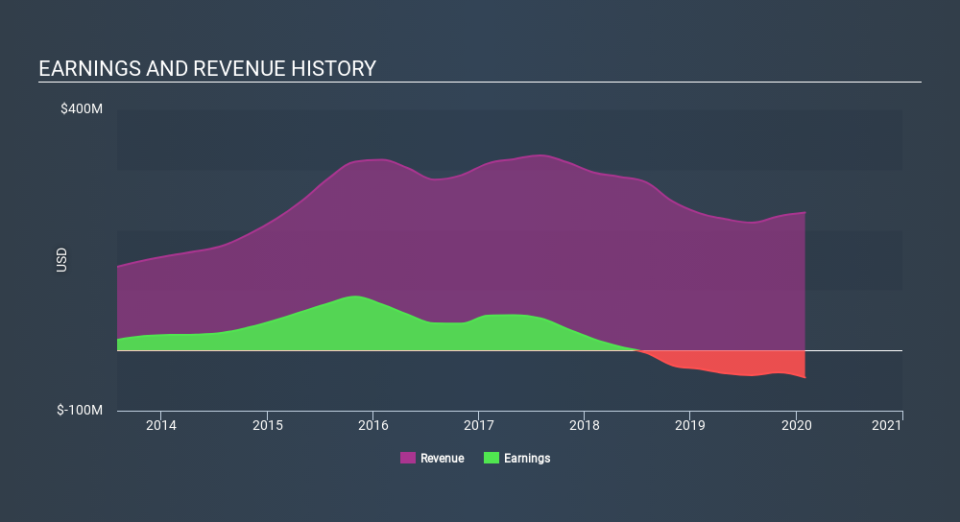

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

Ambarella is well known by investors, and plenty of clever analysts have tried to predict the future profit levels. So it makes a lot of sense to check out what analysts think Ambarella will earn in the future (free analyst consensus estimates)

A Different Perspective

We regret to report that Ambarella shareholders are down 4.2% for the year. Unfortunately, that's worse than the broader market decline of 3.7%. However, it could simply be that the share price has been impacted by broader market jitters. It might be worth keeping an eye on the fundamentals, in case there's a good opportunity. However, the loss over the last year isn't as bad as the 7.4% per annum loss investors have suffered over the last half decade. We'd need to see some sustained improvements in the key metrics before we could muster much enthusiasm. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Consider for instance, the ever-present spectre of investment risk. We've identified 2 warning signs with Ambarella (at least 1 which makes us a bit uncomfortable) , and understanding them should be part of your investment process.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

Yahoo Finance

Yahoo Finance